- 23 Apr 2020

- By Erik Norland

US, Japanese and Western European governments have announced nearly $6 trillion in relief and stimulus aid to mitigate the economic impact of the COVID-19 pandemic. Relative to the size of their economies, this additional spending is without precedent in peacetime.

In the US, the $2 trillion already approved by Congress and the additional $500 billion in the pipeline will amount to 11.7% of GDP, compared to 15% of GDP in the UK, 15.5% in Spain and 18% in France. Announced relief measures in Japan, Germany and Italy equate to between 19% and 21% of their respective GDPs.

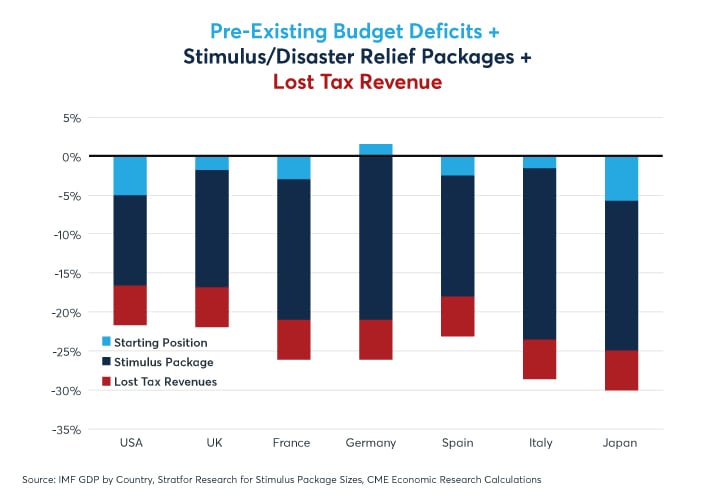

What’s more is that these stimulus measures don’t account for likely lost tax revenues. In many of these nations, tax revenues fell by 4-6% of GDP during the global financial crisis. And, except for Germany, which ran a 2% of GDP budget surplus last year, all the other nations were running budget deficits before the coronavirus pandemic. Some of these deficits were modest: Italy, Spain and the UK all ran deficits around 2% of GDP. Deficits in Italy and Japan were in the 5-6% range.

Given the starting positions of the various deficits, the size of the stimulus packages and the likelihood of sharp falls in tax revenues, it’s possible for budget deficits to grow to the 20-30% of GDP range in the next 12 months (Figure 1). The number could be smaller if the economy makes a strong rebound. Of course, deficits could grow larger if economies take longer to recover and if additional stimulus/ recovery funds are appropriated.

For the moment, it looks as though bond markets could be bracing for a flood of additional sovereign debt issuance. What’s surprising is that bond investors are greeting the possibility of unprecedented peacetime deficits with long-term yields that are at or near record lows in most bond markets (Figure 2). There are various explanations for this:

- Central banks could buy a large portion of the debt as they expand their balance sheets in renewed quantitative easing.

- Inflation expectations remain extremely low amid pressure in the oil market, soaring unemployment and a negative demand shock. Indeed, many fear significant deflation over the next 12 months or so due to the intensity of the decline in global demand.

- There is little expectation that central banks will be able to lift short-term interest rates in the near term.

Nevertheless, even extremely long-term interest rates remain low and yield curves remain remarkably flat by historical standards. Could such large budget deficits eventually lead long-term bond yields higher?

Thanks to the Bank for International Settlements (BIS), investors have access to historical series of credit to the non-financial sector stretching back to at least the year 2000 for most countries – and for some countries the data goes back much further. For Australia, Canada and South Korea, the credit numbers go back to the late 1980s and early 1990s. Japanese data begins in 1980. The US data series go back to the early 1950s.

Taken in combination with widely available data on short-term and long-term interest rates in these countries/currency areas, what the BIS data reveals is an interesting debt paradox. In almost every other market that we can think of, all else equal, increased supply means lower prices. If that were true in the debt market, then an increased supply of debt would mean a lower price for bonds and therefore higher yields, since bond yields move inversely with price.

Curiously, for debt markets, the relationship appears to work in reverse. Historically, an increased supply of debt appears, on balance, to increase bond prices, thereby lowering the average level of both short-term interest rates and long-term bond yields. Take Japan as a case in point. Japan achieved extremely high debt levels sooner than any other country. It also got to near zero short-term interest rates a decade sooner than anyone else (in late 1998 rather than late 2008). In Japan, there appears to be a strong inverse relationship between the total level of debt (government + households + non-financial corporations) and the level of both short-term interest rates and longer maturity yields (Figure 3).

Similar relationships hold in the US (Figure 4) and every other developed-market currency area. In Figure 5 we examine the correlation across time for 12 different currencies between their total debt levels on the one hand and their short-term rates and long-term bond yields on the other hand.

In each of the 12 currency areas, the higher the overall level of debt, the lower the average level of short-term interest rates. Interestingly, in 11 of the 12 currency areas, the correlation was more strongly negative for long-term rates than for short-term rates (Figure 5). Please see the appendix for charts like figures 3 and 4 for the other nations.

One might have expected the opposite to be true. If debt levels are excessively high, central banks can set policy rates to low levels to help governments, households and corporations manage their debt burden. So, what keeps long-term interest rates low in the face of vastly increased debt supply?

While the short-term rate part of this puzzle is clear, central banks have more difficulty controlling longer-term rates. Some central banks, including the Bank of Japan, have explicitly engaged in yield curve targeting/control: setting ceilings on the level of yields for different maturities to engineer a positively sloped yield curve and buying as many bonds as needed to prevent further, unwanted steepening. Others, like the Federal Reserve and the Bank of England, have opted to sporadically buy long-term debt maturities with the idea of keeping longer-term interest rates lower than they would otherwise be, but without setting explicit targets.

Nevertheless, despite central bank buying, and the near certainty of additional quantitative easing across the US, Europe and Japan, not all of the additional public debt coming to the market is likely to be purchased by central banks. It may be that bond investors willingly absorb the additional debt supply at high prices/low yields simply because they perceive that high debt levels will oblige their respective central banks to keep policy rates low for a long time. Moreover, since few market participants fear the imminent, or even long term, return of inflation, there is little incentive to insist on higher yields in return for taking on additional duration risk. Indeed, the concern over the next 12 months or so is outright deflation. If inflation is to develop, it will take many take years, if not a decade or more.

Even so, it is striking how flat yield curves in the US and elsewhere remain in the face of ultra-easy fiscal and monetary policy. At the end of previous Fed easing cycles in 1992, 2003 and 2009, long-term bond yields were 300-500bps higher than short-term rates (Figure 6). Today, they are barely 100bps higher despite a US budget deficit that is likely to be 2.5 times what it was in 2009 and roughly 5-6 times larger than it was in 1991 or 2002 (Figure 7).

Finally, the BIS data series breaks down into government, household and non-financial corporate debt. Does one matter more than the others? For example, are central banks/long-term bond investors especially sensitive to the level of government debt but less so to household or corporate debt? The evidence suggests that investors are primarily concerned with the overall debt level (Figures 8 and 9).

In some countries, short and long-term interest rates show low or even positive correlations to a given category of debt. For example, Swedish and Swiss public debt levels correlate positively with the level of rates. In both these nations, however, public debt levels are extremely low: 35% of GDP in Sweden and 27% in Switzerland. By contrast, both nations have extremely high levels of private sector debt: 255% in Sweden and 253% of GDP in Switzerland. In fact, in just about every country the most strongly negative correlation between debt and short or long-term interest rate levels concerns the dominate issuer of debt. In Australia and Canada, where households are extremely indebted, household debt has the most negative correlation with interest rate levels. In Japan, it’s the 200%+ of GDP public debt that appears to weigh most heavily on the minds of investors and the central bank. In Europe, its public debt and the debt of non-financial corporations. In the US, its everything. But everywhere, it’s the total level of debt that matters more than any individual category or type of debt.

Investors should ponder one other aspect of the current situation. The COVID-19 pandemic has led central banks into an experiment with modern monetary theory (MMT), fusing fiscal and monetary policy (see our paper here). In the short term, with high rates of unemployment and severely underutilized resources, there appears to be little risk that central bank buying of large quantities of government debt will generate inflation. Deflation is the primary concern over the next year until the economy starts to rebuild and unemployment drops materially. In the long-term, however, MMT could generate inflation if it isn’t reigned in after employment returns to former levels and after the share of unused productive capacity falls to low levels. How long this takes will depend on the success of stimulus/recovery efforts and the course of the pandemic.;

Investors should also bear in mind the components of the debt ratio equation:

Policies that boost real growth or inflation, or both, so that the denominator of the equation grows more quickly than the numerator, can bring debt ratios down. If MMT or other policies bring about a strong growth in nominal GDP, either because of strong real growth or higher inflation, that may be the ticket to higher interest rates and rising long-term bond yields.

- Unlike other markets where increased supply lowers price, the opposite appears to be true in global debt markets.

- In the past, increased debt burdens have correlated strongly with lower interest rate levels at both the short and long end of the curves.

- It doesn’t seem to matter who issued the debt (governments, household or corporations).

- What matters to central banks and long-term bond investors is the overall level of debt.

- MMT and other policies that could grow nominal GDP faster than debt could shrink debt ratios and eventually lead interest rates/longer term bond yields higher.

-

Recommended For You

-

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

About the Author

Erik Norland is Executive Director and Senior Economist of CME Group. He is responsible for generating economic analysis on global financial markets by identifying emerging trends, evaluating economic factors and forecasting their impact on CME Group and the company’s business strategy, and upon those who trade in its various markets. He is also one of CME Group’s spokespeople on global economic, financial and geopolitical conditions.

View more reports from Erik Norland, Executive Director and Senior Economist of CME Group.

FX Options

Benefit from our award-winning FX options platform, the market depth you need, the products you want and the tools you require to maximize your options strategies across 31 FX options contracts, available nearly 24 hours a day.