- 4 Feb 2021

- By Adila McHich and Erik Norland

As 2021 began, a cold snap in Europe and Asia rallied natural gas prices in markets there to multi-year highs, taking the price of liquefied natural gas (LNG) along with them. By contrast, Henry Hub benchmark prices in the United States remained unswayed at around $2.50 per MMBtu (Figure 1) as strong exports countered a decline in domestic demand due to the pandemic.

The price divergence notwithstanding, regional natural gas markets around the world continue to become more deeply connected. Prior to 2016, LNG shipments by vessels from the U.S. were rare and did not exceed more than about 0.1% of U.S. production. Over the past four years, however, LNG exports by vessels have steadily risen, and in 2020 ranged between 3% and 7% of total U.S. natural gas withdrawals (Figure 2). U.S. natural gas exports to Canada and Mexico have remained steady at around 7% of production.

The growth in U.S. natural gas exports may have two consequences:

- Exports could help put a floor under the Henry Hub price, at least when export demand is solid.

- We have seen substantial convergence among the international prices in recent years, despite the recent split.

Despite the strong international demand for LNG, Henry Hub natural gas futures have come under pressure, with prices staying below $3 per MMBtu in recent months. Front-month Henry Hub futures averaged $2.05 in 2020, the lowest annual average price in decades, and last November, prices plunged to a new low of $1.66 per MMBtu. The bearish sentiment continued to linger in January 2021 due to the onslaught of the pandemic. The exceptionally mild heating season this winter across the Lower 48 has exerted extra pressure on prices and kept a lid on large storage withdrawal, with the current holding stocks level above last year’s level and the 5-year average (Figure 3). The uncertainty over the weather has raised volatility and led February Henry Hub futures to fluctuate more than 30 cents during the first week of January.

However, the growing demand from the U.S. LNG export sector has been a counterbalance that has curbed prices from falling further, considering the bearish environment. U.S. LNG terminals have been producing near capacity, with feed gas reaching 11 Bcf/d in January as a response to historic spikes of spot LNG prices globally. Japan/Korea Marker (JKM) front-month futures jumped to $19.70 MMBtu while the JKM spot price surged to a staggering high in the $30s on January 12 amid unusually cold winter weather in North Asia, shipping bottlenecks, and outages at major LNG exporter terminals. In Europe, the lower-than-normal temperatures have increased storage withdrawals. Compared to last year, the LNG market fundamentals have reversed, moving from being oversupplied to a very tight market. This imbalance has propelled prices to historic highs. The spread between JKM, Dutch Title Transfer Facility (TTF) and Henry Hub is driving arbitrage opportunities, and given the price premium, more cargoes are being redirected to the Asian market.

In transporting LNG, it takes a vessel about 48 hours to load and unload its cargo. In addition, a trip from the U.S. to Europe takes about 1-1/2 to 2 weeks. Shipments to Asia typically takes about 20 days, a significant reduction from the 34 days prior to the expansion of the Panama Canal.

U.S. gas production has slowed due to the curtailment of associated gas produced from oil wells because of the sharp oil production cuts in 2020 amid the pandemic. This is especially noticeable in regions that produce mainly oil such as the Permian Basin, Anadarko, Eagle Ford and Niobrara. Meanwhile, in areas that focus mainly on natural gas, such as Appalachia and Haynesville, production levels have been more stable (Figure 4). While the number of operating rigs fell sharply (Figure 5), productivity per rig has soared, like it did from 2014-16 when oil prices fell sharply (Figure 6).

Recent regulatory changes should have little immediate impact on production levels. For starters, only 9% of U.S. oil and natural gas production comes from federal land. Moreover, companies can still drill on federal land where they have existing permits, so any decline in production levels will likely occur over a long period of time as those projects come to completion. Finally, equipment used to drill on federal land can eventually be moved to state or private land where over 90% of oil and natural gas production occurs.

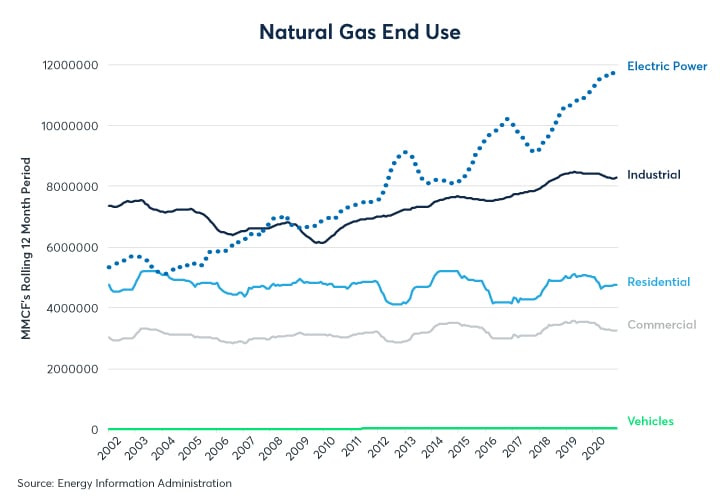

Meanwhile, most of the growth in natural gas usage in the U.S. has been for electricity generation (Figure 7). The pandemic has significantly reduced electricity demand from offices and businesses. Once the pandemic comes to an end, however, there is the possibility of much stronger domestic demand. If domestic demand improves, the U.S. and international markets might move much more closely in line and export demand may begin to exert a much stronger influence on the Henry hub price.

Implied volatility on natural gas options are often among the highest of exchange-traded futures, even higher than other energy products (Figure 8). This is due to the extreme inelasticity of short-term supply and demand for natural gas. Extremely high storage levels have, for the moment, played a role in dampening some of natural gas’ upside volatility: any short-term spike in demand for natural gas could quickly be met with withdrawals from storage facilities. However, the high levels of storage may accentuate downside risks in the U.S. were to experience unusually warm wintertime temperatures. That said, perhaps because of the support from strong international LNG demand, traders see the upside and downside risks to natural gas prices as being relatively even at the moment (Figure 9).

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

About the Author

Adila Mchich is Director of Energy Resources & Product Development at CME Group.

About the Author

Erik Norland is Executive Director and Senior Economist of CME Group. He is responsible for generating economic analysis on global financial markets by identifying emerging trends, evaluating economic factors and forecasting their impact on CME Group and the company’s business strategy, and upon those who trade in its various markets. He is also one of CME Group’s spokespeople on global economic, financial and geopolitical conditions.

View more reports from Erik Norland, Executive Director and Senior Economist of CME Group.

Natural Gas Futures

Henry Hub Natural Gas futures allow market participants to manage risk in the highly volatile natural gas price.