- 27 Jul 2022

- By CME Group

Aluminum finished June 2022 at 1,514 contracts traded per day +165% versus June 2021.With the increased attention on Aluminum futures, participation is at an all-time high.

We are witnessing more consistent trading volumes and a build in average open interest. Open interest currently stands at 700 contracts as of July 15. Product code: ALI. Bloomberg code: ALEA Comdty.

Source: CME Group

Learn more about ALI

Case study: How one auto maker protected profits and cut aluminum storage costs

Read: Five things you should know about Aluminum futures

Read: Aluminum futures: A cost effective alternative to the forwards market

Read: Aluminum correlation and differential to global market

When: September 14, 2022, 6 p.m. - 10 p.m.

Where: Gotham Hall, New York.

Speaker: Richard Fisher, former President and CEO of Federal Reserve Bank of Dallas.

Since launching on May 2, Micro Copper futures (MHG) have had a great start.

ADV is 3,375 contracts and open interest is 1,225 as of July 15 with a record trading day on June 6 with 7,810 contracts trading

The contract is 1/10 the size of benchmark Copper futures and provides an efficient, cost-effective new way to fine-tune copper exposure.

Source: CME Group

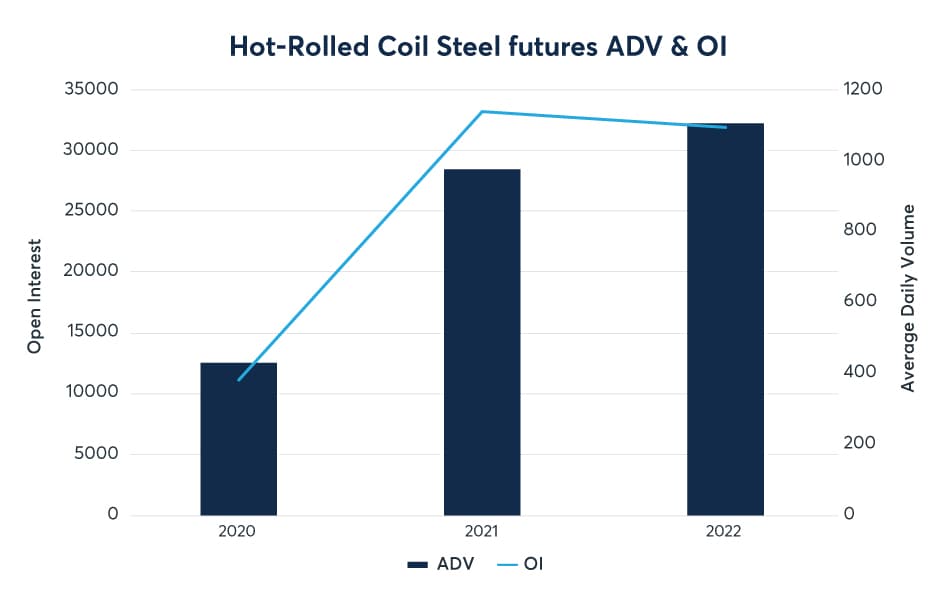

Steel futures (HRC) continue to grow on the back of its fifth consecutive year of volume growth in 2021. Year-to-date over $27M (or 1,126 contracts) worth of HRC has traded per day in 2022, up 11% at at June 30.

Average open interest sits at ~32,048 contracts, which represents nearly $800M in notional terms as at July 15.

Source: CME Group

Copper options have been gathering pace in 2022. Average daily volume has hit record highs in July, trading over 5,200 contracts. Open interest has also risen to a record levels of 97.5K contracts.

Screen liquidity remains strong with bid/ask spread under one implied vol for the first four monthly expiries.

Much of commentary on gold and silver focuses on macroeconomic demand drivers including the influence of short-term U.S. interest rate expectations and the strength of the U.S. dollar.

However, it's a mistake to overlook the role of supply. Mining supply for gold and silver can exert a strong influence on price movements and in recent years mining supply has been heading downward.

That said, the current prices of both metals are far above their cost of production and this may imply increased investment in gold and silver mining operations in the future.

Cobalt futures open interest is on the rise and is now above 5,000 tons (5,055 tons as at July 14), extending all the way out to Q3 2024.

The contract is finding quick adoption from the market place, as the automotive sector seeks to manage commodity price risk in the transition to higher EV production volumes. Cobalt is a key component in many EV car battery models.

We continue to see great traction in our North European Steel futures where market adoption has been growing steady since its launch in 2020.

Average daily volume in July 2022 currently stands at 229 contracts or 4,580 metric tons and open interest stands at 2,107 contracts or 42,140 metric tons. .

Learn more

On May 2, we added Monday and Wednesday expiries to Gold, Silver and Copper weekly options to complement the existing Friday weekly options.

Both Monday and Wednesday weekly options have been actively trading with 60% of the volume resulting from Wednesday options and 40% resulting from Monday options.

Average daily volume has been over 1.6K combined in the new Monday and Wednesday expiries.

Learn more

Data as of June 30, 2022, unless otherwise specified

View the current version and an archive of the Metals Update online at: cmegroup.com/education/metals-update.html.