Fresh from the Trading Room: Catching a break

The opinions expressed in this report are those of Inspirante Trading Solutions Pte Ltd (“ITS”) and are considered market commentary. They are not intended to act as investment recommendations. Full disclaimers are available at the end of this report.

Subscribe to get the latest updates

Highlights

Upcoming economic events (Singapore Local Time):

|

Date |

Time |

Venue |

| 2025-02-13 | 21:30 | U.S. PPI (Jan) |

| 2025-02-14 | 18:00 |

EU GDP 2nd Est (Q4) |

| 2025-02-14 | 21:30 |

U.S. Retail Sales (Jan) |

| 2025-02-17 | 07:30 | Japan GDP Prel (Q4) |

| 2025-02-19 | 07:50 |

Japan Balance of Trade (Jan) |

| 2025-02-20 | 03:00 |

FOMC Minutes |

| 2025-02-21 | 07:30 |

Japan CPI (Jan) |

Market snapshots

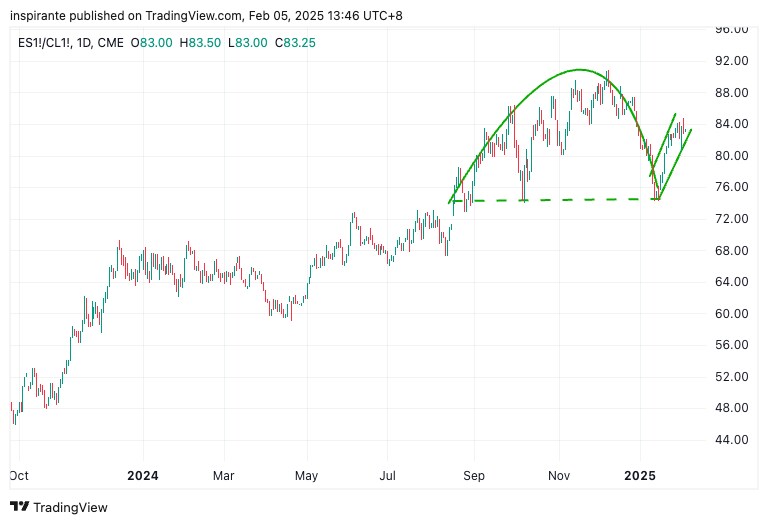

Figure 1: E-mini S&P500 Index/ Crude Oil futures ratio

The rising S&P 500 Index to crude oil ratio over the past few months highlights the growing disparity in market sentiment—optimism in equities, fueled by strong technological advancements versus broader market pessimism amid potential trade tensions. The formation of an inverse cup-and-handle pattern in the ratio suggests a possible bearish reversal, which could bring market expectations into closer alignment.

Figure 2: USD/JPY (Weekly)

The rapid rebound of USD/JPY following the initial unwinding of the yen carry trade suggests that the yen remains a preferred funding currency. However, this preference appears to be waning recently.

Figure 3: AUD/JPY (Monthly)

Despite the prior uptrend in AUD/JPY, which signaled a preference for selling the yen, the pair failed to break out of its multi-decade trading range and has since reversed.

Figure 4: Japanese Yen futures (Weekly)

Following the unwinding of the carry trade, the yen broke above its multi-year resistance line, which has now turned into support. This suggests a shift in market sentiment indicating potential yen strength.

Figure 5: Soybean futures

After a prolonged downtrend, soybean has formed a double bottom and is now attempting to break above key resistance. A decisive breakout could signal the start of a strong bullish reversal.

Beyond the charts

Just two weekends into U.S. President Donald Trump’s second term, his policies have already kept markets on edge. Over the weekend, he signed three executive orders imposing new tariffs: a 25% duty on all Canadian goods (with energy products taxed at a lower 10%), a 25% duty on all Mexican goods and an additional 10% duty on all Chinese imports. These measures were set to take effect just three days after the announcement, triggering a global market sell-off the following Monday.

However, following a swift response from Canadian Prime Minister Justin Trudeau, who announced 25% retaliatory tariffs on U.S. goods, and Mexican President Claudia Sheinbaum, who pledged countermeasures, the negotiation took a turn, with the proposed tariffs on Canada and Mexico being postponed by at least a month. Meanwhile, China unveiled its own retaliatory measures, though they were perceived as measured, likely leaving room for further trade talks. While trade tensions remain elevated, President Trump’s first term taught markets one key lesson: escalating trade tensions drive persistent policy uncertainty, making it difficult for markets to price in regulatory and geopolitical shifts.

At the start of the year, we highlighted Japan as an area with lower geopolitical risk exposure. This time, however, our focus shifts to its currency. After decades of deflation, we witness Japan entering a sustained inflationary regime, with core inflation reaching a 16-month high of 3% in December and surpassing Bank of Japan’s 2% target for the thirty-third consecutive month. This strengthens the case for further rate hikes as Japan moves toward monetary policy normalization, contrasting with other major central banks, which are leaning toward rate cuts. A narrowing interest rate differential would provide a more fundamental justification for the unwinding of yen carry trades, rather than the previous unwinding driven primarily by panic which has since reversed.

“Secretary Bessent and I confirmed we would consult closely in regards to forex,” said Japanese Finance Minister Katsunobu Kato following a video conference with U.S. Treasury Secretary Scott Bessent. Given Trump’s previous criticisms of a weak yen, calling it a “disaster” for U.S. manufacturers, we expect renewed discussions around a stronger yen. Moreover, if geopolitical tensions escalate, the yen could once again regain its safe-haven appeal. Together, these factors set the stage for yen appreciation.

From ideas to actions

We conclude with the following hypothetical trades:1:

Case Study 1: Long Japanese Yen futures

We would consider taking a long position in the Japanese Yen futures (6JH5) at the current price of 0.006595, with a stop-loss below 0.0062, a hypothetical maximum loss of 0.006595 – 0.0062 = 0.000395 points. Looking at Figure 4, the Japanese yen has the potential to rise back to its previous highs at 0.0072 and 0.0078, resulting in 0.0072 – 0.006595 = 0.000605 points and 0.0078 – 0.006595 = 0.001205 points, respectively. Each point move in the Japanese Yen futures contract is 12,500,000 USD.

Case Study 2: Long Soybean futures

We would consider taking a long position in Soybean futures (ZSH5) at the current price of 1077’4, with a stop-loss below 1065’4, a hypothetical maximum loss of 1077’4 – 1065’4 = 12 points. Looking at Figure 5, if the Double Bottom reversal is confirmed, soybean prices have the potential to reach 1194’4, resulting in 1194’4 – 1077’4 = 117 points. Each Soybean futures contract represents 5,000 bushels and each point move is 50 USD.

1 Examples cited above are for illustration only and shall not be construed as investment recommendations or advice. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. Please refer to full disclaimers at the end of the commentary.

Disclaimer

This publication is provided by Inspirante Trading Solutions Pte Ltd (“ITS”) for general information and educational purposes only. ITS is NOT licensed or regulated for the provision of investment or financial advice, and we do not seek to do so.

Any past performance, projection, forecast, or simulation of results is not necessarily indicative of the future or likely performance of any investment.

Any expression of opinion, which may be subject to change without notice, is personal to the author, and ITS makes no guarantee of any sort regarding the accuracy or completeness of any information or analysis supplied.

None of the information contained here constitutes an offer or solicitation of an offer to buy, sell or hold any currency, product, or financial instrument, to make or hold any investment, or to participate in any particular trading strategy.

ITS does not take into account your personal investment objectives, specific investment goals, specific needs, or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. Suitable advice should be obtained from a licensed financial advisor for this purpose. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice, or any other advice or recommendation of any sort.

ITS shall not be liable for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here. The contents of these publications should not be construed as an express or implied promise, guarantee, or implication by ITS that the reader will profit or that losses in connection therewith can or will be limited from reliance on any information set out here.

This content has been produced by ITS. CME Group has not had any input into the content, and neither CME Group nor its affiliates shall be responsible or liable for the same.

CME Group does not represent that any material or information contained herein is appropriate for use or permitted in any jurisdiction or country where such use or distribution would be contrary to any applicable law or regulation.

Connect

Keep up with Fresh from the Trading Room on LinkedIn or Twitter

Subscribe to Fresh from the trading Room

Keep up with the latest expert analysis from Fresh from the Trading Room, produced by Inspirante Trading Solutions. Create a free CME Group account and/or sign in today to view the most recent report.

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.