- 30 Nov 2020

- By CME Group

Metals volatility through the pandemic

Gold volatility

Gold implied volatility has found an equilibrium below 20% range after spiking above 40% in March. In the absence of election-related surprises, gold implied volatility has trended down over the last eight sessions.

Source: QuikStrike

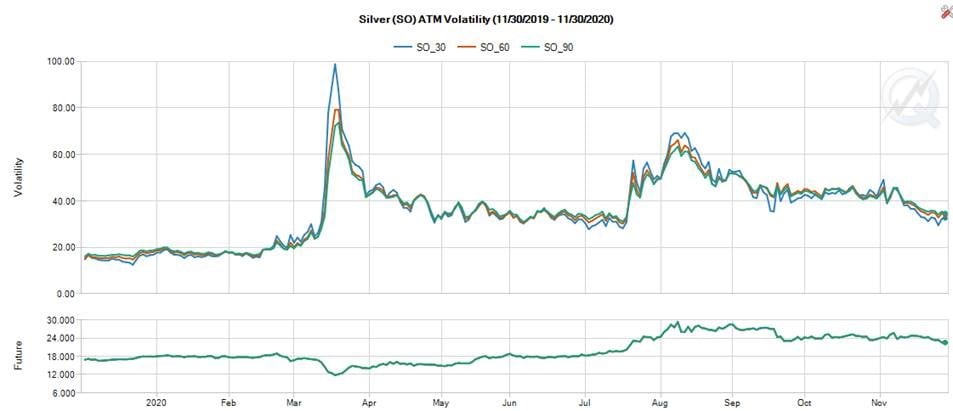

Silver volatility currently remains at multi-year highs in the 40% range. The five-year mean for silver volatility has been near 20%, and silver implied volatility has had periods above 60% volatility in March and August. While gold has been orderly relative to the amount of global macro news, silver has had a much more volatile year and remains at an elevated implied volatility level.

Source: QuikStrike

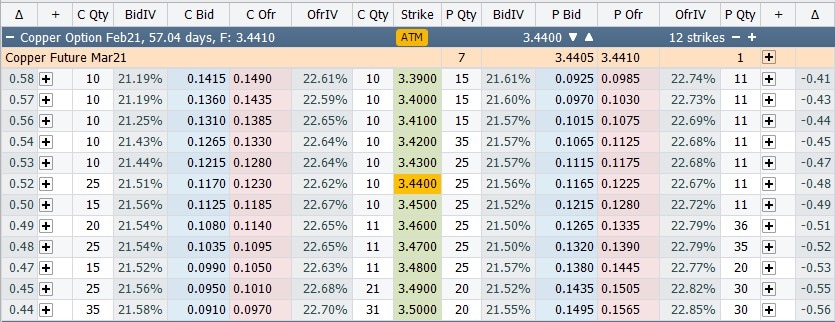

Copper has found an equilibrium in the 20% range after a March spike to 40%. The prospects of a global recovery and increased consumption have contributed to a steady rally with copper trading close to the $3.50 level. Considering that copper has rallied from a low in the $2 range in April, implied volatility has been orderly given how much the price of copper has risen since May.

Source: QuikStrike

- Copper has come back into focus as the price of copper has risen from below $2 to above $3

- Copper options typically have a one vol. bid/ask spread on screen with deep liquidity available via block trades and RFQs.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.