- 17 Jun 2022

- By CME Group

After years of accommodation, many central banks have sped up plans to tighten monetary policy in the face of rising inflation readings around the world.

Using RepoFunds Rate (RFR) Indices, we explore how rising rates are impacting euro repo markets, and look to sterling repo markets for insight into what eurozone participants might expect once ECB rates increase.

What are RepoFunds Rates (RFR) Indices?

- Each day, CME Group Benchmark Administration (CBA) publishes repo rate benchmarks for the eurozone, UK, and Japan based on roughly €462B in daily repo volumes executed on BrokerTec, MTS, and JBOND YTD.

- The rates measure the overall cost of funding achieved by the market, inclusive of both general collateral (GC) and suitable specific collateral (SC) repo trades.

- RFR Euro is available as a volume-weighted average across Europe, and for 10 individual sovereign bond markets across the eurozone.

- RFR Indices are registered as benchmarks under EU BMR.

With increased money market volatility driving demand for quality repo trading, global participants continue to rely on BrokerTec's leading liquidity and network across both CLOB and RFQ protocols:

- Notional ADV reached a record month of €344B in May, with Gilt repo leading the way following the BOE's May 5 rate hike.

- Dealer-to-client RFQ trading on BrokerTec Quote rose in May to a new monthly high and continues to see new LPs and LCs go live on the platform, as well a host of new functionality now live.

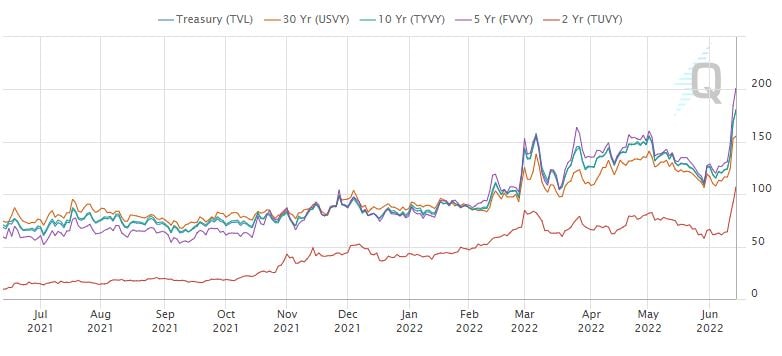

With Treasury market volatility rising sharply across the curve and front-end yields surging on rising rate hike expectations, clients are turning to RV Curve to efficiently manage their risk.

Recent activity on RV Curve:

- June 10: $3.5B notional traded in conjunction with the May CPI release (5th highest day on record)

- June 13: $4.8B notional traded as yield curve inverted (all-time high)

- June 14: $4.2B notional traded (2nd highest day on record)

Source: QuikStrike CVOL tool

On June 28, the BrokerTec Global Front End Client will be upgraded to version 10.5 with several impactful enhancements, including:

- GC Allocation for EU repo: Traders will be able to allocate collateral for "GC Trades" via a tab in Log Book, offering another convenient option to allocate GC trades directly via GFE.

- Bid/Buy in Bulk for U.S. repo: Currently, the Buy in Bulk and Bid in Bulk C and REG windows allow traders to target <10Y or <30Y collateral. In this release, a new option to target <3Y collateral will be added.

- BrokerTec Stream: A number of UI enhancements are included in 10.5 to improve user experience.

In Q4, BrokerTec will launch the next-generation trading platform for BrokerTec Stream, our relationship-based streaming service for U.S. Treasury markets.

Here's what to expect from the next-gen platform:

- Significantly enhanced processing times and faster market data

- New features such as sweepable orders, client-to-client matching, and enhanced market maker inventory management

- Retained existing features such as 1/16 MPI, single ticket fills, firm pricing, directed orders, and shared STP, front end, and credit with the CLOB

- Integration with leading ISVs such as Broadway, CQG, and ION Trading

- As the Fed reduces its balance sheet, the supply of U.S. Treasuries could allow other entities to expand their own positions.

- On its current trajectory, Treasury will issue $23B fewer securities per month, leaving approximately $146B in net new duration issuance before the end of 2022.

If you’re active on LinkedIn, follow BrokerTec for timely updates on our markets including product news, research, and more.

Stay in the know

Stay up to date with the latest CME Group BrokerTec news.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.