- 4 Nov 2020

- By CME Group

CME Group offers the widest range of global benchmark products across all major asset classes, including a suite of futures, options, and cash. At CME Group, we also provide access to OTC markets, help optimize portfolios, analyze data, and help manage risk. The Cross-Commodity Recap includes the latest CME Group Commodity product updates and news on the metals, energy, and agricultural markets – it is our curated look at these Commodity products.

Register here to receive a copy of the Quarterly Cross-Commodity Recap, delivered directly to your inbox.

- COMEX Micro Gold (MGC) and Micro Silver (SIL) achieved record average daily volume (ADV) in Q3 of 140K and 21K contracts, respectively. This is the third consecutive quarter of record volume for both products.

- Overall volume in our Precious Metals futures was a record 668K contracts in Q3, led by a record 151K contracts of ADV in our flagship Silver (SI) contract.

Q3 ADV Records |

||

|---|---|---|

Product |

ADV |

Previous Record |

Precious Metals futures |

668k |

658k |

Silver Futures (SI) |

151k |

120k |

Total Metals – APAC Region |

145k |

127k |

Micro Gold Futures (MGC) |

140k |

72k |

Micro Silver Futures (MGC) |

21k |

3k |

Aluminum Futures (ALI) |

348 |

149 |

Source: CME Group

The COMEX Copper futures price has risen more than 40% to over $3 per pound since the March low.

Source: CME Group

- This price action has driven higher volumes (Q3 ADV 99K, up 3% YoY) and rising open interest (290K up 46% vs lows in May) in Copper. Our Copper futures and options market continues to be the most liquid electronic venue to trade copper.

- After rising to nearly 40% implied volatility in March, Copper options are now close to the two-year mean of 20% implied volatility. Both call skew and implied volatility have reverted closer to the mean even as the price of copper has rallied 40%.

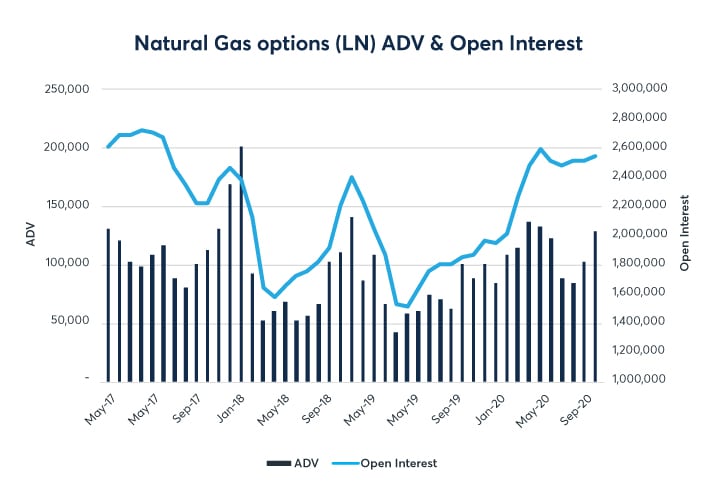

Global gas price convergence and uncertainty around supply and demand heading into the upcoming withdrawal season has led to unprecedented growth in the Henry Hub commodity. A combination of economic factors around the pandemic and uncertainty around the severity of winter in the Northern Hemisphere has contributed to significant price volatility in the natural gas markets. The growth of Henry Hub futures liquidity during both European and Asian trading hours is more evidence for its relevance as a global benchmark.

- Make up 82% of Global Gas futures trading*

- ADV during extended trading hours has grown 17% in 2020

Source: CME Group

- In 2020 YTD, market share is 73%, up from 68% in 2019 YTD*

- Record electronic volume in 2020 YTD of 60K contacts per day

- Growth driven by RFQ strategies – 56% of all screen volume in 2020

- Open interest of 3.4M contracts is the highest since 2015

Source: CME Group

* Source: ZE Power

Since launching on September 21, South American Soybean futures volume has continued to grow. A month into trading, open interest has reached over 300 contracts and average daily volume (ADV) has increased to 102 contracts. Market participants from across the globe have started to capitalize on trading opportunities provided by this new contract.

- A more effective hedge for South American producers, exporters, and importers of Brazilian soybeans ‒ as it reflects export price at the Port of Santos

- An opportunity to trade the spread between North American and South American soybeans, and effectively, the South American soybean basis

- Available for screen trading on CME Globex or block trade reporting via CME ClearPort

Source: CME Group

The latest white paper from CME Group researchers, Alison Coughlin and Dominic Sutton-Vermeulen, addresses the relationship between soybean prices in major importing and exporting countries and the usefulness of a cleared South American Soybean futures contract for managing global soybean price risk.

Global Command Center (GCC) is the market operations and customer service desk for electronic trading and handles inquiries, issues, and support requests from CME Globex and CME ClearPort customers 24 hours a day.

Regional numbers:

US: +1 800 438 8616

EMEA: +44 20 7623 4747

APAC: +65 6532 5010

For general, non-urgent questions, please email GCC at gcc@cmegroup.com.

Email all clearing inquiries to Clearing Client Services at ccs@cmegroup.com.

If you have any questions relating to Energy products, please contact energy@cmegroup.com.

Will Patrick

London

+44 20 3379 3721

Phil Hatzopoulos

Chicago

+1 312 930 3018

Tim Smith

Hong Kong

+852 2582 2236

Register here to receive quarterly updates on the latest news across Metals, Energy, and Agriculture.

-

-

View Past Editions

- Read the quarterly Cross-Commodity Recap for highlights and trading activity in benchmark CME Group Agricultural, Energy, and Metals markets.

-