- 5 Jun 2023

- By CME Group

Improved latency, match type optionality, and cutting-edge liquidity management services and analytics are all coming in the upgraded platform. CME Group will launch BrokerTec Stream 2.0 on Sunday, June 11 (trade date Monday, June 12), kicking off the next era of relationship-based trading for U.S. Treasuries.

- See the Client Impact Assessment

- Reach out to the team to get your questions answered at BrokerTecStream@cmegroup.com

- See Stream in action, request a demo

BrokerTec Markets on CME Globex Update notices are now available via the subscription center. Sign up to receive critical information, announcements, and resources required for customers to support BrokerTec markets on CME Globex.

We invite you to join us for a cocktail reception in beautiful Lisbon, Portugal at the ISLA conference on Wednesday, June 21. The event will be on the rooftop at the Lux Lisboa Park Hotel, celebrating ISLA's 30th Annual Securities Finance & Collateral Management Conference.

Follow the link below to register for the event, or reach out to events@cmegroup.com if you have any questions. The BrokerTec team hopes to see you there.

BrokerTec is pleased to announce the integration of clearing of euro-denominated securities in collaboration with LCH Group via Sponsored Clearing. This enables clients to efficiently clear securities through BrokerTec Quote, greatly accelerating trading opportunities and growing the reach of the platform's bilateral, relationship-driven alternative execution service.

The inclusion of euro securities follows up the existing partnership between BrokerTec and LCH Group for Gilt Repo. The addition of this currency allows members to access LCH's deep liquidity pool, which averaged 3.3 trillion euros worth of daily outstanding liquidity in Q1, enabling fresh netting and risk management opportunities.

Data as of May 31, 2023 unless otherwise specified

*Pending regulatory review

The market-wide €STR First initiative is having a sizable impact on trading activity. Average top-of-book depth has expanded by over 400% across the front eight contracts, while the average bid/offer spreads have narrowed by 25%. Trading activity has also extended further out on the curve while inter-commodity spreads have also received record attention.

RV Curve savings: Surging market volatility has increased the appeal of RV Curve trades, which feature no legging risk and the additional savings available from the program's "excess efficiencies." Savings are achieved by trades being done in a yield format, which leads to better prices than original spread orders due to rounding. These spread improvements could prove to be crucial in today's choppy market, especially when coupled with the fact that this program provided traders with $8 per million in savings in 2022.

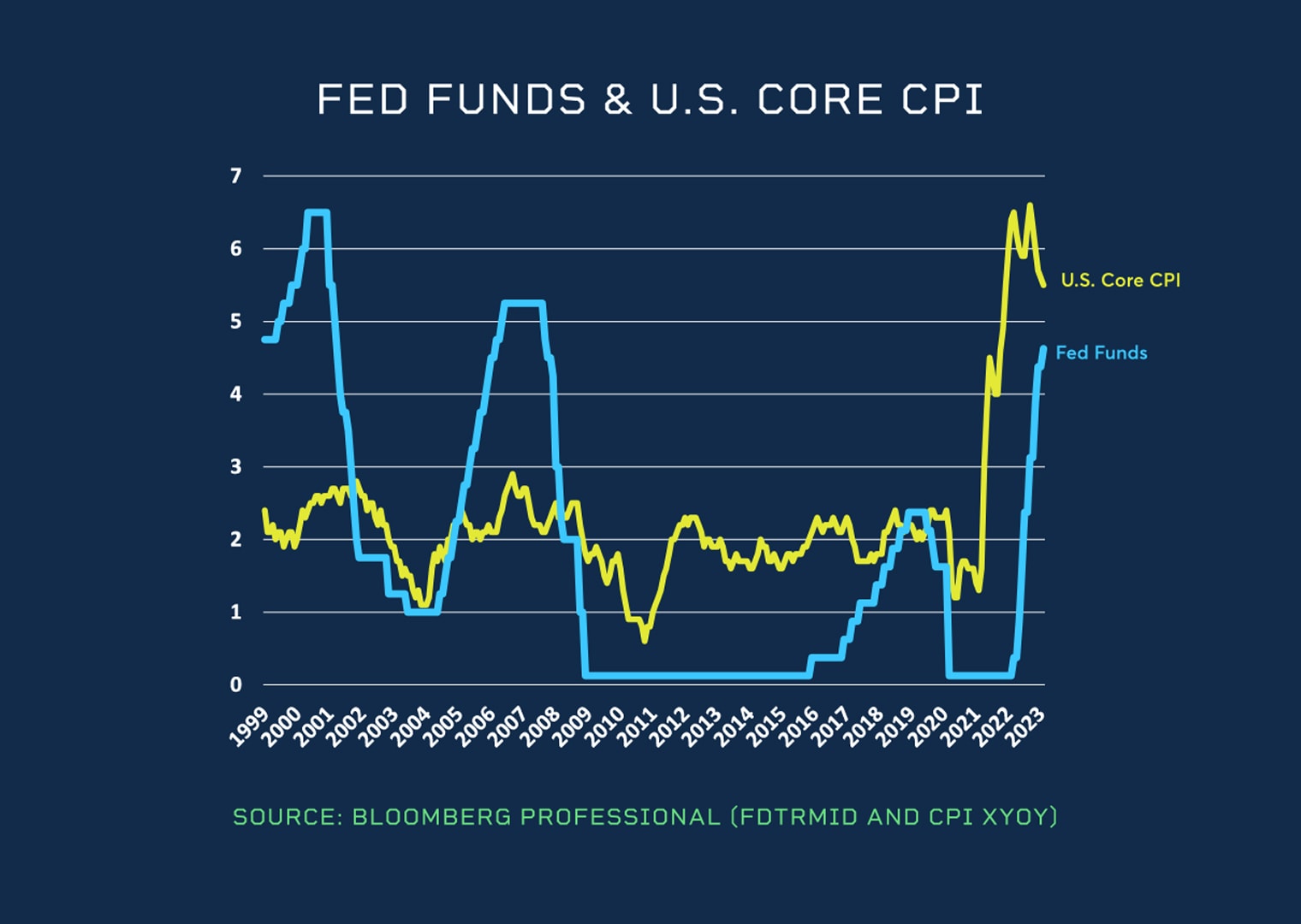

Fed's path ahead: The Fed is in a quandary over what to do with rates in the near-term. Inflation remains stubbornly high, but concerns over the health of the banking sector have been brought to the forefront lately. How does the Fed juggle these issues -- and more -- this summer? Eric Norland offers his perspective in this recent video, The Fed's Balancing Act.

RepoFunds Rates info - Measure one-day repo rates for the euro, British sterling, and JBOND markets with CME Group's suite of RFR benchmarks. These offer a way to track overall funding costs all in a centrally cleared and electronically executed way. Discover more about RFR benchmarks.

CME Group Data Service Highlight -- BrokerTec European Government Bonds (EGB): This platform offers premium accuracy and frequency of pricing across 1,000 bonds in 13 key European markets. Data consists of executable prices streamed directly from the platform, providing a crucial tool for price discovery and authentication. Learn more about EGBs.

Stay in the know

Stay up to date with the latest CME Group BrokerTec news.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.