- 22 Oct 2024

- By CME Group

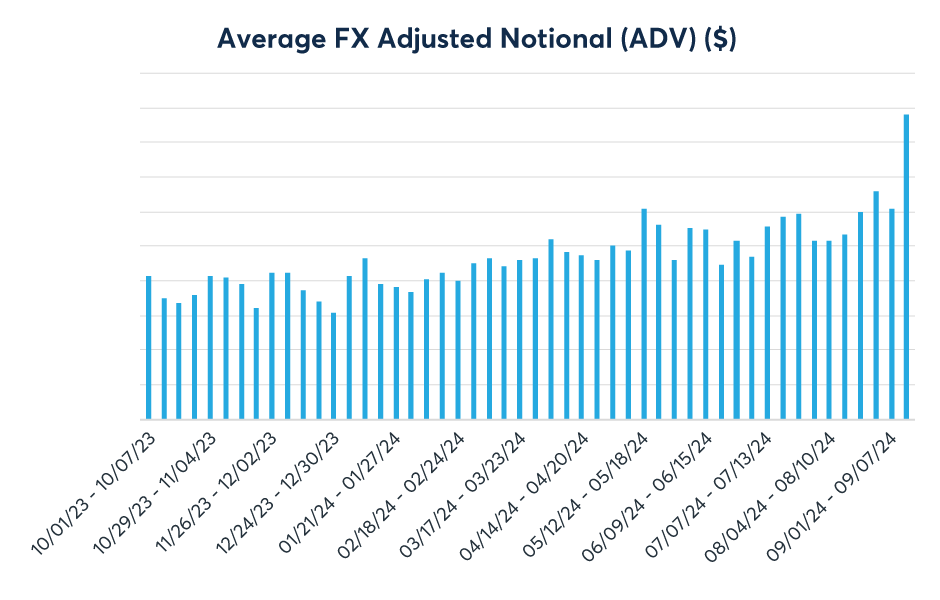

The end of summer can often be a slower time for markets, but it was an incredibly active period for BrokerTec Quote. Weekly, monthly and daily records were easily surpassed. Of particular note:

- Nominal ADV has increased 200% YoY

- Multiple record days throughout summer, with highest ADV on September 25

- 8 of the top 10 biggest-volume days in BrokerTec Quote were in August, while the trend continued into September with 10 record days in the month.

Source: CME Group

See more about how BrokerTec Quote and the rest of our products and services are fulfilling the market's needs, especially during times of heightened volatility.

Recent enhancements only further expand the potential for growth on the D2C Repo RFQ platform. Support for Asian trading hours has been extended, while new functionality for search and best price calculations have been implemented.

See the full list of supported products, key features and connectivity choices for additional details.

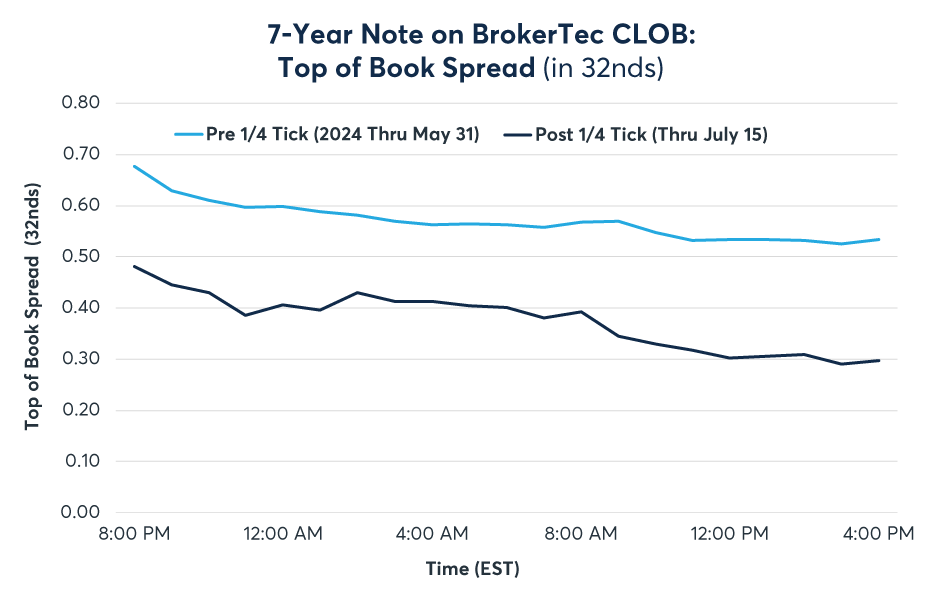

Important changes for CLOB UST trading have also driven record activity on that platform in 2024. With heightened volatility, the BrokerTec CLOB was able to provide continuous deep liquidity pools for risk management of on-the-run Treasuries, including a robust $249 billion in average daily notional value (ADNV) on August 5.

Part of this increased volume can be attributed to recent enhancements to the platform, such as the MPI reduction for the 7-Year Note. This change to 1/4 of a tick has led to increased top-of-book activity and spreads that have tightened by as much as 33%.

Source: CME Group

BrokerTec Stream also joined in on the positive trends across the platform as of late, including three straight record months across the summer.

Market makers continue to join the platform, helping to boost liquidity. Connect with us for details, or see more about our relationship-based platform on our home page below.

All data as of October 1, 2024 unless otherwise noted.

August was a banner month for the RV platform, bolstered by activity in Butterfly trades as market volatility increased. Featured highlights:

- Record month: $2.8 billion in ADV, including half a billion in Butterflies

- 2024's high session: August 5 saw $7.5 billion, the second-highest since launch

Complementing our Government Repo execution offering, Corporate Repo is now available for trading on Quote. MBS is coming soon to round out our offering. Reach out to your dedicated BrokerTec representative for details.

The latest addition to the ever-growing European trading lineup is new Austrian T-Bill Cash instruments, Repos and GC Baskets.

All three will be listed on Globex, see the recent notice for details on these new products which are available for customer testing in New Release.

In addition to cash markets, CME Group will allow for the seamless display of €STR and SOFR futures directly on the BrokerTec GFE later this quarter. This opens up additional liquidity and risk management opportunities, all on a single platform.

The content in this communication has been compiled by CME Group for general purposes only and is not intended to provide, and should not be construed as, advice. Although every attempt has been made to ensure the accuracy of the information within this communication as of the date of publication, CME Group assumes no responsibility for any errors or omissions and will not update it. Additionally, all examples and information in this communication are used for explanation purposes only and should not be considered investment advice or the results of actual market experience. This communication does not (within the meaning of any applicable legislation) constitute a Prospectus or a public offering of securities; nor is it a recommendation to buy, sell or retain any specific investment or service.

CME Group does not represent that any material or information contained in this communication is appropriate for use or permitted in any jurisdiction or country where such use or distribution would be contrary to any applicable law or regulation. In any jurisdiction where CME Group is not authorized to do business or where such distribution would be contrary to the local laws and regulations, this communication has not been reviewed or approved by any regulatory authority and access shall be at the liability of the user.

Certain CME Group subsidiaries are authorised and regulated by regulatory authorities. CME Group subsidiaries are required to retain records of telephone conversations and other electronic communications for a period of 5 to 7 years where required by certain regulation, copies of which may be available on request (which may be subject to a fee). For further regulatory information please see www.cmegroup.com.

BrokerTec Americas LLC. (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (https://brokercheck.finra.org/), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL offers products and services in relation to U.S. Treasury Benchmark instruments, Repurchase and Reverse Repurchase instruments, including U.S. Treasury, Government of Canada, Corporate and Mortgage-backed products. BAL does not provide services to private or retail customers. All investments involve risk of loss, particularly in terms of fluctuations in value and yield. If an investment is denominated in a currency other than your base currency, exchange rate fluctuations may have a favorable or unfavorable impact. Further, there are risks associated with investing in fixed income asset classes that include, but are not limited to, market risk, interest rate risk, default risk, event risk, credit risk, and government security risk.

Copyright © 2024 CME Group Inc. All rights reserved.

Mailing Address: 20 South Wacker Drive, Chicago, Illinois 60606