- 15 Dec 2020

- By CME Group

CME Group’s FX Market Profile tool provides new insights into the working of the global FX markets, both for spot and futures markets. It offers data on bid-ask spread, top-of-book order sizes, and volumes traded across a range of currency pairs.

We can use FX Market Profile to assess the impact of the recent change to the minimum price increment for the CME Australian Dollar futures contract. This MPI was changed from 0.0001 to 0.00005 effective November 23, 2020.

The FX Market Profile tool can be configured with respect to dates, so we can review the AUD/USD market in the days before and the days after the MPI change to see the impact.

Let’s take a look at the week before the MPI change.

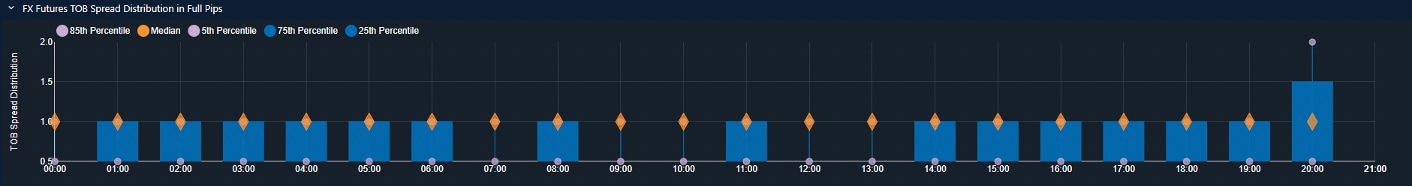

This chart of traded volume and top-of-book bid ask spread shows that futures had a typical spread of 1.1 pips throughout the trading day, perhaps slightly wider in the London morning. The chart of spread distribution shows that deviation from the then 1 pip minimum was in fact a rarity.

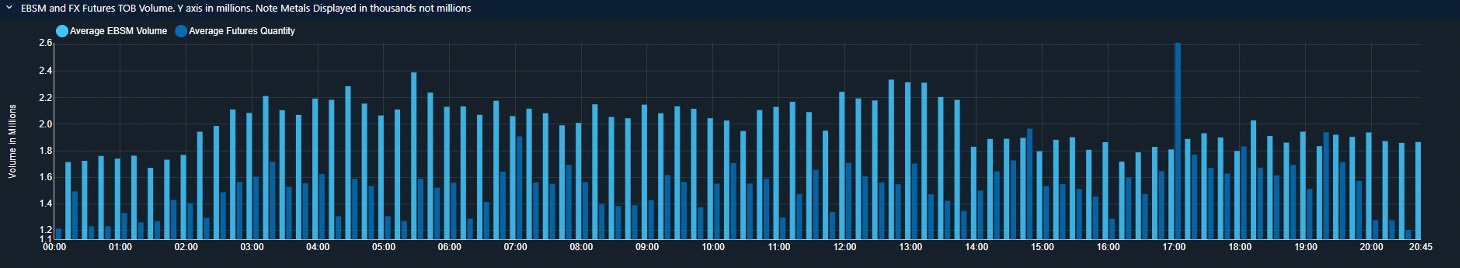

The chart of top-of-book volume shows a large amount of orders being held on the bid and ask through the day, sometimes in excess of $6 million.

This large value of resting orders at the minimum price increment is a strong indication that a tighter price increment would be beneficial for the market.

The week after the change in MPI included the US Thanksgiving holiday, and therefore is not an ideal week to draw comparisons. However, looking at the three days following the change does provide some insight.

The chart of traded volume and top-of-book bid ask spread shows that futures had already adopted the tighter price increment to some extent. The average bid ask spread is below 1 pip throughout the whole trading day. The chart of spread distribution shows that 1 pip remained the median spread width, but that the tighter spread of 0.5 pips was seen for a considerable amount of time.

Comparing the charts of bid-ask spread before and after the MPI change highlights the improvement.

Over the day, the average improvement in futures bid ask spread is 0.3 pips.

As would be expected, the top-of-book order volume with the tighter bid -ask spread shrunk. In the three days after the change, the average size shown at the top-of-book throughout the day was $1.5 million.

In addition to top-of-book spread, the FX Market Profile tool also calculates a VWAP bid ask spread for futures products, which shows the bid ask spread on a volume equal to that available at the top of book in the EBS spot market. With the EBS top-of-book volume essentially unchanged in two periods, at approximately $2.0 million on average, the calculated VWAP bid ask spread is a useful way to compare the liquidity available pre and post MPI change.

Comparing the two charts for VWAP spread shows the improvement:

The VWAP bid-ask spread has improved by an average of 0.2 pips for the whole trading day, demonstrating that the MPI change in AUD/USD is improving the liquidity available in the futures market.

This analysis has looked at only a fews days’ data, and as noted the period following the change was just before a major US holiday. As the market continues to develop, the FX Market Profile tool will provide additional data to review the impact.

All images sourced from the FX Market Profile tool.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.