- 10 Mar 2020

- By CME Group

Reviews by Asset Class

Interest Rates | Equity Index | Energy | Agricultural | FX | Metals

| Asset Class | ADV | ADV YoY | % Globex | Open Interest | OI YoY |

| Total Options | 6,110,522 | 73% | 65% | 79,301,225 | 7% |

| Interest Rates | 4,294,616 | 77% | 55% | 63,133,411 | 6% |

| Equity Index | 1,079,433 | 93% | 97% | 4,830,005 | 18% |

| Energy | 337,031 | 59% | 67% | 6,103,772 | 7% |

| Agricultural | 200,725 | -17% | 86% | 2,588,111 | -5% |

| Metals | 125,708 | 145% | 78% | 1,846,886 | 27% |

| FX | 73,009 | 44% | 99% | 799,040 | 16% |

- Treasury options averaged a record 1.48M contracts/day, with outsized growth in 10s and T-Bonds

- Open interest in T-Bond options climbed to the second highest level ever, reaching 1.53M contracts on 2/20

- Eurodollar options ADV of 2.8M contracts was the second highest on record

- With the majority of swaptions uncleared, Treasury options and Eurodollar options can provide significant margin, capital, and operational efficiencies to clients impacted by the expanding Uncleared Margin Rules (UMR) in September of 2020 and 2021, with inclusion based on gross notional thresholds of $50B and $8B, respectively

| Symbol | ADV | ADV YoY | % Globex | Open Interest | OI YoY | |

| Eurodollar options | 2,809,744 | 78% | 41% | 55,285,912 | 3% | |

| Eurodollars (Quarterly/Serial) | GE | 2,254,526 | 157% | 40% | 45,489,960 | 27% |

| 1-Year Mid-Curve | GE0 | 436,633 | 15% | 46% | 6,377,829 | -39% |

| 2-Year Mid-Curve | GE2 | 85,940 | -61% | 53% | 2,307,538 | -49% |

| 3-Year Mid-Curve | GE3 | 32,206 | -65% | 54% | 1,075,111 | -62% |

| 4-Year Mid-Curve | GE4 | 430 | -94% | 76% | 35,474 | -66% |

| 10-Year Note | 1,040,371 | 91% | 79% | 4,416,242 | 55% | |

| Quarterly/Serial | OZN | 781,692 | 91% | 77% | 3,957,728 | 60% |

| Friday Weekly | ZN1-5 | 225,251 | 86% | 84% | 416,435 | 15% |

| Wednesday Weekly | WY1-5 | 33,428 | 154% | 90% | 42,079 | 227% |

| 5-Year Note | 215,607 | 19% | 76% | 2,020,392 | 20% | |

| Quarterly/Serial | OZF | 193,255 | 24% | 74% | 1,946,356 | 21% |

| Friday Weekly | ZF1-5 | 17,253 | -14% | 93% | 68,559 | -1% |

| Wednesday Weekly | WF1-5 | 5,099 | -12% | 99% | 5,477 | -18% |

| T-Bond | 205,123 | 86% | 84% | 1,090,238 | 35% | |

| Quarterly/Serial | OZB | 161,795 | 90% | 81% | 1,010,557 | 47% |

| Friday Weekly | ZB1-5 | 34,870 | 58% | 93% | 58,707 | -48% |

| Wednesday Weekly | WB1-5 | 8,458 | 211% | 98% | 20,974 | 146% |

| 2-Year Note | OZT | 22,451 | 66% | 83% | 286,061 | 60% |

| Ultra T-Bond | OUB | 378 | -41% | 5% | 9,909 | -32% |

| Ultra 10-Year Note | OTN | 599 | 22664% | 0% | 15,867 | 31634% |

| Fed Funds | OZQ | 342 | 3151% | 60% | 8,758 | 415% |

- Monday and Wednesday weekly E-mini S&P 500 options ADV +164% and 154% respectively

- E-mini Nasdaq 100 options volumes surged 245% YoY to a record 27.5K contracts/day

| Symbol | ADV | ADV YoY | Open Interest | OI YoY | |

| E-mini S&P 500 options | 1,011,065 | 96% | 4,493,141 | 19% | |

| Quarterlies | ES | 321,720 | 114% | 2,475,736 | 4% |

| Monday Weekly | E1A-E5A | 88,489 | 164% | 228,874 | 426% |

| Wednesday Weekly | E1C-E5C | 111,816 | 154% | 175,408 | 549% |

| Friday Weekly | EW1-EW4 | 294,389 | 36% | 1,047,936 | 27% |

| End-of-Month | EW | 194,651 | 169% | 565,187 | 14% |

| S&P 500 options | 36,403 | 12% | 136,931 | -36% | |

| Quarterlies | SP | 4,371 | 36% | 90,435 | 9% |

| Monday Weekly | S1A-S5A | 3,715 | 8% | 7,485 | 178% |

| Wednesday Weekly | S1C-S5C | 6,486 | 110% | 103 | -99% |

| Friday Weekly | EV1-EV4 | 12,673 | -30% | 31,848 | -66% |

| End-of-Month | EV | 9,159 | 99% | 7,060 | -74% |

| E-mini NASDAQ-100 options | 27,584 | 245% | 162,192 | 18% | |

| Quarterlies | NQ | 10,405 | 214% | 94,466 | 105% |

| Weekly | QN1-QN4 | 12,059 | 188% | 56,622 | 344% |

| End-of-Month | QNE | 5,119 | 977% | 11,104 | 222% |

| E-mini Russell 2000 options | RTO | 4,135 | 147% | 33,990 | 31% |

| E-mini Dow ($5) options | YM | 213 | -15% | 3,250 | -65% |

| Bitcoin options | 33 | N/A | 502 | N/A |

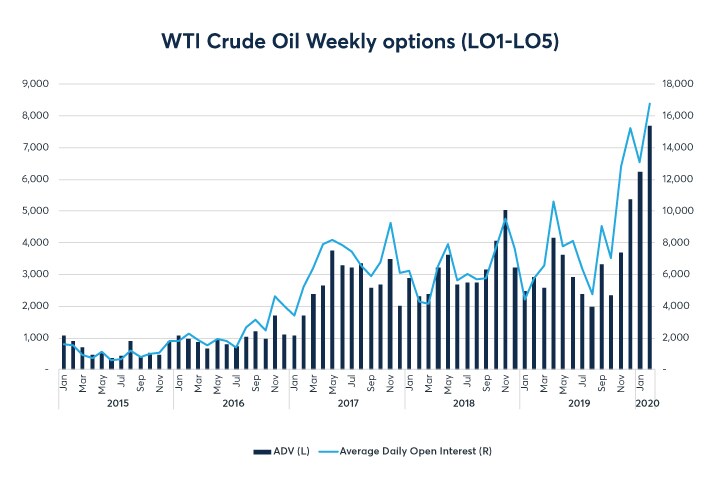

- WTI weekly options (LO1-5) saw record ADV for the third straight month bolstered by new participants and deepening liquidity

- WTI-Brent spread options trading jumped 114% YoY to 8.5K contracts/day

| Symbol | Settlement | ADV | ADV YoY | % Globex | Open Interest | OI YoY | |

| Crude Oil options | 203,153 | 53% | 74% | 3,519,764 | -13% | ||

| WTI Crude Oil | LO | Physical | 161,147 | 50% | 88% | 2,099,678 | -16% |

| WTI 1 Month CSO Physical | WA | Physical | 11,826 | 59% | 2% | 417,100 | -28% |

| WTI-Brent Spread | BV | Financial | 8,518 | 114% | 1% | 227,275 | 51% |

| WTI Weeklies | LO1-5 | Physical | 7,687 | 164% | 99% | 14,811 | 12% |

| WTI 1 Month CSO Financial | 7A | Financial | 6,036 | 258% | 0% | 211,400 | 44% |

| Brent Futures-Style | BZO | Financial | 3,784 | -1% | 49% | 102,900 | -41% |

| WTI Average Price | AAO | Financial | 2,159 | -3% | 0% | 369,671 | 24% |

| Brent 1 Month CSO | 9C | Financial | 958 | 507% | 0% | 18,400 | -39% |

| Natural Gas options | 131,778 | 73% | 56% | 2,521,787 | 62% | ||

| Natural Gas European | LN | Financial | 114,864 | 73% | 57% | 2,211,350 | 52% |

| Natural Gas American | ON | Physical | 8,208 | 20% | 99% | 77,902 | 27% |

| Natural Gas 1 Month CSO | G4 | Financial | 4,399 | 113% | 0% | 47,750 | 1325% |

| Natural Gas 3 Month CSO | G3 | Financial | 2,059 | 7014% | 0% | 72,825 | 16083% |

| Natural Gas 6 Month CSO | G6 | Financial | 1,384 | 221% | 0% | 71,800 | 278% |

| Refined Product options | 1,887 | -19% | 32% | 49,962 | -40% | ||

| NY Harbor ULSD | OH | Physical | 1,249 | -14% | 31% | 27,674 | -47% |

| RBOB Gasoline | OB | Physical | 467 | -42% | 44% | 6,516 | -51% |

- Livestock volumes remain elevated

- 2020 April Lean Hogs implied volatility and put skew matching or beating last year volatility levels.

- Live Cattle futures down 11% on the month, with April implied vol approaching 40% and 25 delta puts trading at a 5% vol premium vs 25 delta calls.

- For more on volatility trends read the Feb Ag options update

- 15% of Chicago Wheat and Soybeans option activity happened during non-US hours in February

- Dairy options posted ADV of 4.3K contracts, second highest mark ever, helped by the new Block Cheese option contract

Recommended reading: Options Strategies in Grain Part 1 – Learn how options spreads like Verticals can potentially optimize risk/reward profiles and mitigate risk

| Symbol | ADV | ADV YoY | % Globex | Open Interest | OI YoY | |

| Corn | OZC | 57,449 | -36% | 85% | 686,265 | -27% |

| Soybean | OZS | 41,340 | -20% | 90% | 489,677 | 9% |

| Chicago SRW Wheat | OZW | 32,838 | -26% | 85% | 322,953 | -7% |

| Lean Hogs | HE | 15,370 | 26% | 96% | 301,954 | 30% |

| Live Cattle | LE | 15,097 | 77% | 93% | 179,595 | 2% |

| Soybean Oil | OZL | 11,217 | 76% | 78% | 115,616 | 60% |

| Soybean Meal | OZM | 9,173 | 36% | 80% | 94,347 | -12% |

| KC HRW Wheat | OKE | 4,251 | -20% | 82% | 66,869 | -13% |

| Short-Dated New Crop | Multi | 3,114 | -32% | 61% | 71,599 | 4% |

| Weekly Corn | ZC1-5 | 2,358 | -66% | 90% | 8,687 | -60% |

| Class III Milk | DC | 2,110 | 27% | 97% | 66,926 | -2% |

| Feeder Cattle | GF | 1,805 | 94% | 96% | 29,058 | -2% |

| Nonfat Dry Milk | GNF | 926 | 167% | 71% | 21,805 | -2% |

| Weekly Soybeans | ZS1-5 | 805 | -29% | 94% | 1,038 | -63% |

| Grain Calendar Spread options | Multi | 653 | 4% | 17% | 44,880 | 65% |

| Weekly SRW Wheat | ZW1-5 | 549 | -21% | 100% | 3,844 | -15% |

| Class IV Milk | GDK | 416 | 109% | 93% | 13,466 | 28% |

- With volatility rebounding from a prolonged slumber, FX options volumes in Feb were the highest since May 2018

- Monday expiring weekly options launched, averaged 285 contracts/day and open interest growing to 5.1K

| Symbol | ADV | ADV YoY | % Globex | Open Interest | OI YoY | |

| EUR/USD | EUU | 33,624 | 41% | 99% | 329,439 | 26% |

| JPY/USD | JPU | 17,744 | 106% | 99% | 173,153 | 44% |

| AUD/USD | ADU | 7,667 | 74% | 100% | 92,325 | 36% |

| GBP/USD | GPU | 7,644 | -13% | 95% | 114,538 | -30% |

| CAD/USD | CAU | 5,543 | 17% | 100% | 71,279 | 7% |

| MXN/USD | 6M | 348 | 271% | 72% | 7,140 | 97% |

| CHF/USD | CHU | 311 | 225% | 100% | 8,428 | 190% |

| NZD/USD | 6N | 127 | 50% | 100% | 2,707 | 186% |

- Having never reached 100K ADV prior to June 2019, Metals options have now averaged over 100K contracts/day for 3 consecutive months and 5 out of the last 9 months

- Weekly Gold options (OG1-5) posted record ADV of 12.3K contracts/day, a 49th consecutive month of YoY growth

- Open interest in Gold weeklies sits at a record high of 66.6K contracts as of 3/5

- Copper options posted record ADV of 5.1K contracts/day, with open interest climbing to a record 90K contracts on 2/24

| Symbol | ADV | ADV YoY | % Globex | Open Interest | OI YoY | |

| Gold | OG | 93,554 | 144% | 74% | 1,582,732 | 35% |

| Silver | SO | 13,231 | 130% | 94% | 141,371 | -35% |

| Gold Weeklies | OG1-5 | 12,315 | 298% | 95% | 39,732 | 101% |

| Copper | HX | 5,104 | 38% | 68% | 59,253 | 47% |

| Silver Weeklies | SO1-5 | 969 | 665% | 99% | 3,990 | 669% |

| Platinum | PO | 230 | 6% | 14% | 11,783 | 72% |

| Palladium | PAO | 48 | -12% | 55% | 3,157 | 251% |

Open Interest as of 2/28/20, unless otherwise specified

YoY – Compares current period 2020 to same period 2019

MoM – Compares current month 2020 to previous month 2020

Futures and options trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade. All references to options refer to options on futures.

CME Group is a trademark of CME Group Inc. The Globe logo, CME, E-mini and Globex are trademarks of Chicago Mercantile Exchange Inc. CBOT is a trademark of the Board of Trade of the City of Chicago, Inc. NYMEX and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. S&P® 500 and S&P MidCap 400™ are trademarks of The McGraw-Hill Companies, Inc., and have been licensed for use by Chicago Mercantile Exchange Inc. NASDAQ-100 is a trademark of The Nasdaq Stock Market, used under license. Dow Jones is a trademark of Dow Jones & Company, Inc. and used here under license. Russell 2000® is a trademark and service mark of the Frank Russell Company, used under license. All other trademarks are the property of their respective owners.

The information within this document has been compiled by CME Group for general purposes only and has not taken into account the specific situations of any recipients of the information. CME Group assumes no responsibility for any errors or omissions. The information in this brochure should not be considered investment advice. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, CBOT and NYMEX rules. Current CME/CBOT/NYMEX rules should be consulted in all cases before taking any action.

Copyright © 2020 CME Group Inc. All rights reserved