- 5 Nov 2020

- By Ted Schroeder

The CME Pork Cutout (PRK) futures contract from CME Group provides a new price risk management tool for pork packers, processors, retailers, and food service. Anyone wanting to establish forward prices for wholesale pork products can use the Pork Cutout futures contract as a financial derivative to hedge. This paper briefly overviews the Pork Cutout futures contract and illustrates how it may be used to manage wholesale pork product price risk.

The Pork Cutout futures contract is a 40,000 pound futures and options contract that discovers future values for the typical US pork carcass cutout. The pork cutout refers to the estimated wholesale value of a representative pork carcass as collected and reported by the US Department of Agriculture (USDA), Agricultural Marketing Service (AMS) under Livestock Mandatory Price Reporting (LMR). The CME Pork Cutout futures contract is a cash-settled contract with the expiring contract price settling to the CME Pork Cutout Index, which is a five-day weighted average of the USDA AMS pork cutout FOB plant value from negotiated sales from the national AMS afternoon reports (LM_PK602).

Pork packers who process 100,000 or more barrows and gilts (or packers processing 200,000 or more sows and boars) annually are required to report sale prices for individual pork products daily to the USDA under LMR regulations. AMS combines individual wholesale pork product prices, adjusted for proprietary packer yields and assumed fabrication costs for refined processing for the many pork products, into a composite wholesale pork carcass cutout value that represents the value per pound of a typical hog carcass.1 The pork carcass cutout value is a negotiated cash market estimate of a wholesale pork carcass value.2 The calculated value is an “estimate” of the carcass value, as opposed to an actual price, because it combines adjusted prices from many diverse pork products together using a standard calculation procedure to form a single composite wholesale carcass value estimate.

The approximate percentages of each pork primal comprising the cutout in the USDA’s 2020 calculation is presented in Table 1. The composition of the pork cutout value calculation is important for prospective pork product hedgers because it provides preliminary insight into which pork products the Pork Cutout futures contract will likely offer the most predictable hedging opportunities and, therefore, the most price risk protection. For example, if one were hedging pork tails in Pork Cutout futures, since tails represent only 0.18% of the cutout value, tail prices are likely not highly correlated with the overall cutout value or the CME PRK. In contrast, the loin represents about 25% of the pork cutout value, so loin prices will likely more highly correlated with Pork Cutout futures than tail prices. However, how effectively tails, loins, or any other wholesale pork product can be hedged using Pork Cutout futures requires data analysis to estimate hedging relationships and associated hedged price risk.

| Primal Product | Percentage of Cutout Value |

|---|---|

| Loin | 25.12% |

| Butt | 10.27% |

| Picnic | 11.25% |

| Sparerib | 4.66% |

| Ham | 24.56% |

| Belly | 16.43% |

| Jowl | 1.47% |

| Neck Bones | 1.77% |

| Tails | 0.18% |

| Front Feet | 1.03% |

| Hind Feet | 1.34% |

| Cut Loss | 1.92% |

| Total | 100.00% |

Source: https://www.ams.usda.gov/sites/default/files/media/LMRPorkCutoutHandout.pdf

The CME Pork Cutout futures contract provides an opportunity for hedging specific pork cut product prices. Hedging a product that is different from the underlying Pork Cutout futures contract, for example, hams, loins, butts, or spareribs, is referred to as cross-hedging. Since Pork Cutout futures represent a commodity that is a weighted average of prices across several different pork products, hedging any single pork product in this composite futures contract requires cross-hedging. Two aspects are essential in cross-hedging: 1) hedge ratio - determining the amount of cash position being effectively hedged per futures contract and 2) hedging feasibility – assessing how well the cross-hedge will work in mitigating future price risk.

The hedge ratio is the pounds of a futures position (or number of contracts) needed to fully hedge cash market commodity price risk. In a normal hedging relationship of, say, cash corn in Corn futures, generally a hedge ratio of 1.0 is assumed. This is because corn cash and futures prices move nearly one-for-one most of the time. So, one hedges 5,000 bushels of cash corn per 5,000 bushels of Corn futures.

However, when cross-hedging, the one-for-one price relationship may not hold and, as such, the futures position to take to protect a given volume of the cash commodity must be estimated from price data. Consider a case where the cash product price changes by $2/lb for every $1/lb change in the futures contract price. In such a case, the hedge ratio would be 2, implying to cross-hedge the cash commodity, the hedger would want a futures position that is twice the size of the cash commodity volume. For example, each 40,000 pound futures contract would effectively hedge 20,000 pounds of cash commodity if the hedge ratio was 2. The hedge ratio is estimated using historical data on cash and futures prices as we will illustrate below.

The second important aspect of cross-hedging is to determine whether the cross-hedge is feasible. Feasibility here refers to the strength of price correlation between the underlying prices of the cash commodity and the futures contract. High correlation generally is indicative of a viable cross-hedge, whereas, low correlation suggests the cross-hedge may not be effective at mitigating price risk.

One important additional consideration in cross-hedging is the relationship may vary seasonally. This is especially true if the cash commodity or product price has a different seasonal pattern than the underlying futures market. In cross-hedging wholesale pork products in the Pork Cutout futures contract, seasonality is important to assess because different pork products are well known to exhibit varying seasonal patterns. Cross-hedging without considering possible seasonal variation in the hedge ratio or hedging feasibility can lead to unexpected poor performance of the hedge at mitigating price risk.

Given these considerations, next we provide examples of cross-hedging specific wholesale pork products using the Pork Cutout futures contract. In the ensuing analyses, realize we estimate hedge ratios and hedging feasibility using the USDA negotiated cash market pork cutout value and not the actual Pork Cutout futures prices because Pork Cutout futures had not started trading at the time of this publication. As such, our best proxy for Pork Cutout futures is the published USDA pork cutout value.

Suppose you wanted to cross-hedge wholesale ⅛” Trimmed Loin VAC using the Pork Cutout futures contract. First, consider the correlation of this wholesale loin cut price with the pork cutout value. The correlation provides a rough measure of how the price of loins and the cutout value tend to move relative to each other. The simple correlation of the daily prices over the 2013- October 2020 period was 0.82. As we will see in further analyses below, if we delete prices during 2020, the correlation between the two series was even stronger at 0.89. This suggests the carcass cutout value and the trimmed loin prices generally track each other fairly closely.3 To delve further into assessing the hedging relationship and feasibility, we explore the relationship among the prices of the two more closely.

The ⅛” Trimmed Loin price and pork cutout value are graphed over time to illustrate their relationship (Figure 1). The line graph clearly demonstrates the two series tend to follow similar patterns consistent with the high correlation. However, also evident is the relationship between the two series varies. For example, at times the prices are close to each other such as in late 2016, late 2017, and late 2018. At other times, the series diverge, such as in March 2014, May 2015, June 2016, and particularly May 2020 during the COVID pandemic. This suggests the relationship between the two series may be seasonal, and as such, cross-hedging relationships may differ by season. Therefore, it is prudent to estimate the cross-hedging relationship by season.

To better illustrate the variation in the two series relative to each other, we provide a ratio of the loin price to the cutout value in Figure 2. Here we can see more clearly that the two series, while highly correlated, exhibit variation in relative value with the trimmed loin price being usually 130% to 150% of the carcass cutout value. However, noteworthy is in April 2020, the trimmed loin price went as high as 258% of the carcass cutout value.

Next, we estimate the hedging relationship. Since we noted seasonality may be present in the relationship of ⅛” Trimmed Loin VAC prices and the pork cutout value, we allow the hedging relationship to vary by season. For this exercise we will illustrate the relationship using seasons of winter (January-March), spring (April-June), summer (July-September) and fall (October-December).

To estimate the hedge ratio and the strength of the hedging relationship we estimate a simple regression of the daily ⅛” Trimmed Loin VAC price as a function of the USDA negotiated cash market pork cutout value separately for each season over the 2013-October 12, 2020 time frame. Statistical results of the hedging relationships by season are summarized in Table 2. The hedge ratio provides an estimate of how many pounds of Pork Cutout futures would be needed to hedge a single pound of ⅛” Trimmed Loin VAC. For example, the hedge ratio for the summer is 1.40. This indicates each 40,000 pound Pork Cutout futures contract would effectively cross-hedge about 28,571 pounds of loins (40,000/1.40 = 28,571) to be purchased during summer months. In the fall, the hedge ratio increases to 1.67, suggesting each 40,000 pound Pork Cutout futures contract would effectively cross-hedge about 24,000 pounds (40,000/1.67) of wholesale ⅛” Trimmed Loin VAC.

Also provided in Table 2 are other important statistics for assessing the cross-hedging relationship. The R-squared measures the correlation of the series – the square root of the R-squared in these simple models is equal to the simple correlation. The correlations for the four seasons are all greater than 0.70 (R-Squared of 0.49 or greater) with the highest correlation in fall at 0.91 (square root of 0.83 R-squared). RMSE refers to the root mean squared error of the regression. The units of RMSE are the same as the loin price, $/cwt. The RMSE provides a dollar-level risk assessment of the cross-hedge where a smaller RMSE indicates less risk in the cross-hedge. The RMSE provides a roughly two-thirds range confidence interval for the expected cross-hedged price. We go into a bit more detail below.

| Season | Intercept | Hedge Ratio | R-Squared | RMSE | Observations |

|---|---|---|---|---|---|

| Winter | -5.26 | 1.40 | 0.70 | 11.22 | 504 |

| (3.26) | (0.04) | ||||

| Spring | 18.89 | 1.18 | 0.51 | 19.34 | 512 |

| (4.50) | (0.05) | ||||

| Summer | -8.59 | 1.40 | 0.82 | 10.64 | 512 |

| (2.56) | (0.03) | ||||

| Fall | -34.89 | 1.67 | 0.83 | 8.13 | 439 |

| (3.02) | (0.04) |

Note: Standard errors are reported in ( ).

Using the fall example, what appears to be the most reliable seasonal hedging relationship, the hedged loin price would be expected to end up being within $8.13/cwt (the RMSE) of the predicted price two-thirds of the time. The predicted price being hedged for any given CME Pork Cutout futures price is illustrated for the fall hedge in Figure 3. If the fall 2021 CME Pork Cutout futures price was trading at $90/cwt, the expected hedged price for ⅛” Trimmed Loin VAC for delivery in fall 2021 would be $115.41/cwt (1.67 × $90 – 34.89). Using the RMSE of 8.13 for fall would imply the hedged price would end up being in the range of $107.28/cwt and $123.54/cwt ($115.41 +/- $8.13) two-thirds of the time.

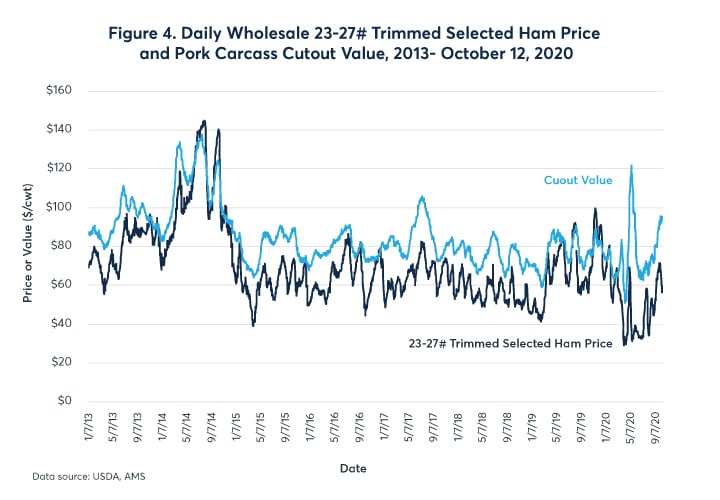

Consider a second example of cross-hedging wholesale 23-27# Trimmed Selected Hams using Pork Cutout futures. The correlation of the ham price and pork cutout value over the entire 2013-October 2020 period was 0.84. As illustrated in Figure 4, the two series generally follow similar long-run patterns. However, the ham price is certainly more variable than the cutout value and thus the cutout value may be less capable at mitigating ham price risk during some time periods. The ratio of the ham price to the cutout value is presented in Figure 5. Here again, the variation in the ham price relative to the cutout is evident as the ratio ranges from about 25% in May 2020 to around 115% at various times.

The cross-hedging relationships estimated using the daily wholesale 23-27# Trimmed Selected Ham prices relative to the pork cutout values over the 2013 – October 2020 time period by season are reported in Table 3. The R-squared values suggest seasonality in the strength of the price relationships with the highest correlation in the summer (R-Squared 0.84, or correlation 0.92) and lowest in the spring (R-squared 0.63, correlation 0.79). Hedging relationship risk is greatest in the spring at $12.59 and lowest in the winter, $6.75.

Season |

Intercept |

Hedge ratio |

R-squared |

RMSE |

Observations |

|---|---|---|---|---|---|

Winter |

-9.08 |

0.91 |

0.73 |

6.75 |

504 |

(1.96) |

(0.02) |

||||

Spring |

-17.68 |

0.98 |

0.63 |

12.59 |

512 |

(2.93) |

(0.03) |

||||

Summer |

-41.38 |

1.31 |

0.84 |

9.49 |

512 |

(2.29) |

(0.03) |

||||

Fall |

-46.53 |

1.44 |

0.73 |

9.43 |

439 |

|

(3.51) |

(0.04) |

|

|

|

Note: Standard errors are reported in ( ).

The ham hedge ratios also have notable variability. In the winter and spring, the futures position would be smaller than the cash position in pounds where a 40,000 pound futures contract position would cover about 44,000 pounds of cash hams in the winter (40,000/0.91) and just under 41,000 pounds in the spring. In contrast, in the fall a 40,000 pound futures position would cover just under 28,000 pounds of cash hams (40,000/1.44).

The hedging relationship for the summer is illustrated in Figure 6. A Pork Cutout futures price of $95/cwt would covert to hedging an expected ham price of $83.07/cwt (1.31 × $95 – 41.38) using the 1.31 hedge ratio. The two-thirds confidence interval on the hedged ham price would be $73.58/cwt to $92.56/cwt ($83.07 +/- $9.49).

With the introduction of the CME Pork Cutout futures contract, those wishing to establish forward prices for wholesale pork products have a new instrument available to manage price risk. Cross-hedging wholesale pork products using the Pork Cutout contract may be a viable alternative to forward contracts. A few caveats are worth keeping in mind. First, the analysis completed here is for illustrative purposes only and anyone wishing to cross-hedge wholesale pork products needs to determine hedge ratios and associated hedging risk for their own situation and particular products being hedged. Estimating this relationship requires historical data.

Second, all analysis completed here used the USDA Pork Cutout cash negotiated trade values to estimate hedging relationships. These will not be the same as Pork Cutout futures prices. As such, hedging relationships should be reexamined using actual futures prices as they become available. Finally, cross-hedging generally involves greater price risk than direct hedging because individual product prices can vary notably from the underlying futures contract price. For example, in 2020, loin prices went up whereas in contrast ham prices declined substantially relative to the carcass cutout value. Such unexpected divergences from normal relationships between the carcass cutout value and individual pork product prices increases cross-hedging risk.

1 Details of how USDA AMS calculates the pork carcass cutout value are available at: https://www.ams.usda.gov/sites/default/files/media/LMRPorkCutoutHandout.pdf.

2 The pork cutout value specifically compiles wholesale pork product sales prices FOB the plant for products sold in the negotiated cash market in which the products must be delivered within 10 days if they represent combos of containers and 14 days for boxed products.

3 Simple correlation ranges from zero for two series that are completely unrelated to each other to a maximum of 1.0 for series that move in tandem with each other.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.