- 27 Aug 2020

- By CME Group

Gold volatility

- Implied volatility in 2019 was in the 10% range with high periods in the low teens. For 2019 overall, it was approximately one standard deviation lower than the 10-year mean of approximately 15%.

- So far in 2020, gold volatility has been approximately 1.5 standard deviations above the long-term mean.

- Implied volatility in 2020 started in the 10% range and spiked to nearly 40% in late March, as the basis between OTC and COMEX Gold became volatile due to perceptions of disruption in the supply chain for physical gold bars.

- Volatility declined steadily from March through July to nearly 15%. As gold traded above 2000 for the first time, gold volatility again rallied to 25%

Silver volatility

- Silver volatility in 2019 was approximately one standard deviation lower than the 10-year mean.

- Silver volatility in 2020 was two standard deviations higher than the 10-year mean.

- Implied volatility in 2020 started in the 20% range and spiked to nearly 70% in late March, again as a result of volatility in the metals markets.

- Volatility declined steadily from March through July to near 25% and spiked up to 65%, as silver traded near the $30 level.

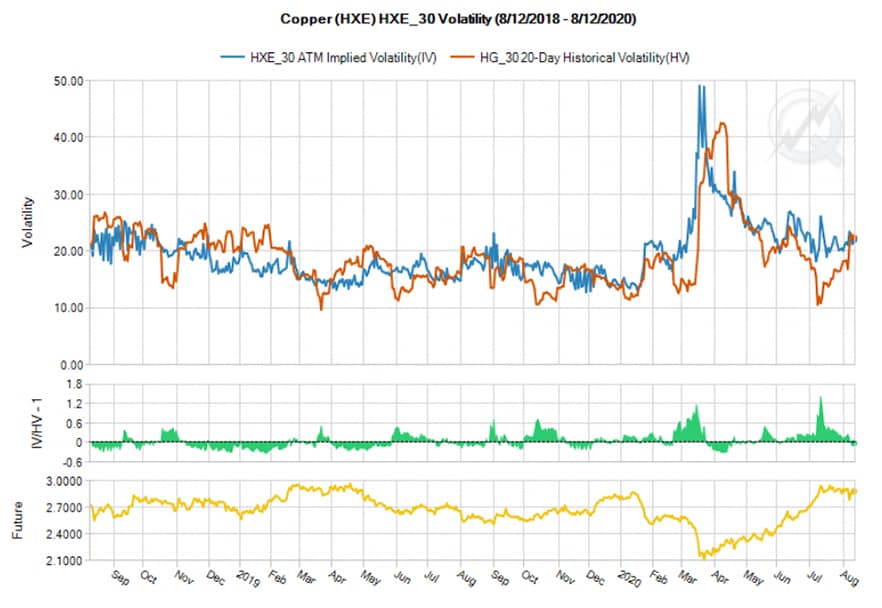

Copper volatility

- Copper volatility has fluctuated from the high teens to the low twenties over the last two years until the recent spike, caused by fears that Covid-19 would reduce global copper consumption.

- Volatility spiked to near 40% as the price of copper fell to near $2.00.

- Since late March, copper volatility has returned to mean levels as the price of copper recovered back to near $3.00.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.