- 17 Dec 2018

- By CME Group

While the Federal Open Market Committee (FOMC) does not aim to surprise markets, it is not uncommon for participants to disagree about whether the FOMC will decide to change the fed funds rate at its scheduled meetings. These disagreements can be observed in the CME Group FedWatch tool, which estimates the probability of changes to the target fed funds rate based on the Fed Fund Futures contract. The tool calculates the probability of a future rate hike by the FOMC implied by intraday Fed Funds futures prices.

In the last year, the FOMC executed a steady and well-advertised pace of rate increases. Since December 2017, the FOMC increased its target rate four times: December 2017, March 2018, June 2018, and September 2018. Each meeting resulted in a modest increase of 25 basis points, with the most recent increase resulting in a target range of 2.00% - 2.25%. Ahead of each meeting, the probability of a rate increase approached 1 (representing 100% probability) closer to the FOMC meeting, showing the market coalescing around a common expectation of the FOMC’s decision.

With less than two weeks to go, the probability of a rate increase for the upcoming December 19 FOMC meeting has remained persistently below 80%, lower than any recent meeting that resulted in a rate increase at the same point. As of December 6, the market implied probability of a rate increase at the December 19 FOMC was 71.5%.

It is not uncommon for the probability of a rate increase to dip ahead of the nearest FOMC meeting. In the 90 day period ahead of prior FOMC meetings, we observe occasional points of falling probabilities in response to market volatility. However, while these previous dips in probability were generally short-lived, the probability of a rate increase in December has remained consistently lower than previous meetings. On-going volatility in recent months has rattled expectations about a rate hike, which may have implications for key futures markets.

Market volatility has been pronounced in Q4 to date. The S&P500® has oscillated between positive and negative returns for the year since October, with daily changes swinging between 2.3% and -3.3%. This began about 70 days ahead of the December 19 FOCM, with the probability of a rate hike shown in the chart below. Traders may believe that stock market volatility will impact the FOMC’s decision on a rate increase, and are positioning themselves accordingly, causing the change in the FedWatch implied probabilities.

This shows markets wavering confidence in a rate increase, with probabilities falling below 70% just one month before the meeting. On December 4, two weeks ahead of the meeting, the implied probability of a rate hike fell below 80%, just as major stock indices fell into negative growth from the beginning of 2018. The S&P500® closed 3.2% down on December 4. It opened on December 6 down 1.2% from the start of 2018.[1] This more prolonged volatility may be depressing the implied probability of a rate hike at the December FOMC.

The December probabilities are unique in how low they’ve remained, but it is common for volatility spikes to impact these probabilities.

Notably, the probability of a rate hike at the March 21, 2018 meeting dropped to 70% about 40 days before the meeting, the lowest probability given for any meeting at that point. This was in early February, right as markets experienced a return of volatility after a remarkably long period of low volatility. The S&P500® dropped more than 4% on February 5 and yield on the 10-year Treasury Note fell nearly 5%, ending at 2.7%. As markets stabilized, the probability of a rate increase slowly rose ahead of the meeting, but this shock to the stock market appears to have impacted the market’s expectation regarding a rate increase.

Similarly, the probability of a rate hike in June dropped to 72.5% just 15 days before the FOMC meeting. This precipitous drop came just as rates markets saw a spike in volatility in response to Eurozone turbulence on May 29. It was a major market-moving event, leading to a 1.2% decrease in the S&P500® and a 5.1% drop in 10-year Treasury Note yield. Both returned to their previous levels in a few days, as did the probability of a June rate increase, but this incident does highlight sensitivity of market expectations to these events. While the probabilities for both of these rate increases eventually recovered following their respective volatility spikes, the December probability has not recovered in the same manner.

The 10-year Treasury Note is particularly sensitive to changes in the fed funds rate, so we expect this future market to respond significantly to rate decisions. As we’ll see with prior meetings, minor differences in expectations about rates did result in unique market responses. Though this did not result in any notable reduction in liquidity, it does illustrate the potential impact of expectations on market movements.

Though participants correctly anticipated recent rate increases, markets often move significant volumes of the 10-year T-Note in response to the rate announcement. However, there can be a difference in response based on market expectations and volatility.

For example, with market volatility in 2017 near historic lows, the FOMC announcement of a rate hike on December 13, 2017 was widely expected. The probability of a rate hike ahead of the meeting did not suffer the uncertainty we saw ahead of the March or June meetings. When the FOMC made its announcement at 13:00 (Chicago time) on December 13, the market responded with increased volume on 10-year Treasury Note futures. However, this was lower than the volume seen at 07:00; the announcement did not have a meaningful impact on volume, though prices did increase in the aftermath of the rate increase.

In contrast, the March meeting, where the February volatility spike caused a drop in the probability of a rate increase, volumes were much higher in response to the FOMC announcement, but lower throughout the day. Trader activity on the 10-year Treasury Note was limited before hearing the FOMC’s decision on rates.

The June meeting, about two weeks after the volatility spike on May 29, saw a similar pattern, much higher after the announcement at hour 13:00, and lower throughout the day in anticipation.

The difference in volatility scenarios approaching the FOMC meetings in December 2017 and March and June 2018 can also be seen in the reaction of prices on the 10-year Treasury Note future throughout the trading days. While minimum and maximum prices on December 13, 2017 start to gap at 07:00, prices are largely stable on March 21 and June 13, 2018 until the FOMC announcement comes in at 13:00.

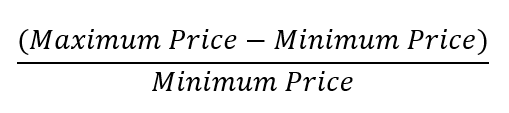

Measuring the price gaps between the two dates illustrates the difference in market expectations as well, where the price gap is calculated as:

In December 2017, on the heels of a remarkably low volatility period, prices move throughout the day, and the gap at 13:00 isn’t even the largest gap of the day. In March and June, when market volatility created some uncertainty in advance of the FOMC’s rate decision, the gap is negligible until the announcement at 13:00, when it spikes.

Clearly, market volatility can impact expectations regarding a potential rate increase from the FOMC, causing significant volumes in the 10-Year T-note and movements in trade price. However, even as the market faced greater uncertainty, the implementation costs for the 10-year Treasury Note have remained at or near the minimum 1-tick throughout the FOMC’s rate increase schedule since December 2017. The chart below shows the cost to trade for the 10-year T-Note at 120 lots, with every day below 1.05 ticks. This data can be seen at the CME Liquidity Tool.

This is a strong indication that liquidity was not impacted by the rate announcement, even in light of the market’s uncertainty about the outcome.

On-going volatility in Q4 2018 has depressed the market-implied probability of a rate increase at the December 19 FOMC meeting. While previous rate hike probabilities were impacted by market volatility events, none have been as low as 71.5% just two weeks out from the FOMC meeting. The length of the current volatile period and the decrease in the probability of a rate increase this close to the FOCM are unique to the December meeting.

- Market volatility can impact expectations of the FOMC’s rate decisions, and volatility has kept downward pressure on rate increase probabilities ahead of the December 19 FOMC.

- The market’s response to FOMC decisions may differ depending on the its expectations ahead of the meeting.

- Participants often turn to the 10-year T-Note to manage the risk of interest rate movements.

- Liquidity in the 10-year T-Note remained high even when the market was less-than-certain about the FOMC outcome.

- Many markets were closed on December 5, 2018 in honor of the National Day of Mourning. https://www.cmegroup.com/media-room/press-releases/2018/12/02/cme_group_u_s_equityinterestratemarketstoclosefornationaldayofmo.html

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

Try the CME Liquidity Tool

Analyze bid-ask spreads, book depth and cost to trade statistics for CME Group products.

More Liquidity Insights

Read insights on market movements based on analysis from the CME Liquidity Tool data. Dive into how macroeconomic events affect liquidity in CME Group futures markets.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.