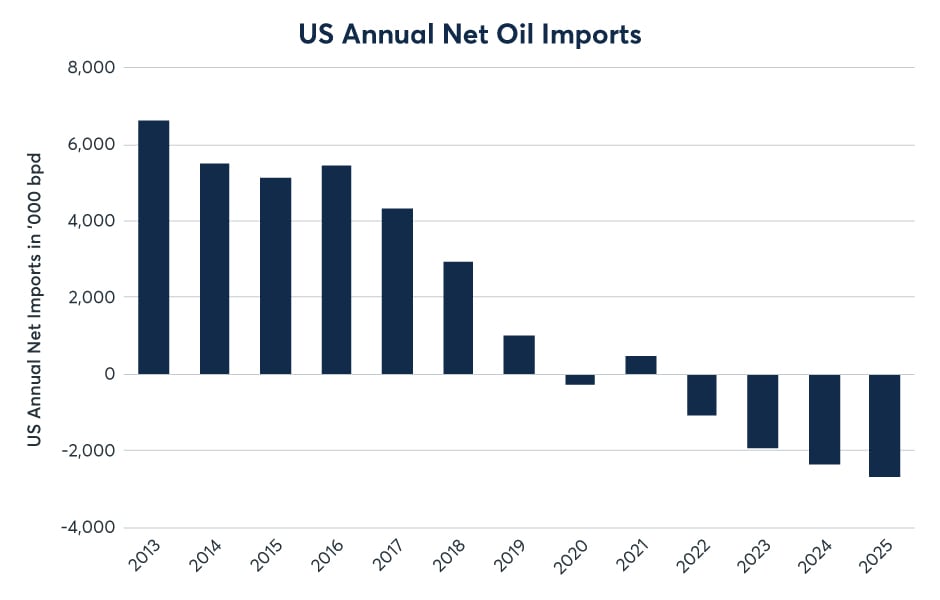

Whilst geopolitics influence the economy, the reverse is more profoundly accurate. Economic developments have a tangible impact on a country’s foreign policies. The case in point is aptly illustrated in the chart above. With the emergence of the U.S. shale industry in the first half of the previous decade, the country’s net crude oil and product imports progressively declined, and from 2022 onwards, the U.S. has been a net exporter of oil. Considering that it relied on foreign oil to the extent of more than 6.6 mbpd in 2013, and 12 years later it sends more than 2.6 mbpd of oil overseas, it is nothing short of a spectacular achievement. This 9.3 mbpd swing was the result of crude oil imports declining by 5.6 mbpd and product exports rising by 3.7 mbpd over the period.

Of course, to conclude that the U.S. achieved complete independence would be a step too far. U.S. refiners are unable to satisfy their demand for the most suitable crude oil grades domestically, therefore gross crude oil imports remain elevated at around 6.5 mbpd. On the product front, seasonality and occasional refining capacity constraints necessitate product imports. On a gross basis, it fluctuates between 1.7 and 1.8 mbpd. Yet, the undeniable fact is that declining reliance on foreign oil has rewritten the U.S. foreign policy. The role foreign oil plays in national security considerations has diminished.

The extended production alliance, known as OPEC+, would have never been born without growing U.S. oil independence. OPEC heavyweight, Saudi Arabia, which exported as much as 1.3 mbpd of its oil to the U.S. in 2013 is now able to send a mere 300-400,000 bpd. It needed more allies to maintain its influence on the supply side of the equation. The U.S. approach to international affairs has also changed. Military interventions, such as the two Gulf Wars in 1990 – 1991 and 2003 are less plausible than before. The seismic changes in the U.S. domestic oil landscape have led to strategic changes in U.S. foreign policy. The attitude towards international conflicts has become more lenient, and it is expected to remain so, notwithstanding the occasional price spikes, unless U.S. retail gasoline prices, the yardstick against which every U.S. president is measured, are running out of control on a protracted basis.

Stay in the know

Keep up with the crude oil markets. Get biweekly analysis from PVM, the leading oil instrument broker – courtesy of CME Group.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.