Oil: Flex Jobs, Fuel Efficiency Stymie Rally from Output Cuts

OPEC+ has announced three production cuts in the past nine months. First, in October 2022, the grouping of oil producers announced a reduction of two million barrels per day (bpd) in output. In early April 2023, they cut output by an additional one million bpd. Finally, on June 5, Saudi Arabia announced that it was voluntarily reducing production by another one million bpd for the month of July, and that OPEC+ would extend its curtailment through 2024. All in all, 3.66 million bpd – or about 3.6% of global output – has been removed from the market. Yet, despite these cuts, oil prices have continued to slide.

OPEC+ cited weak global demand as the reason for the output cuts, and it appears to have gauged the market correctly. There are several factors behind the feeble state of global demand:

- More efficient vehicles provide a constant headwind

- Reduced driving

- Weak economic growth in China

Increased Efficiency

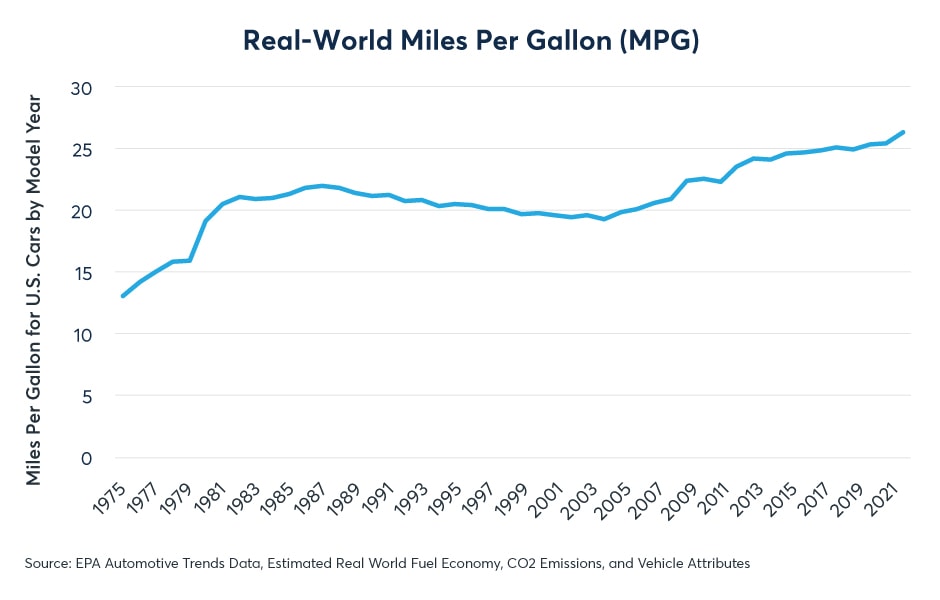

Between model year 2004 and 2022, fuel efficiency of the average car in the U.S. went from 19.3 miles to 26.4 miles per gallon (8.6 to 11.9 kilometres per litre) (Figure 1). Given that Americans keep their cars for an average of 12.5 years, each year roughly 8% of the cars on the road are replaced by newer ones. In Europe, the numbers are similar, with the average car lasting 12 years.

Figure 1: The average car sold in the U.S. in 2022 can go 37% further per unit of fuel than in 2004.

In other parts of the world, the turnover in vehicle fleets is even faster. The average Japanese driver, for example, keeps their car for about nine years. In rapidly growing countries, like China, the average vehicle in just 4.4 years old. This has meant that, in recent years, the average car on the road uses about 1.6% less fuel per unit of distance driven than the year before. This further implies that in order to keep global demand stable, people, collectively, would need to drive about 1.6% more each year than in the previous year.

Driving less

Rather than driving more, on the whole, people appear to be driving less. In the U.S., data from the Federal Highway Administration shows that Americans are driving about 2.6% less so far in 2023 than they were driving during the same months in 2019. Yet, since 2019, their cars are using about 6% less fuel per mile driven. The fact that many people have hybrid schedules, allowing them to work from home at least part of the time, appears to be capping demand (Figure 2).

Figure 2: Americans are driving 2.6% fewer miles than they were pre-pandemic

In China, the drop off appears to have been much steeper. In March 2023, three months after the government lifted its COVID restrictions, Chinese drivers drove roughly 50% less than they had in March 2019 (Figure 3). Lifting COVID restrictions did boost oil demand relative to 2020, 2021 and 2022, but not by anywhere near as much as most observers anticipated.

Figure 3: Chinese passenger car trips have not recovered to pre-pandemic levels

The lack of a strong rebound in driving in China may reflect a preference for working from home, but it may also be an indicator of deeper economic distress. Many categories of Chinese data have shown unexpected softness in recent months. Home prices and housing construction continue to fall. Manufacturing and exports are both in decline. Consumer spending is still positive year on year, but the pace of growth has been less than what many expected. Overall, many Chinese households appear to be prioritising saving money over travelling.

Over the past 18 years, oil prices have often followed the so-called Li Keqiang index, which is composed of the year-on-year change in rail freight volumes, electricity production and bank loans. The Li Keqiang Index has been showing year-on-year growth of 6.5%, which is solid, but not spectacular. Moreover, it’s been on a slowing trend recently (Figure 4). The index often leads oil prices by around 12 months (Figure 5). As such, the soft pace of growth in China may be impacting demand levels for products beyond driving, including jet fuel and plastics.

Figure 4: WTI often follows the Le Keqiang Index with a lag

Figure 5: WTI crude often reacts to changes in China’s pace of growth about one year later

The reason for the oil market’s sensitivity to Chinese growth has a lot to do with China going from being a net oil exporter in the 1980s and early 1990s to being the world’s largest importer of oil by the 2010s. Fluctuations in the pace of Chinese growth often helped to set the marginal price of oil worldwide and that is probably still true today (Figure 6).

Figure 6: China’s consumption growth has helped to set global prices since the 2000s

Russian oil, being sold at steep discounts due to sanctions for its invasion of Ukraine, may also be a factor weighing on the global prices. While the general softness in demand may be bearish for oil, there is one major upside risk: relatively low inventories. Crude oil inventories are close to average, but inventories of gasoline and diesel fuel remain exceptionally low (Figure 7). So far, output cuts by OPEC+ haven’t put a bid in oil, but the modest levels of inventories could leave the market vulnerable to further supply shocks.

Figure 7: Crude and product inventories are lower than in 2019 or 2021 but higher than 2022

Energy data

Discover opportunities in the energy markets using CME Group's real-time, historical, or alternative data sources.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.