- 17 Sep 2020

- By Eric Leininger

Adjusted Interest Rate (AIR) Total Return futures on the S&P 500 Total Return Index (SPTR) are the latest innovation in the CME Group’s Total Return futures suite of products. AIR Total Return futures provide investors total return exposure on the S&P 500 Index while using an embedded overnight floating interest rate for financing. Like the existing Total Return futures (TRFs), AIR TRFs provide the same capital and margin efficiencies combined with easy execution. The Adjusted Interest Rate is based on the Effective Federal Funds Rate making interest rate decisions potentially easier and opening new trading opportunities.

It is probably safe to assume that most investors seek a total return on their investments. In Equity Index investing and trading, that entails both the change in the price of the index as well as any dividends that equity index produces. The underlying stocks of an index often go ex-dividend at different times from each other, with varying distribution amounts and as such, the timely reinvestment of dividends can be challenging.

The OTC markets developed products such as Total Return Swaps. In a like manner, CME Group developed Total Return futures (TRFs) on indices such as the S&P 500, Nasdaq-100, Russell 1000 and 2000, and Dow Jones Industrial Average1.

These futures can offer capital and cross margining efficiencies as well as around-the-clock access. Adjusted Interest Rate Total Return Futures (AIR TRFs) are the new kid on the block and provide additional mechanisms to address the nuances of financing requirements that market participants may find useful.

Understanding the key nuances of the AIR TRFs construction are important. There are many use cases for both the existing TRFs and the new AIR TRFs that offer a range of hedging and risk management opportunities.

Total return products are designed to provide capital gains as well as dividend reinvestment. For example, the S&P 500 Index (S&P 500) represents the weighted market capitalization of the stocks in the index. Created in 1957, it was the first US market-capitalization-weighted stock price index. As of May 29, 2020, the index comprises 505 common stock listing of 500 firms, with aggregate market capitalization of $26.2 trillion2.

The S&P 500 Total Return Index (SPTR) is similar but will also include both the weighted market capitalization of the stocks in the index and a daily addition of dividends that are reinvested into the index. The result is a growing base of capital when one compares the SPTR to the S&P 500. Here is a simple comparison of the two indexes over the prior decade.

The SPTR Index has a material simplifying feature. It captures the daily dividend accrual in its calculation. This means that one no longer need worry about timing and other operational issues associated with reinvesting dividends, it is all computed within the index. Across TRS and TRFs the SPTR is a commonly used index and is also the underlying index in the new AIR TRFs.

One of the products that banks developed was the total return swap on equity indices. This swap provided non fully funded investors the ability to finance required equity exposures. In an equity TRS, the derivative contract exchanges the cashflows of the total return index with a benchmark interest rate plus a spread to compensate the seller of the TRS for funding the purchase of the equity index (more on this later).

TRS are over-the-counter bilateral agreements that are subject to ISDA documentation including a Master Agreement and Credit Support Annexes (CSA). These documents are used to determine how much margin must be exchanged to decease the credit risks between the two counterparties and is computationally intensive. The time and cost associated to set up these legal documents can be material.

Second, because these are bilateral and not cleared, it can be difficult to net positions between two offsetting trades at different counterparties for margin calculation. Trading OTC Equity TRS is often additive to margin requirements as well as any additional capital to support any credit buffers.

Operationally TRS can present some additional steps to manage them correctly. If a portfolio manager needs to allocate positions across a wide variety of accounts, it can be easier to use futures rather than create individual CSAs for each unique account. Additionally, TRS are not always as liquid as futures, as one needs to return to the same counterparty to unwind the transaction. The ease of execution can be simplified though exchange traded derivatives.

More recently, TRS have fallen under increased margin requirements as specified by multiple regulatory bodies and the Uncleared Margin Rules (UMR). The intent is to reduce systematic risk through increasing margin requirements for all market participants. With increased margins comes increased costs. The margin efficiencies that Total Return Future provide make them more compelling than ever.

Total Return Futures can offer a similar intended risk profile as TRS, but as exchanged traded instruments, they can potentially provide margin and capital efficiencies along with a reduction in complexities.

In August 2016, CME Group launched the S&P 500 Total Return futures. At that time, the dealer community was coming to terms with the new Uncleared Margin Rules (UMR) that subjected them to a 15% margin requirement on any uncleared equity swap transaction.

Traders soon realized the benefits of reduced margin requirements as well as the additional efficiency to hedge and manage risk using a listed and centrally-cleared futures product.

Total Return futures (TRFs) also simplified trading business. A great benefit was that ISDA documentation and confirms were not required. For buy-side firms that have multiple entities, TRFs allowed the required exposures with much less complicated paperwork and set up time requirements.

Given the success of the S&P 500 Total Return futures, CME Group announced the expansion of Total Return futures to include Nasdaq-100, Russell 1000 and Russell 2000 as well as the Dow Jones Industrial Average Total Return indices in late 2018.3

These TRFs trade via the Basis Trade at Index Close (BTIC) mechanism in index points. This means that the BTIC price at the time of trade inception reflects the expected financing payment, inclusive of the forward rate and spread between trade date and expiration, which is then present valued at today’s discount rate and transposed into index points as a function of today’s spot index level. As such, the financing component of these traditional TRFs has a fixed rated component that is locked in on trade date. While this suits many investors, some prefer to use an additional interest rate hedge to convert the fixed-rate risk to a more traditional floating-rate risk found in equity swaps.

With the introduction of the AIR Total Return futures, both ‘legs’ of the TRFs have been simplified. SPTR provides any change in the index price plus the daily reinvestment of dividends. On the financing side, Federal Funds is accrued daily along with an agreed upon financing spread quoted in basis points (as opposed to index points).

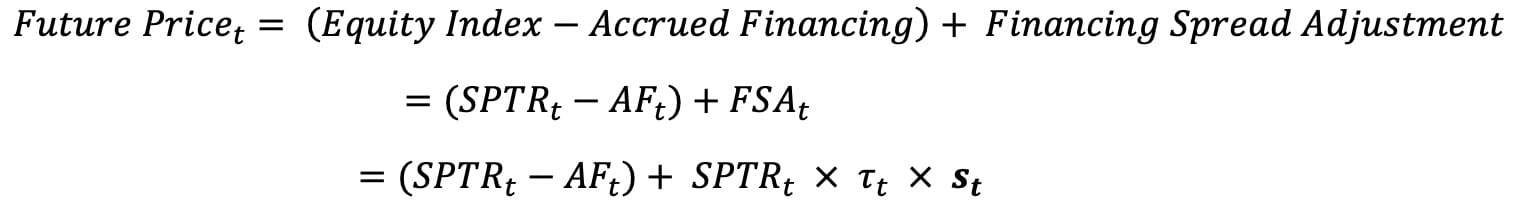

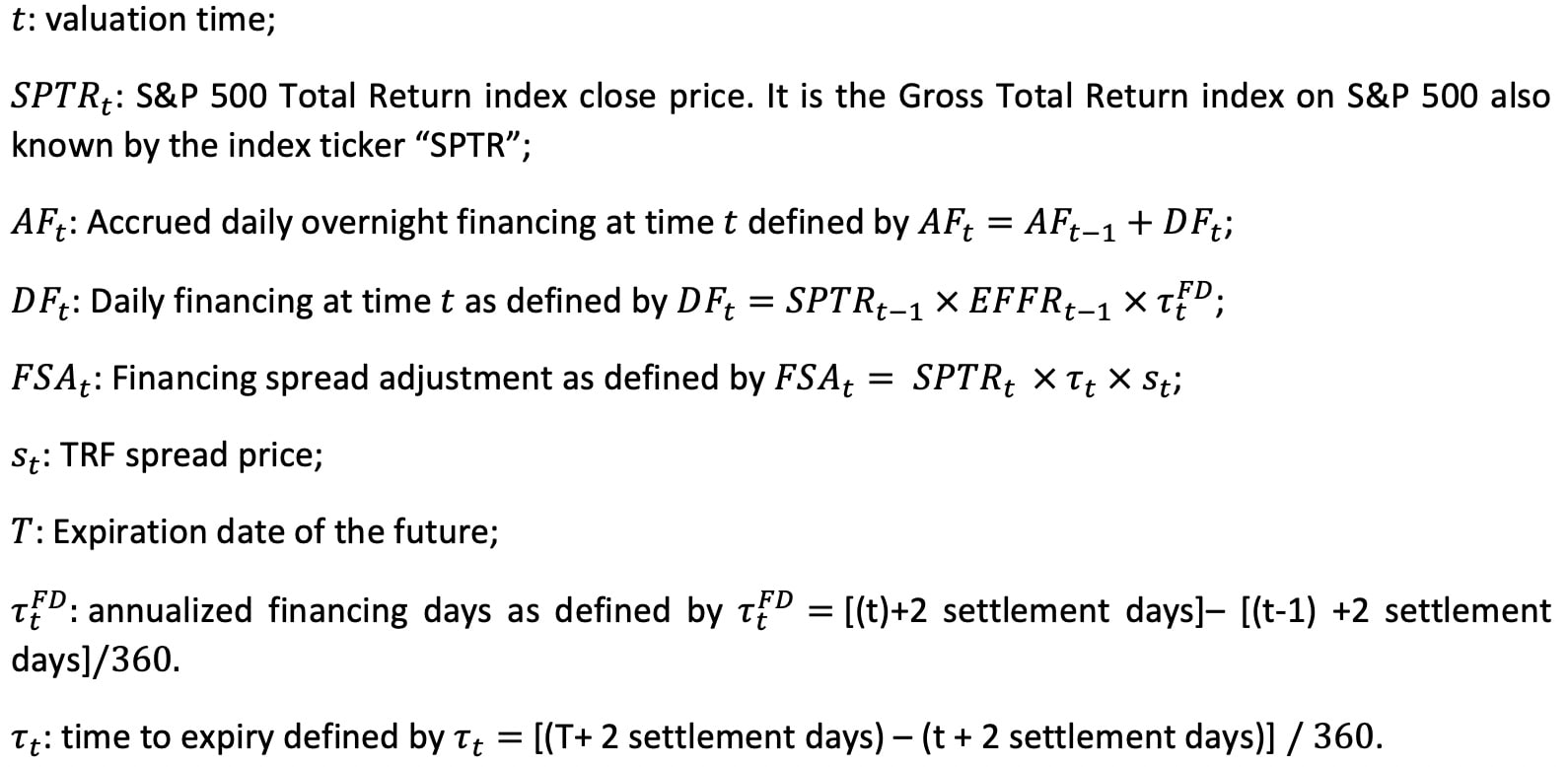

The AIR S&P 500 TRFs valuation has three components; an equity index component, a daily benchmark financing component and a financing spread adjustment component.

AIR S&P 500 TRFs = (Equity Index – Accrued Financing) + Financing Spread Adjustment

For the AIR TRFs, the Equity Index is the S&P 500 Total Return Index (SPTR). The Accrued Financing is Effective Federal Funds Rate and the Financing Spread is the additional haircut added to or subtracted from the financing rate that is agreed at trade inception.

AIR TRFs are also traded via the BTIC mechanism. When trading AIR TRFs, the counterparties agree to an annualized spread in basis points over or under the reference rate – this is known as the TRF Spread. The Financing Spread Adjustment is computed in index points based on that day’s closing value of the SPTR multiplied by the TRF spread and time weighted days to maturity.

Financing Spread Adjustment = (SPTR X TRF Spread) x Days to Maturity

A fictitious numerical example of the spread is presented in Appendix 1.

To support the need for longer dated exposures, AIR TRFs will be listed with the 13 consecutive quarters, 1 nearest January contract, and 7 additional Dec quarterly contracts. These provide a rich array of expiries to manage exposures out to several years.

As mentioned in the TRS section above, the selling of an equity swap gives rise to a funding cost – where the seller, in theory, borrows funds at the prevailing rate to purchase the underlying equities needed to replicate the index performance. Therefore, the seller must be compensated for such costs by the buyer of the equity swap who receives the index exposure without needing to purchase the underlying assets. The cost of funding equities is determined by the supply and demand of the user base on both a daily and a term-basis, where the financing level can change and sometimes dramatically.

The chart below is a 6-year history of the implied financing cost associated with the roll of the S&P 500 Index futures. Differences in the implied financing levels of the S&P 500 futures, which are the best proxy for equity funding rates, are driven by many complex supply and demand factors including balance sheet pricing, regulatory changes, and market conditions. This can create situations where the roll is rich or cheap to the financing rate.

For example, from the roll periods of September 2016 through December 2019, future rolls traded rich as new regulation drove higher balance sheet costs and a persistent equity bull market moderated the natural short-base in the S&P 500. Following the recent market sell off in early 2020 along with subsequent Central Bank activity, the equity financing market has normalized.

See more on equity financing calculations from the CME Group publication Total Return Index futures.

AIR TRFs open new opportunities to potentially simplify portfolios and trading books. In addition to all the other features of existing TRFs, AIR TRFs help simplify the funding component to and overnight interest rate. This can provide simplification for managing interest rates in these books as well as other opportunities.

Positioning Opportunity along the curve

One of the most important aspects of the AIR TRFs is market participants now can trade equity financing explicitly via the TRF Spread. There is normally a curve that reflects the cost to fund equity positions over time. This curve can move with different market conditions as well as supply and demand, and some market participants can trade this parameter as an alpha generating opportunity e.g. flattening/steepening trades 1yr vs 5 yr. Others may inherently already have this risk embedded in their portfolio and wish to manage this risk. In both cases AIR TRFs can be an excellent way to do this as they provide transparency into the equity financing levels at different points along the curve.

This allows delta-hedging farther out the curve without locking in the interest rate component. As discussed earlier, traditional TRFs have an embedded fixed rate and would require an interest rate swap to transpose the position back to a floating rate. With AIR TRFs there is an element of the position, as a function of product design – not hedge maintenance – that provides recourse against daily rate fluctuations.

Portfolio management

Both investors and market makers can simplify their portfolios via AIR TRFs by consolidating various bespoke swap expirations and tenors. If portfolios currently have TRS, using the Exchange for Risk (EFR) mechanism can exchange the related OTC TRS instrument for the preferred AIR TRF futures4. One can see more information on that process at Exchange for Related Positions. In addition, and as mentioned earlier, if one has many portfolios with multiple CSAs, AIR TRFs can help simplify the operational processes.

Uncleared margin rules

Uncleared Margin Rules (UMR) continue to move forward and are already in force for many. While some dates have been pushed out into the future, some regulators continue to take a firm stance that UMR will apply to most market participants in the coming years.

For OTC TRS, buy-side entities will need to post 15% margin for equity swaps. This increases not only the upfront use of capital but also the operational costs and complexities for these firms. Even if a buy-side entity is not currently impacted by UMR, the increased margin requirements already are likely to apply to the dealer community providing the swap exposure. All else equal, this will mean that the spread on the equity swap will widen. Simply put UMR already is and will continue to make uncleared OTC TRS more expensive.

In contrast, TRFs and AIR TRFs replicate a Total Return swap, and as a centrally-cleared product is not subject to UMR. As broad-based index futures, TRFs carry much lower margin requirements all while simplifying both the execution and the margin process, providing increased operational safety.

Both AIR TRFs and TRFs are cleared products. Margin offsets against other CME futures and options are possible and applicable when available. This is not always the case in a TRS transition and can lead to additional margin efficiency by trading futures at CME.

Round-the-clock trading

Another key feature is the ability to trade TRFs and AIR TRFs outside of normal trading hours. With a TRS, if one wants to change the existing profile or unwind the swap, the counterparty will need to wait until the original dealer is available during normal business hours.

Documentation and process simplification

TRS require comprehensive ISDA documentation and counterparty confirmations. This can require significant legal and operational set up costs. If a buy-side firm has many discrete entities, this increases the complexity and costs commensurately. Total Return Futures are operationally a much simpler product to get up and running.

Commodity code |

Contract title |

Commodity code |

btic code |

||

|---|---|---|---|---|---|

| Adjusted Interest Rate S&P 500 Total Return Index futures (AIR S&P 500 TRF) | ASR | AST | |||

Underlying index |

S&P 500 Total Return Index (SPTR) |

||||

Reference rate |

Effective Federal Funds Rate (EFFR) |

||||

Trading unit |

$25 x Adjusted Interest Rate S&P 500 Total Return Index futures Price |

||||

Trading and clearing venue |

ASR: CME ClearPort for EFRP transactions AST: CME Globex & CME ClearPort for block trades The price basis for all CME Globex or block transactions shall be BTIC only |

||||

Trading and clearing hours |

ASR: CME ClearPort: Sunday 5:00 p.m. - Friday 5:45 p.m. Central Time (CT) (no reporting Monday – Thursday 5:45 p.m. – 6:00 p.m. CT AST: CME Globex: Sunday - Friday 5:00 p.m. - 3:00 p.m. CT with a 60-minute break each day beginning at 4:00 p.m. CT CME Globex Pre-Open: Sunday 4:00 p.m. CT. Monday – Thursday 4:45 p.m. CT CME ClearPort: Sunday 5:00 p.m. - Friday 5:45 p.m. (no reporting Monday – Thursday 5:45 p.m. – 6:00 p.m. CT) |

||||

Listing schedule |

Quarterly contracts (Mar, Jun, Sep, Dec) listed for 13 consecutive quarters, 1 nearest January contract, and 7 additional Dec quarterly contracts |

||||

Termination of trading |

ASR: Trading terminates on the 3rd Friday of the contract month AST: Trading terminates on the business day prior to 3rd Friday of the contract month |

||||

Price basis and minimum price increment |

ASR: Prices are quoted and traded in Index points. Minimum price increment: 0.01 Index points AST: Prices are quoted and traded in Basis points. Minimum price increment: 0.50 Basis points |

||||

Settlement method |

Financially Settled |

||||

Settlement procedures |

The SOQ shall be determined on the third Friday of such delivery month and shall be based on opening prices of the component stocks of the Index. If the Index is not scheduled to be published on the third Friday of the contract month, the Final Settlement Price shall be determined on the first earlier day for which the Index is scheduled to be published |

||||

Price limits |

There shall be no trading when trading is halted in the Primary futures Contract Month for E-mini S&P 500 Index futures pursuant to Rule 35802.I |

||||

Block eligible / minimum block minimum |

ASR: No / Not block eligible AST: Yes / 500 contracts Reporting Window: RTH – 5 minutes, ETH/ATH – 15 minutes |

||||

Position limits / reportability thresholds |

Position Reportability: 25 contracts All-Month Position Limit: 60,000 S&P 500 Stock Price Index (SP) futures equivalents, subject to aggregation. 5 AIR S&P 500 TRF = 1 SP futures equivalent |

||||

CME matching algorithm |

F: First In, First Out (FIFO) |

||||

Total return products continue to evolve. While TRS and traditional TRFs continue to have uses, the new Adjusted Interest Rate (AIR) Total Return Futures and the transparency of isolating the financing rate above or below the benchmark financing rate of Effective Federal Funds can remove interest rate risk and provide possibilities for additional trading opportunities. Market participants can now effectively practice what they were doing in the OTC world, in a listed format potentially resulting in more efficient capital usage, eliminating counterparty risk, ease of operations, whilst enjoying transparent equity financing levels across the curve allowing prudent risk management and allowing clients to take advantage of alpha generating opportunities. A welcome development.

A fictitious example with an AIR TRF being traded on October 20, 2020 with a final settlement date of December 17, 2021 is presented below (mathematical formulae are in Appendix 2).

Date |

SPTr |

Effective Federal Funds Rate (bps) |

AIR TRFS traded spread (bps) |

AIR TRFS settlement spread (bps) |

Accrued financing |

|---|---|---|---|---|---|

October 19, 2020 |

7,330 |

10 |

|

15.0 |

10.3271 |

October 20, 2020 |

7,345 |

10 |

16.0 |

18.5 |

10.3475 |

On October 19, 2020, EFFR was 10 basis points (1 basis point is of 1 percentage point and denoted as bps). The SPTR closing level on October 19, 2020 is 7,330. The daily financing value for October 20, 2020 in index points is:

7,330 × 1⁄360 × 0.10⁄100 =0.0204

This daily financing amount gets added to the accrued financing to date (from the table above).

0.0204+ 10.3271 = 10.3475

On October 20, 2020, an investor trades the AIR TRF Spread at a level of 16 basis points. The time-to-maturity is 425 days. The AIR TRF’s traded Financing Spread Adjustment in index points is calculated as:

7,345 × 425⁄360 × 0.16⁄100 =13.8739

The AIR TRF’s valuation at the time of trading is:

7,345 – 10.3475 + 13.8739 = 7,348.53

The end of day October 20, 2020 valuation is calculated similarly (assume the SPTR level closes at the same as the traded level). The end-of-day Financing Spread Adjustment with an AIR TRF Settlement Spread of 18.5 basis points on October 20, 2020 is:

7,345 × 425⁄360 × 0.185⁄100 =16.0417

The daily financing and accrued amounts are the same as calculated before. Thus the final settlement value for October 20, 2020 is:

7,345 – 10.3475 + 16.0417 = 7,350.69

The price of AIR TRF is defined as:

Where:

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.

Adjusted Interest Rate (AIR) Total Return Futures

Get total return swap exposure with the capital efficiency of futures