Timera Energy Chart of the Month

February 2025 highlights

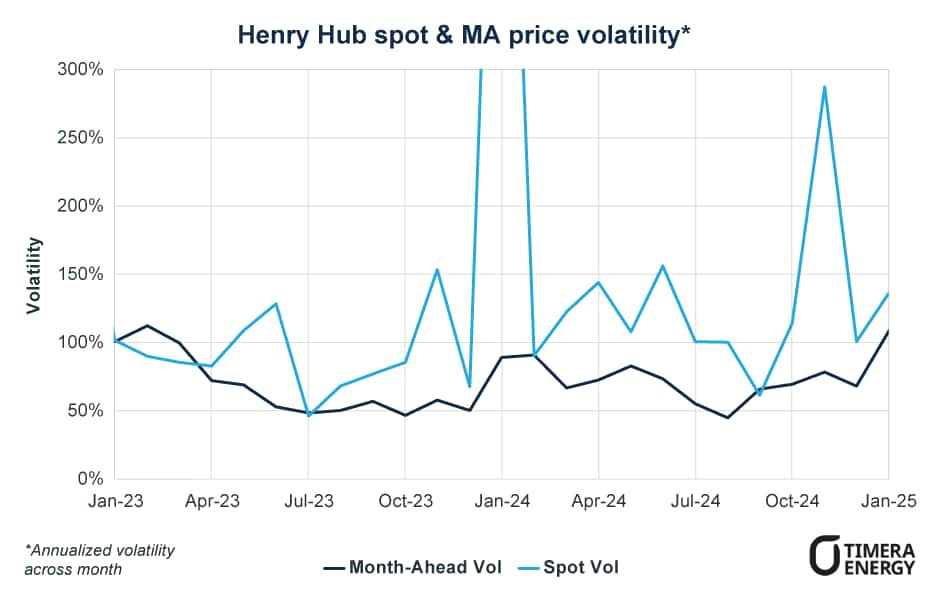

- Henry Hub front-month prices jumped above $4/mmbtu in early January, triggering heightened volatility.

- Surge in volatility is driven by cold weather in North America and record-high U.S. LNG feedgas demand.

- The onset of USGC supply growth in 2025 is anticipated to amplify market volatility, fueled by enhanced global gas hub integration, uncertainties in project ramp-up schedules and rising power demand from data centers.

Henry Hub volatility surges amid winter price rally

U.S. natural gas prices have rallied significantly since late October, with Henry Hub front-month futures surpassing the $4/mmbtu mark for the first time since early 2023. Spot prices also peaked at $4.40/mmbtu on January 13.

The intensity of this recent price rally has led to a notable increase in volatility across both futures and spot markets. Two key factors are driving this spike in volatility:

- The polar vortex across much of North America has sustained high domestic residential and commercial gas demand. Net storage withdrawals from gas reserves totaled 258 Bcf for the week ending January 10, significantly exceeding the previous five-year average (2020–2024) of 128 Bcf.

- Expectations of rising feedgas demand have also fueled market volatility. The rapid commissioning of Plaquemines LNG Phase 1 pushed U.S. LNG feedgas flows to an all-time high of 15.3 Bcf/d during the week commencing January 13. Further upside risk remains with the Corpus Christi Stage 3 expansion achieving its first LNG.

Looking ahead to 2025, the onset of a new wave of USGC liquefaction capacity growth could drive further volatility through:

- Increasing integration with global gas markets. As traders balance assets against U.S. SRMC, Henry Hub prices are becoming increasingly correlated with global gas hubs, amplifying volatility even from marginal changes in demand.

- Rising power demand from data centers, driving increased investment in gas-fired power generation.

- Growing power demand from data centers is driving increased investment in gas-fired power generation

In response to the heightened focus on volatility, CME Group is enhancing the granularity of its options products with the introduction of the new NG Weekly option.

timera-energy.com

+44 (0) 207 965 4541

info@timera-energy.com

The contents of this document is for informational purposes only, should not be considered as investment or trading advice, and is not an offer to sell or a solicitation to buy any futures contract, option, security, or derivative including foreign exchange.

© Timera Energy 2020 | Registered in England and Wales No 6728502

Stay in the know

Get monthly analysis of natural gas trends and events from Timera, a leading industry consultant – courtesy of CME Group.

Already have an account? Log in

By clicking above, you are subscribing and agreeing to receive the specified content. I understand that I can unsubscribe at any time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The opinions and statements contained in the commentary on this page do not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs. This content has been produced by Timera Energy. CME Group has not had any input into the content and neither CME Group nor its affiliates shall be responsible or liable for the same.

CME GROUP DOES NOT REPRESENT THAT ANY MATERIAL OR INFORMATION CONTAINED HEREIN IS APPROPRIATE FOR USE OR PERMITTED IN ANY JURISDICTION OR COUNTRY WHERE SUCH USE OR DISTRIBUTION WOULD BE CONTRARY TO ANY APPLICABLE LAW OR REGULATION.