- 28 Jan 2021

- By TriOptima

- Topics: Technology

In October 2020, we saw the official launch of our triReduce Benchmark Conversion functionality that facilitates the proactive reduction of exposure to legacy benchmarks. Much has been written about the future of interest rate benchmarks, but all we can say for certain is that the future is anything but. As a number of regulators recently updated their recommendations for legacy benchmarks, TriOptima is able to support customers in transitioning their OTC swap portfolios to the alternative benchmarks.

Moving towards the most efficient form of legacy benchmark risk

12 months ago, we began the journey to increase awareness of how triReduce’s leading multilateral compression network could form the foundation of a robust and effective conversion mechanism on to alternative benchmarks. We demonstrated the value of our existing compression activities as well as providing a window into the future where each individual party can proactively perform their transition.

The basic tenets start with maximising compression opportunities to remain as close to the core net risk position in legacy benchmarks. This objective can be achieved by focusing on participation, trade submission and risk tolerances.

We conducted a series of coordinated simulations to demonstrate the potential in these key areas to each customer in quantifiable terms. This included a thorough examination of their compression activity and untapped potential, which can be visualised through the reverse waterfall below. The conversations that followed helped to shed light on the great work that was already being done; clear guidelines for how service utilisation could be improved further; as well as establishing a comprehensive playbook for how back book transition could occur with the adoption of triReduce’s Benchmark Conversion functionality.

The mechanism for converting what remains

In preparation for the second part of the process, where legacy risk can be converted into the alternative benchmark, we have delivered functionality for risk replacement trades based on trade templates that have been made available by CCPs. These templates are particularly important in portfolios where insufficient volume in the alternative benchmark exists. In this case, we can use the templates to obtain valuations and risk sensitivities from each participating firm’s own mid-market curves.

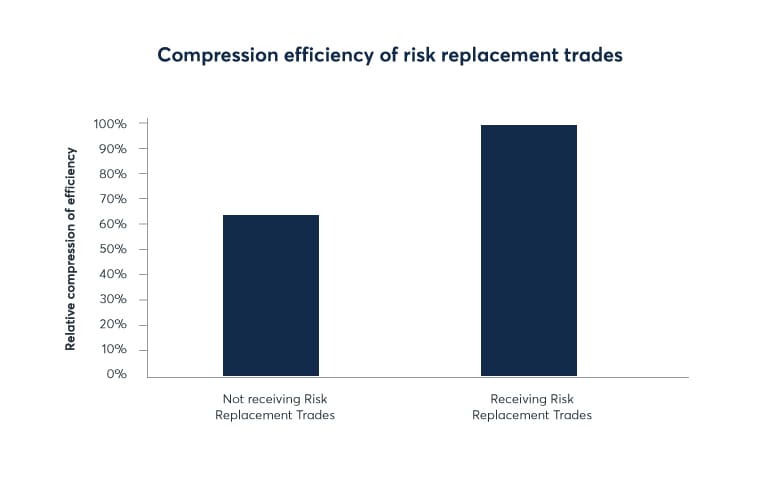

As shown in the chart, risk replacement trades are initially being used to further maximise the compression of legacy benchmark gross notional. At this time, the early adopters are experiencing up to 40% greater reduction in post-2021 ICE Libor gross notional through our regular triReduce cleared compression cycles. Meaning that iteratively over time, they will find themselves in the best possible position to handle whatever eventuality materialises after the end of 2021.

Maintaining best practices in alternative benchmark portfolios

While our customers focus on ensuring they maintain the most efficient legacy benchmark portfolio possible, they are also making certain that they are implementing the best risk management practices for the increasing number of alternative benchmark trades in their portfolios. One of the ways they are doing this is to review their trade extracts that feed into the compression process, to ensure that these new trades are being captured. In turn they can verify these trades are being priced and risk measured consistently and correctly through our unique pre-compression reconciliation checks. Here participants can also confirm their valuations against those determined by the CCP in one integral process, providing them with the confidence that when the alternative benchmark trades are compressed, they are done within accurate NPV and risk boundaries.

Another way in which our customers are extending best practices to alternative benchmark trades is by validating they can not only execute trades on the new benchmarks, but also price, risk manage and process trade lifecycle events on these trades. Here we once again lend our support to market participants by guiding them through submission into our compression cycles, so they can confirm that beyond entering into such trades, they are also able to exit out of them when the appropriate time comes.

A comprehensive solution for managing a legacy benchmark back book

triReduce supports all approved alternative benchmarks in addition to regularly compressing trades on USD SOFR, EUR €STR, GBP SONIA, JPY TONA, CHF SARON, CAD CORRA, & AUD AONIA. Extensive investment has been made towards developing a fully scalable infrastructure enabling triReduce to offer a comprehensive solution for managing benchmark transition in legacy portfolios.

Delivering certainty when performing compression and conversion at scale is what sets triReduce’s Benchmark Conversion functionality apart. We are already looking to take the lessons learned in our cycles, on to other applications beyond the ICE Libor benchmarks. As the industry seeks solutions in the EONIA to €STR transition, this conversion functionality and these valuation submission checks will continue to play an important role in 2021.

When thinking about 2021 and the challenges that lie ahead, market participants can expect to need to evaluate all possible transition management options. Adherence to the ISDA Protocol for legacy contracts is certainly a top consideration. However, a fully-fledged strategy for transition doesn’t end there. It extends to a continued effort to mitigate legacy benchmark exposures, at the same time as ensuring readiness to hold alternative benchmark trades in the portfolio. Compression plays an integral role here and with it, Benchmark Conversion will offer a vital mechanism for transitioning between benchmarks.

triReduce benchmark conversion

Reduce gross notional and convert exposure for ICE LIBOR swaps to alternative reference rates.