4 Min readArticle09 Jan 2025

Five Things to Watch in Energy Markets in 2025

At a Glance

Energy markets are gearing up for a potentially tumultuous 2025 amid ongoing global conflicts, a change in the U.S. administration, possible snags in the energy transition, trade policies related to tariffs and a mix of supply-side constraints.

Although it could take months before the incoming administration’s impact on the energy sector becomes clear, some are already evident, such as the initiative to scale back support for electric vehicles. These factors have the potential to reshape the energy landscape and contribute to volatility in natural gas, crude oil and the refined products markets.

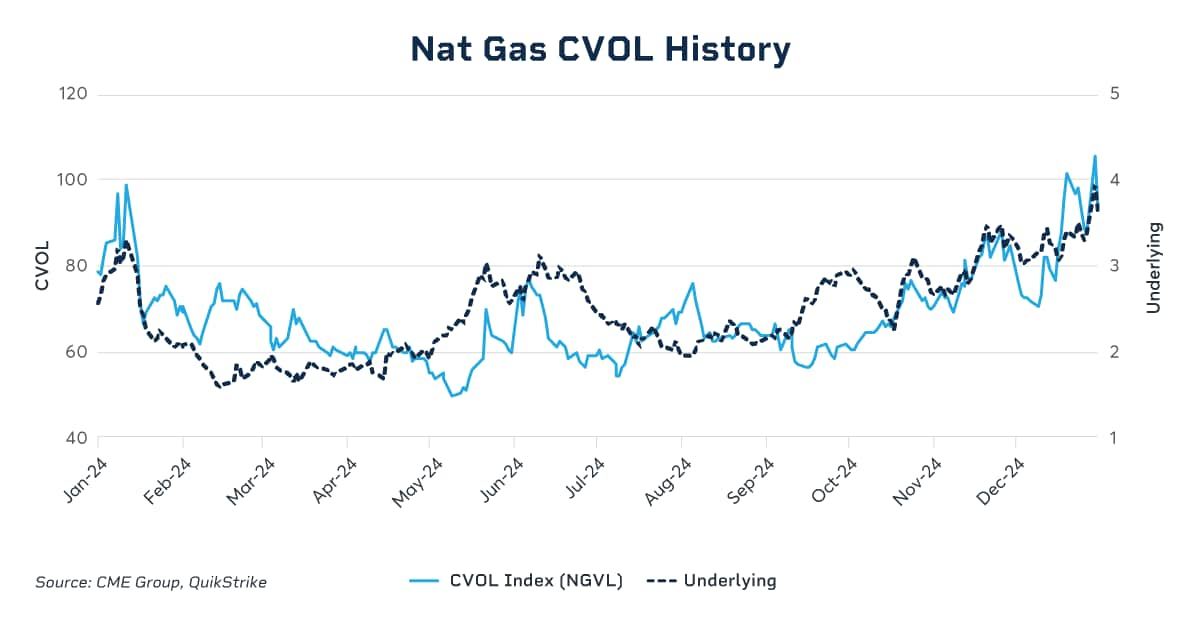

1. Bullish Momentum Fuels Natural Gas Prices

2025 is seen ushering in a tighter demand-supply balance for natural gas, a shift likely to exert upward pressure on Henry Hub futures prices and lift volatility. The market started this winter season with warmer-than-normal temperatures, but forecasts for colder weather reversed the upward price trend while pushing up forecasts for natural gas consumption from the residential and commercial sectors. Meanwhile, feedgas demand from U.S. LNG export terminals is set to remain strong, driven by the competitiveness of LNG netback margin, or profits, between U.S. versus European and Asian markets. Gas demand for power generation is anticipated to continue to grow with the transition from coal to gas.

Tighter balances and rising natural gas prices may encourage producers to roll back gas curtailments that were put in place in early 2024 in response to weaker prices. While gas production is poised to recover in 2025, the incremental supply is anticipated to come primarily from associated gas in the Permian Basin.

Natural gas and LNG could be a main beneficiary of the new incoming U.S. administration, which is expected to revoke the temporary pause on new LNG export licenses. The pause was announced in January 2024, slowing approvals for greenfield LNG terminals and expansion projects. The expected lifting of the pause is anticipated to accelerate investments across the natural gas and LNG industry in 2025.

2. All Eyes on OPEC+

With oil prices near multi-year lows and expectations for surplus oil supply, 2025 could be a challenging year for the Organization of Petroleum Exporting Countries (OPEC). OPEC+, which includes allies like Russia, has been trying to return 2.5 million barrels of curtailed oil production to the market since June 2024, a decision it delayed for a third time in December. S&P Global Commodity Insights believes that any material increases in OPEC+ output in 2025 would put downward pressure on oil prices, which it said could potentially send WTI futures to as low as $30 per barrel.

Complicating the supply-demand balancing act would be any shake-up in U.S. policy on Iran and Venezuela. Oil production from these nations have increased by nearly two million barrels since 2020, supply that tighter U.S. sanctions could remove. These possible curtailments could open the door for OPEC’s desired supply increases, and the uncertainty around these types of actions could keep traders on their toes in 2025.

3. Shifting Mix of Product Demand

The International Energy Agency (IEA) forecasts 2025 demand growth of one million barrels per day, a level that was similar to 2024. However, in 2025, more than 50% of that demand is expected to come in the form of natural gas liquids (NGLs) like propane and butane, which are used as a petrochemical feedstock and produced mainly as a co-product of natural gas.

From a 2019 baseline, S&P Global Commodity Insights sees 2025 demand for traditional oil-based fuels like gasoline and diesel rising by only 300,000 barrels per day. China’s demand for these fuels has peaked as investments in vehicle electrification and LNG-based trucking fleets reach a tipping point.

This shifting product mix is a challenge for oil refiners in China and elsewhere, who have seen narrowing profit margins and announced a series of plant closures. Adding more pressure to existing refiners in 2025 is new refined products supply from the Dangote refinery in Nigeria, which is still ramping up production, and with the potential commissioning of the new Olmeca refinery in Mexico later in the year. Refiners that bear high costs of operations from importing crude oil, exporting product, high energy costs or all the above are likely candidates for more capacity rationalization in 2025. Traders will closely be watching for these announcements to guide price outlooks in the coming year.

4. Biofuels and the Energy Transition

Several changes are expected in the biofuels market in 2025 with a greater emphasis on the role of feedstocks that deliver higher greenhouse gas savings to reach more ambitious carbon reduction goals. The non-traditional feedstocks such as waste oils look set to become a bigger feature of the market as governments make adjustments in an attempt to achieve net zero carbon emissions by 2050.

A much wider range of feedstocks is expected to emerge as governments review the greenhouse gas savings for each product and permit them for use. Regions like the European Union, through their Renewable Energy Directive, have already approved a wide range of biofuel feedstocks, and other countries are beginning to implement similar moves.

The trading of the waste feedstocks – such as waste oils and animal fats – are expected to grow as a proportion of the overall biofuel supply. Given the growth of advanced biofuels such as renewable diesel, the pressure on the supply chains of some key feedstocks is only likely to intensify as the number of buyers continues to expand, potentially outpacing the volume of available products in the market. Other products like sustainable aviation fuels have been allocated their first blending mandates by the European Union, the U.S. and other countries, which will continue to pressurize supply chains in the years ahead.

5. Will Uncertainties Inspire More Short-Term Options Trading?

Amid the uncertainty around upcoming policy changes, continued geopolitical conflicts and slowing growth in major economies, the energy markets are susceptible to significant price movements in both directions. Enhanced price risks have given rapid rise to the use of short-term options, such as CME Group’s WTI Crude Oil Weekly options, since they expire on a weekly cycle, providing traders more precise and lower-cost tools for managing their positions. In 2024, average daily volume in WTI Weekly options averaged more than 20,000 contracts, or 20 million barrels, nearly quadrupled from 2022.

As price risks persist, the appeal of short-term energy options is likely to grow, making these tools a key area to watch in 2025.

With so many crosscurrents, 2025 will be a pivotal year for energy markets as supply and demand factors could be influenced by many possible external events. Risk management in energy markets is likely to continue apace as traders look to cover many uncertain events that could unfold during the course of 2025.

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).