- 24 Apr 2019

- By CME Group

We’re working to deliver creative solutions to your most important challenges,

so you can access the capital and margin efficiencies of our centrally-cleared and transparent market.

We’ve expanded our FX futures offering

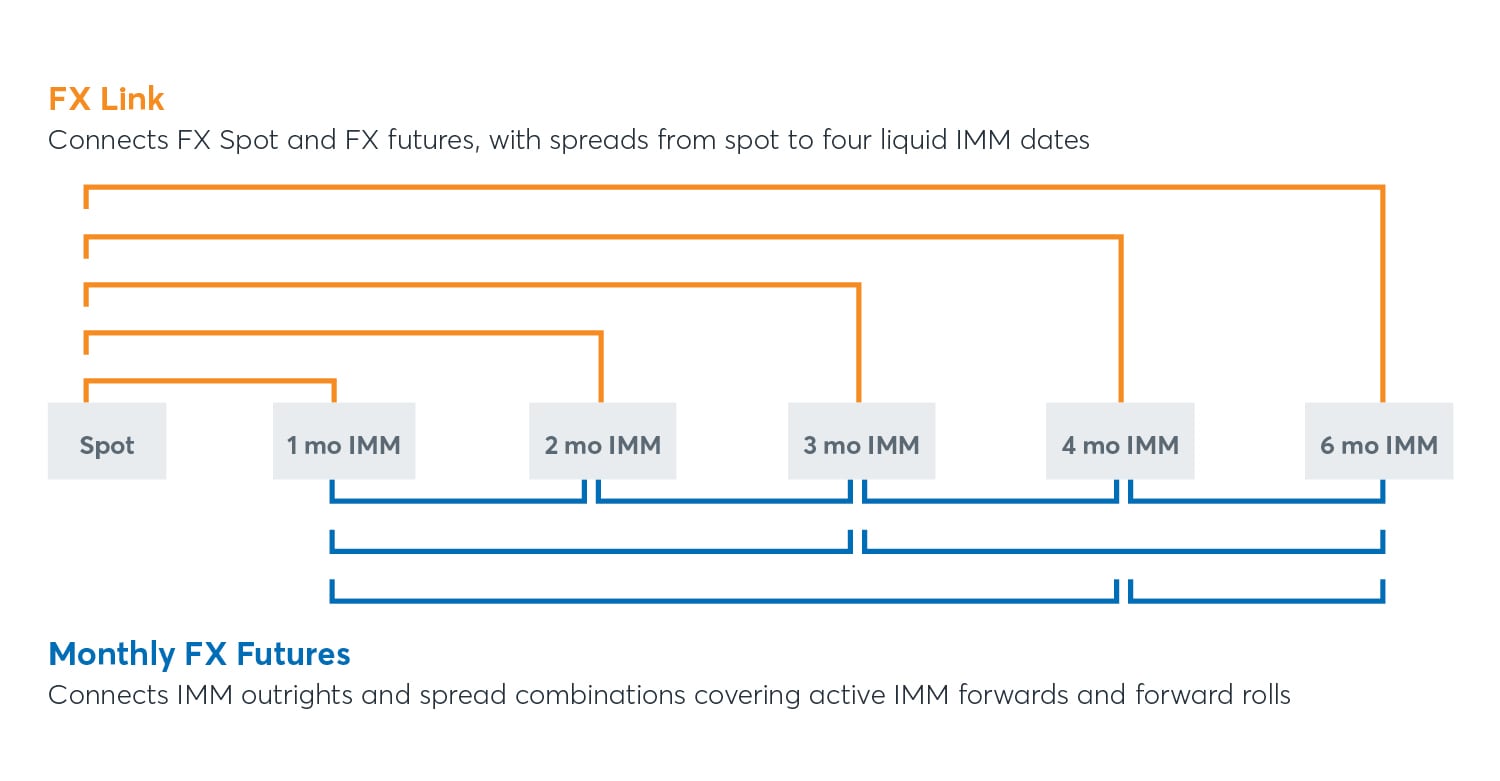

With quarterly expiries across every contract, and monthly expiries on six pairs, all with implied liquidity, and now with CME FX Link which connects the OTC FX market with FX futures electronically, for the first time.

We’ve expanded our listed FX options offering

With Friday and Wednesday Weeklies, we are now the largest centralized all-to-all electronic FX options marketplace in the world.

We’ve expanded our OTC FX clearing offering

Clear NDFs, G10 NDFs (Cash-settled forwards) and new FX options. All under one Guarantee Fund.

- SHIFT TO 10am NEW YORK EXPIRATION TIME: Across all FX Options. Last 2pm Chicago expiration is the June Quarterly on 7June, the first 10am is the Wednesday Week2 on 12June – to bring our markets in line with OTC convention

- STRIKE LISTING CHANGE: New quarterly strikes are now available in CAD/USD, AUD/USD, EUR/USD and JPY/USD – to provide traders with more choice and more ability to optimize strategies

- TWO NEW PAIRS ON FX LINK: NZD/USD and USD/CHF launched on February 19, 2019 – to create more opportunities to trade the OTC FX & FX Futures spread in these currencies

Minimum Price Increment (MPI): The MPI is changing from 1 to .5 for non-consecutive month intra-currency calendar spreads.

Announced: March 21 2019

New Release: March 25 2019

Live: April 29 2019

Follow the performance of all our FX products by subscribing to The FX Report for all the news, views and stats happening in our marketplace.

Monthly, Quarterly, in print and online. Direct to your mailbox. cmegroup.com/fxtrending

Currency market volatility was exceptionally low in Q1 as previously divergent central bank policies converged again, resulting in reduced trading volumes across the FX market and in CME Group’s FX Futures and Options. During 2017 and 2018, the US Federal Reserve as an outlier and alone among the world’s major central banks, tightened policy aggressively, raising rates a further seven times and reducing the size of its balance sheet. The sharp Q4 equity selloff convinced the Fed to join its peers (the ECB, the BoE, the BoJ, the RBA etc.) on the side-lines as it put its tightening policy on hold. This left FX investors without interest rate- trend information with which to differentiate among the currencies.

Moreover, with the Fed moving to the side-lines and China actively easing monetary policy, equity prices rebounded, which, in turn, led to a sharp decline in implied volatility on options across many asset classes, including currencies. The only exception was the British pound where investors spent much of Q1 considering the implications of Brexit on March 29. Yet, when March 29 finally rolled around, Brexit was postponed, leaving the pound still hanging in the balance until the next potential cliff edge on October 31, 2019. Furthermore, the recent extension provided by the EU triggered a sharp and significant drop in GBP implied volatility, bringing it more in line with other majors.

The JPY/USD Vol cone showed the Implied Vol curve near the bottom 5th percentile along the whole curve.

In EUR/USD, taking a 12-year lookback of 30-day EUR/USD volatility, shows Implieds (blue) breaking below Historical (orange) and through the 5% longer term support level.

The only electronic spread connecting the OTC FX Market & FX Futures, linking liquidity and creating access to the capital efficiencies of CME FX Futures.

CME FX Link marked its first year anniversary – live since March 25, 2018. In our first year, over 1,687,441 contracts were traded, equivalent to over $164 Billion in notional.

EUR/USD |

GBP/USD |

AUD/USD |

NZD/USD |

USD/JPY |

USD/CAD |

USD/CHF |

USD/MXN |

|

In response to the ECB announcement on March 11, more participants utilized FX Link than ever before – as a source of liquidity and a means to manage market risk in a capital efficient way. Volume reached a record 26,039 contracts traded with a notional of +$2.86B.

March volume averaged 14,000 contracts from a diverse user base including banks, prop trading firms and buy side firms. All pairs are trading, including NZD & CHF which launched in February, and increasingly strong activity in Mexican Peso.

Liquidity is building with top-of-book regularly 0.1-0.2 ticks wide and $50-$100M deep to better enable multiple FX execution methods.

Source: CME. All data as of March 2019.

Visit cmegroup.com/fxlink to see how market participants are using FX Link to manage swap, forward, basis, options and commodity risk.

Also featuring:

- Daily volume tracker

- Spread functionality specifications

- Onboarding guides

- Instructions on how to start trading on CME Direct

TRADE:

On CME Direct

ANALYZE:

Via Refinitiv

REGISTER:

Your interest with Bloomberg

In March 2019, more European participants turned to CME FX markets to manage their risk, as GBP/USD traded towards the highest volume since the June 2016 Brexit Referendum, in response to uncertainty surrounding the UK’s departure from the EU.

EMEA-participants

43%

Increase MoM

3rd Highest Volume Week of all time ( 11-15 March)

1.25M

Contracts Traded

Q1 Open Interest

150,791

Record Open Interest was achieved on March 15 of 326,243 across futures and options with the whole complex up 30% YTD – with increased activity on FX Link.

March 2019

88,670

ADV

YoY Change

13%

Q1 Open Interest

228,833

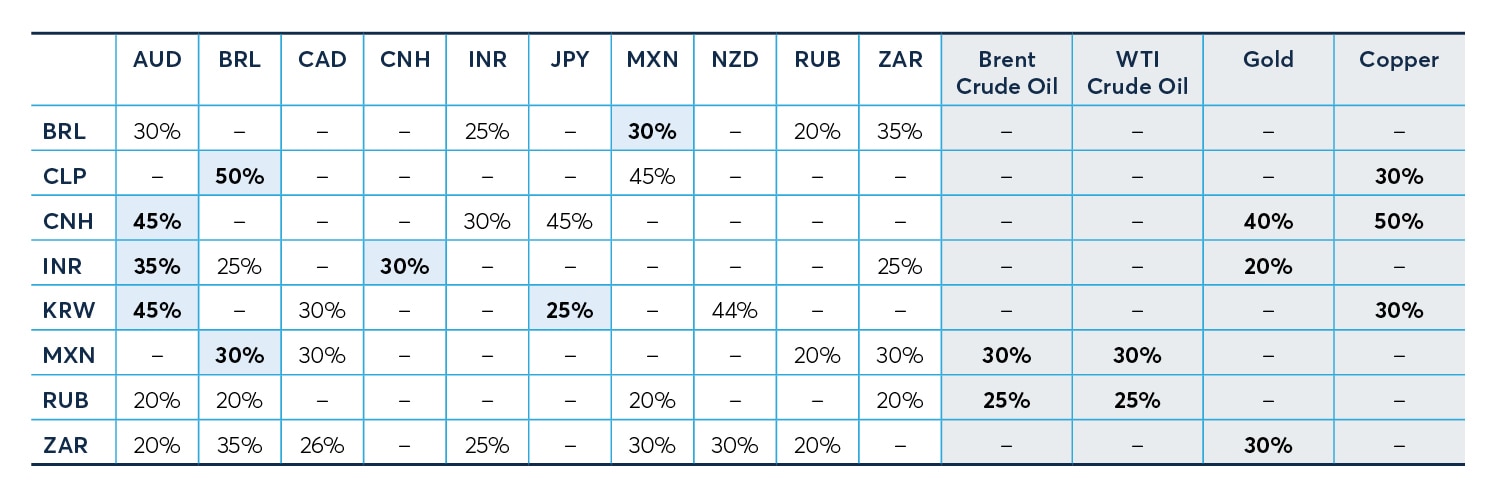

This contract became cash-settled in June 2018, and is increasingly becoming a useful hedging tool, in part because of the margin offsets uniquely available at CME with copper and gold, and in part because of increased accessibility and activity in the renminbi.

March 2019

981

ADV

YoY Change

535%

Q1 Open Interest

1,327

CME is increasingly being utilized as a venue to access Russian assets and commodity markets, with the benefit of facing a regulated, central counterparty with reduced credit risk – volume up 19% YTD.

March 2019

6,750

ADV

YoY Change

19%

Q1 Open Interest

58,770

Quarterlies, monthlies and FX Link create a comprehensive, efficient, central liquidity source for managing various FX forward & swap exposures.

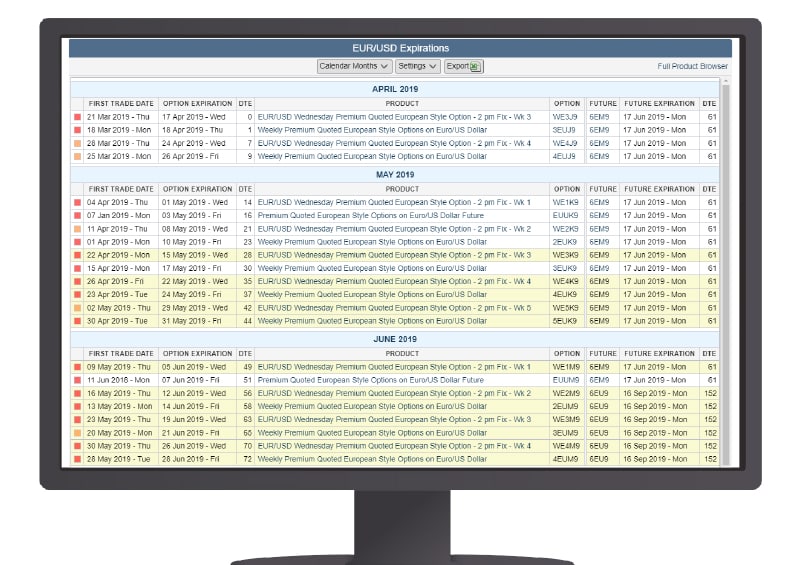

We have been changing our expiration to 10 a.m. New York to bring our FX options in line with the primary OTC market convention. The last 2 p.m. Chicago expiration is the June Quarterly on June 7, the first 10 a.m. is the Wednesday Week 2 on June 12.

All market participants need to be aware and can visit cmegroup.com/10am for more details, along with The Fix, codes, full listing schedule, impacted products and a two minute video on how this change will come into effect.

FX options liquidity is holding strong in the majors, although GBP has been clearly stressed lately given the continued uncertainty regarding Brexit.

Maturity |

EUR/USD |

JPY/USD |

AUD/USD |

CAD/USD |

GBP/USD |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

Spread |

Size |

Spread |

Size |

Spread |

Size |

Spread |

Size |

Spread |

Size |

|

7 Day |

2.1 |

$38 |

2.2 |

$26 |

2.4 |

$13 |

2.3 |

$17 |

8.2 |

$4 |

30 Day |

1.9 |

$50 |

2.3 |

$31 |

2.3 |

$16 |

2.1 |

$20 |

8.7 |

$3 |

90 Day |

2.1 |

$41 |

2.3 |

$29 |

2.6 |

$14 |

2.3 |

$16 |

8.3 |

$5 |

Note: Data represents the time-weighted average spread and size over 5 trading days, during 7am-4pm CT shift.

New quarter strikes are available in CAD/USD, AUD/USD, EUR/USD and JPY/USD, providing traders with more choice and more opportunity to optimize execution. Since launch in early March, these strikes already comprise ~22% of total volume, with activity in all currencies, across all segments.

Of note: The more recent numbers are temporarily distorted due to the expiration of the April monthly contract as activity was more focused on the previously accumulated open interest in the standard strikes.

Did You Know

Our FX Options platform is the largest all-to-all regulated FX Options marketplace in the world.

Now you can view and download 12 months of options listing and expiration dates, including yet-to-be-listed weekly expiries and view all relevant US economic events, and their potential impact, side by side with any expiry.

To access the tool, visit cmegroup.com/options-calendar

Continue learning about the futures and options markets with a variety of courses designed to help you at each stage of your trading journey. Our courses are designed to help you deepen your knowledge and improve your understanding of our markets.

To access the CME Institute, visit cmegroup.com/fx-quote-conventions

Analyse information by client segment including dealer, asset manager and leveraged market participant using The Commitments of Traders tool. The tool charts the CFTC’s report on market open interest released each Friday afternoon based on positions held during the prior Tuesday.

For open interest holders who prefer to carry positions in FX futures over time, the quarterly roll indicates the optimal liquidity period to roll a futures position forward from the expiring front month futures contract to the deferred month futures contract and therefore analyse and set their futures roll strategy. These charts are updated and available on a daily basis during the roll period.

View or trade CME FX futures with CME Direct, a fast, secure and highly-configurable trading front-end. Benefit from the deep liquidity and transparency of CME Group markets and uncover new trading opportunities.

To trade with CME Direct, you will need a relationship with a clearing FCM so contact you bank if you’d like to get connected.

To access the full suite, visit cmegroup.com/fxtools

Paul Houston

Head of FX, London Office

paul.houston@cmegroup.com

+44 203 379 3355

Divay Malhotra

London Office

divay.malhotra@cmegroup.com

+44 203 379 3355

Graham McDannel

Chicago Office

graham.mcdannel@cmegroup.com

+1 312 454 5209

Ravi Pandit

Singapore Office

ravi.pandit@cmegroup.com

+65 6593 5562

Craig Leveille

Chicago Office

craig.leveille@cmegroup.com

+1 312 454 5301

Matt Gierke

Chicago Office

matthew.gierke@cmegroup.com

+1 312 930 8543

Kevin Mcmillin

Chicago Office

kevin.mcmillin@cmegroup.com

+1 312 930 8264