- 2 Jul 2018

- By CME Group

One of the more incredible growth stories in the futures industry is the growth of managed futures, a strategy that involves a professional putting together portfolios of futures contracts.

In some ways, the managed futures industry mirrors the mutual fund or managed money model. With mutual funds, you place money with a professional money manager, pay a management fee and the manager assembles a diversified portfolio of stocks, bonds and cash that hopes to provide market -beating returns. With managed futures, the manager instead assembles a diversified portfolio of futures contracts. The manager is often a CTA (Commodity Trading Advisor (CTA) …as opposed to a Registered Investment Advisor with stocks or bonds).

The first publicly managed futures fund, Futures, Inc., was started in 1949 by Richard Donchian. A year before, he secured regulatory approval to have power of attorney over a futures account. He also developed the trend timing method of futures investing and introduced the mutual fund concept to the field of money management.

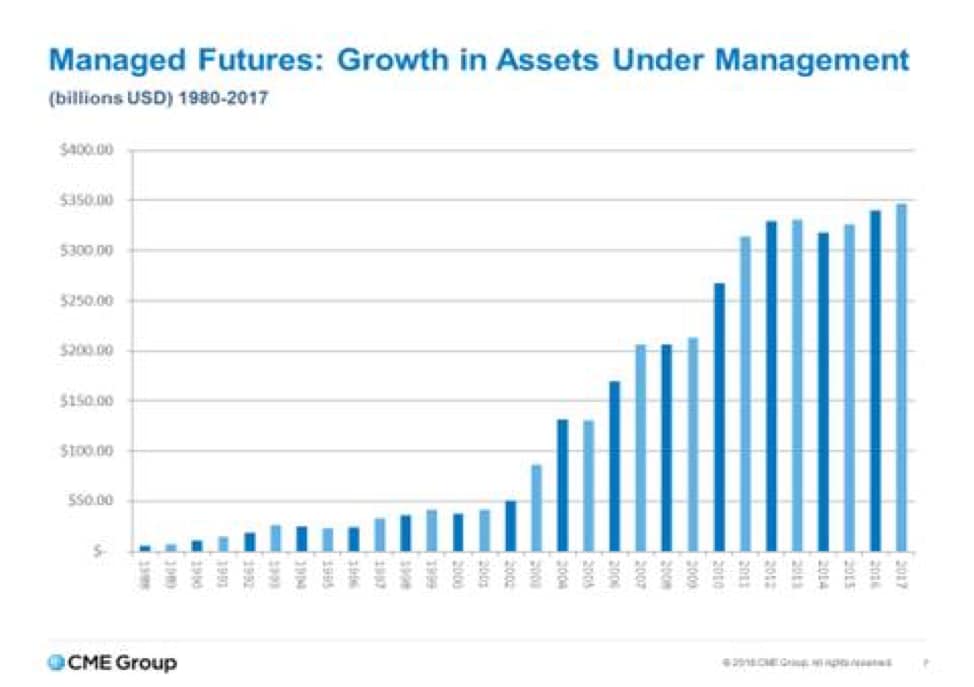

Since then, trading giants and CTAs, such as Richard Dennis, William Eckhardt, Liz Chevall, and many others, have advanced the managed futures field to the point where assets under management for CTAs runs about $367 billion, up from less than $20 million in 1980. See an illustration of this growth in the graphic below.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.