- 16 Dec 2020

- By Adila McHich

Exotic options are widely traded derivatives in the energy market because they capture the distinctive features of commodities. Exotic options refer to any options that are not plain vanilla. As opposed to the other asset classes like equity or bond markets, energy is intrinsically linked to the physical market with its commercial implications which require specific tools to manage some particularities such as high volatility, seasonality, basis risk, etc.

This article illustrates the main characteristics and commercial applications of average price options as one of the most-traded Energy Exotic options:

Average price options (APO) are one of most widely traded options in the energy space, particularly in petroleum markets such as crude oil, heating oil, etc. APOs are sometimes referred to as “Asian options”, as they were initially introduced by Bankers Trust Tokyo in Japan in 1987. Holding a position in APO offers the investor an insurance or the right to buy the underlying instrument at an exercise price equal to the average of all prices over a predetermined period.

APOs belong to an important class of path-dependent options where the payoff depends on the average of all prices over a specific period, as opposed to vanilla European or American options where the payoff is determined at a single expiration date. As such, the intrinsic value of APOs depends on the path or how the price is reached till until expiry. This averaging process can be either geometric or arithmetic and can start either at day zero or at a future date. Geometric Asian options are more popular and tend to be cheaper than the arithmetic ones, as geometric average results in a lower underlying price. Most Asian options are European style rather than American style because early exercise can take place before the averaging period, and consequently, can strip the main averaging feature of the option.

Asian options are extremely important for hedging in energy markets for these two main reasons:

- Asian options mirror the commercial activities and capture the granularity of a typical energy transaction, which usually takes place over a month via multiple deliveries. The averaging feature of the option payoff reflects the commercial aspect of most energy transactions which are priced based on average as opposed to a terminal price.

- Asian options are generally cheaper than the European vanilla ones with the same expiry date, underlying price, and volatility as the averaging tends to smooth down excessive spikes and dampen the volatility, which makes them relatively cheaper risk management instruments.

The averaging feature of Asian options has an important application to mitigate calendar basis risk, which facilitates to the option writer an efficient and easy way to manage continuous exposure price risk over a period of time by simplifying multiple hedge ratios of a stream cash flow or recurring transaction instead of using a basket of European style options. This property allows Asian options to capture the risk profile of energy companies, which rely on average prices for planning and budgeting. Here is an example of this type of application:

Asian options can be an optimal tool for bunker fuel hedging because of fuel consumption incurred on daily operations during the vessel voyage. Companies such as shipowners, cruisers, and charterers are exposed to fluctuating fuel costs, which eventually would impact the budget and cash flows.

APOs are optimal hedging tools for markets that can be prone to price shocks and spikes. Also, they can be ideal for markets with infrequent trades ‒ as these options’ payoff is less sensitive to extreme market fluctuations especially toward the option expiration.

APOs tend to have different trading characteristics than standard options do, especially during the averaging process. In fact, at inception, Asian options behave in a similar way to European options with a lower volatility, as the volatility of an average is lower than the price of the underlying used. A deep in-the-money Asian call option is more sensitive to price fluctuations than a near-the-money or out-of-the money option. Delta for APOs is higher for in-the money and lower for out-of-the-money than European vanilla options. Asian options tend to have a higher gamma, which measures the sensitivity of delta with respect to the underlying price. APOs are less sensitive to price movement in the underlying price when the option is close to expiry, while the option delta tends to diverge rapidly to either zero or one.

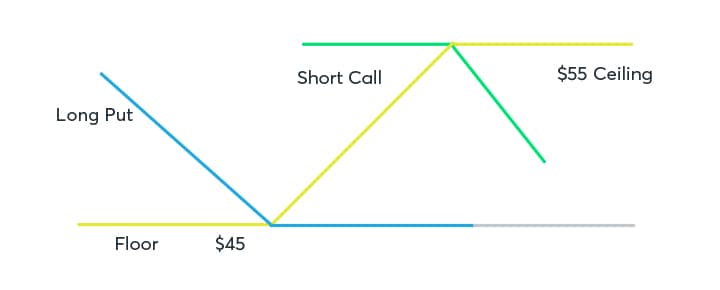

Let’s say that an oil producer expects a bearish price environment and decides to hedge exposure to any adverse price fluctuations, as price decreases reduce his revenues. The producer has a long cash market position and he uses a costless collar (a.k.a. a zero-cost strategy) to hedge against prices going down.

Essentially, a costless collar trading strategy combines the purchase of an out-of-the-money put option at a predetermined strike (floor price), and simultaneously, the sale of an out-of-the-money call option at a predetermined strike (capped price). This strategy allows the producer to manage his supply sale by setting a floor price at which he will be willing to sell his oil production. The premium received from shorting the call can be used to buy or finance the put.

The put purchase protects against a decline in oil prices when the underlying market price becomes lower than the put strike, which offsets the loss in the short position. However, if the price increases, the producer will profit from the long position in the underlying, as long as it is above the strike price of the call.

The producer needs to hedge his December production and will buy a put at $45 strike and pays a premium of $1.55 and a short call at $55 strike and receives $1.55. The underlying futures trade at $50 per bbl. The total cost of the call and the total cash received from selling a put is $1.55, which will cover the $1.55 premium of buying a call.

Long a December 2020 WTI APO put @$45 for a premium of $1.55

Short a December 2020 WTI APO call @$55 for a premium of $1.55

Underlying December WTI Crude Oil Financial futures price $50/bbl

If the spot price of Oil futures is $40 when the two options expire in December, the producer will receive a hedge gain of $5/bbl ($45-$40) from the put, since the production at the wellhead is $40/LLB on December.

If the spot price of Oil futures is $60 when the two options expire in December, the producer will incur a loss of $5/bbl ($60-$55) from selling the call. However, the net price received from the December physical position at the wellhead is $60/bbl.

APOs are widely traded in energy markets due to their distinctive features and payoff patterns, which make them a useful tool to mitigate price risk at any delivery granularity.

Links to some CME Group Energy average price options:

Striking Insights Signup

Discover the latest trends and tools other traders are finding valuable in their day-to-day strategies in Energy options. Subscribe to get access to insights first.

QuikStrike Signup

Access in-depth options analytics with QuikStrike Essentials, our flagship offering. Sharpen your insights with current and historical volatility, spread analysis, and option pricing and delta sheets.