- 15 Jul 2021

- By CME Group

Gold markets have internationalized dramatically in the past five years with price discovery in OTC and exchange cleared markets becoming more inextricably linked than ever.

Markets become healthier as global pools of risk converge. Participation from EMEA and APAC has grown materially as liquidity in COMEX Gold options has improved during non-US hours. The international session has proved to be especially important, given that new highs above 1600, 1700, and 2000 were all recorded during APAC trading hours.

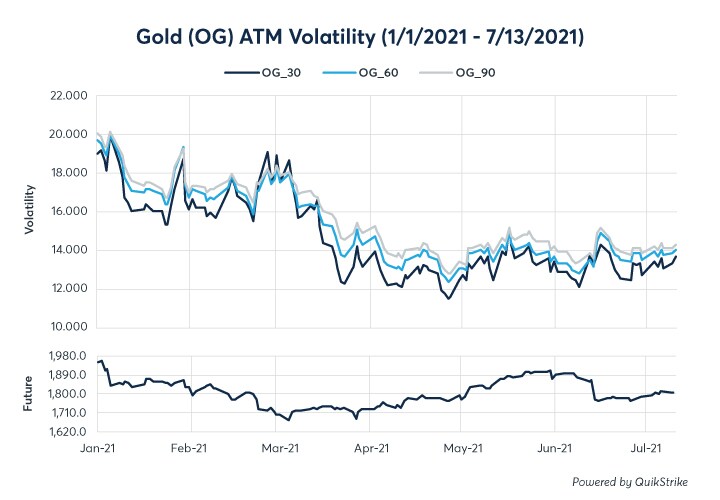

With price discovery happening during international hours, the round-the-clock liquidity of futures options is an important feature that ETF options lack. It is also interesting to note that while gold has traded in a very wide range, and at times, near the 2000 level, volatility has steadily declined to the three-year average level of 14%.

COMEX markets have matured in such a way that the APAC region has begun to utilize both Monthly and Weekly Gold options consistently. As the trend of global liquidity growth continues, COMEX Precious Metal options markets are fast becoming the benchmark for global price discovery.

- Gold has seen a wide range in 2021 as the global economy recovers and inflation concerns rise, but volatility has declined in an orderly manner to long-term mean level.

- Gold has traded between 1700-1900 while implied volatility has eased into the three-year average of 14% over the course of the year.

- Price discovery during APAC hours has been especially relevant as several major levels were first breached during APAC hours.

- Recent new highs above 1600, 1700, and 2000 were first established during the APAC trading session.

- Event-related market moves, particularly as a result of weekend news, have made trading during international sessions especially important.

- Well-functioning liquid markets around the clock have been invaluable as the market has grown to digest information in real time.

- 23-hour markets in COMEX futures options have been an important distinction that ETF options have lacked.

- Non-US volumes have more than tripled since 2018 as liquidity has improved both on-screen and in block markets.

- More than 20% of trading volume happens outside of US trading hours as total volumes have grown.

- More than 20% of trading volume happens outside of US trading hours as total volumes have grown.

- OTC and exchange cleared pricing have also become more closely linked in extended hours as the liquidity of CME Group markets has become more robust around the clock.

- Weekly Gold options have also reached record levels of more than 8,400 average daily volume in 2021.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.