The new U.S. administration's declared goal is to protect the domestic economy and the manufacturing sector, clamp down on immigration and fight against harmful cross-border drug trade. The original idea floated at the end of last month was to impose a 25% tariff on Canadian exports, except oil, which would have been levied with 10% and an across-the-board tariff of 25% on Mexican goods, including oil.

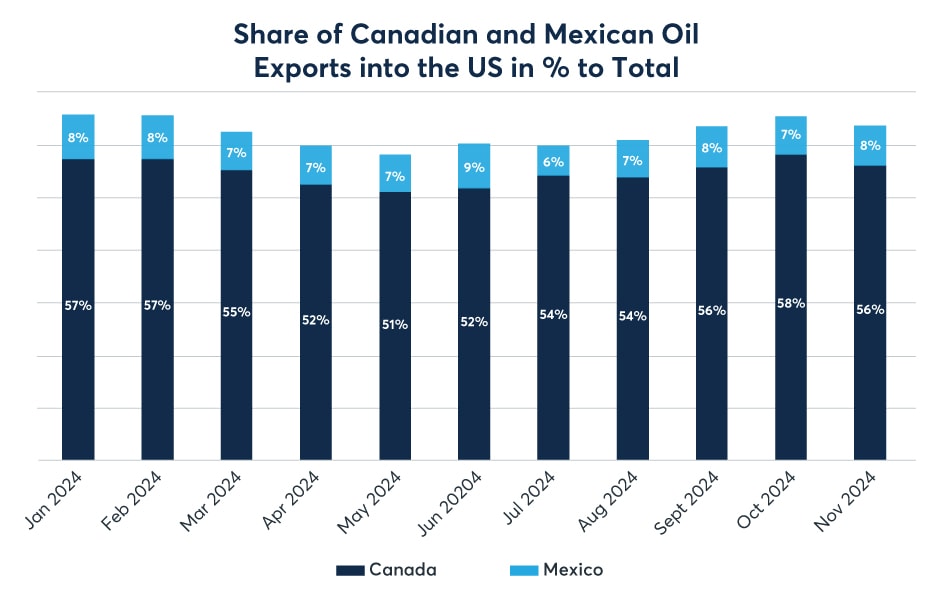

These two countries play a vital role in the U.S. oil sector. The chart above illustrates that their combined share of the U.S. oil import market fluctuated between 58% and 66% in the first 11 months of 2024, based on the latest available EIA data. Canada, on average, sent a total of 4.61 mbpd of oil to the U.S. last year (4.05 mbpd of crude oil and 560,000 bpd of products). The total from Mexico amounts to 632,000 bpd, of which 466,000 bpd is crude oil and 166,000 bpd is products. Additionally, Mexico received a significant volume of U.S. refined products last year, 1.15 mbpd to be precise.

The planned tariffs on oil exports of these two trading partners would have significantly tightened the domestic oil balance. Consequently, the market reacted to the possible introduction of the excise taxes with a fierce but understandable buying spree. Outright prices rallied hard and the structures of the CME Group flagship Crude Oil contract and the two major products, Heating Oil and RBOB, strengthened meaningfully. As assessed by price reporting agency S&P Global Platts, the premium WTI commands over the Western Canadian Select (Hardisty) crude oil grade widened by $1.65/bbl overnight.

Last-minute concessions and a 30-day reprieve in imposing trade sanctions mitigated the tension and pulled the region back from the precipice of a trade war. Both Canada and Mexico pledged to tighten border security and clamp down on the drug trade. Trade deficit and the protection of the U.S, domestic manufacturing sector, however, remain unresolved issues between these traditional trading partners. Tariffs might have been put on hold, but they have not been removed permanently. They remain tools available to the U.S. administration. Should they be eventually slapped on Canadian and Mexican oil, their impact will be similar, if not more profound, than what was experienced at the beginning of this month, especially because reciprocal measures would be anticipated. In the current unpredictable trading environment, buying call options or call option spreads should provide decent protection against unforeseen price rallies in U.S. domestic grades and refined products, caused by trade restrictions.

Stay in the know

Keep up with the crude oil markets. Get biweekly analysis from PVM, the leading oil instrument broker – courtesy of CME Group.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.