- 1 Mar 2019

- By Daniel Brusstar, John Coleman and Alan Gelder

The global crude market is in the midst of a radical transformation in terms of supply sources, demand centres, and crude flows – all due to the introduction and follow on surge of US shale crudes in the global market beginning in 2016. The lifting of the US export ban in December 2015 will prove to be a watershed moment for the global crude market as US crudes are upending traditional trade patterns and pricing relationships.

US crude production has seen a near meteoric rise over the last decade due to the 'shale revolution', which has been exactly that – revolutionary. A decade ago, US crude and condensate production languished near 5 million barrels per day (b/d), a far cry from its previous peak of 10 million b/d in 1970. However, rapid development in horizontal drilling and hydraulic well stimulation and fracturing technology in the ensuing decade has the US now neck and neck with the largest global crude producing nations at just shy of 12 million b/d, according to the US Energy Information Administration (EIA).

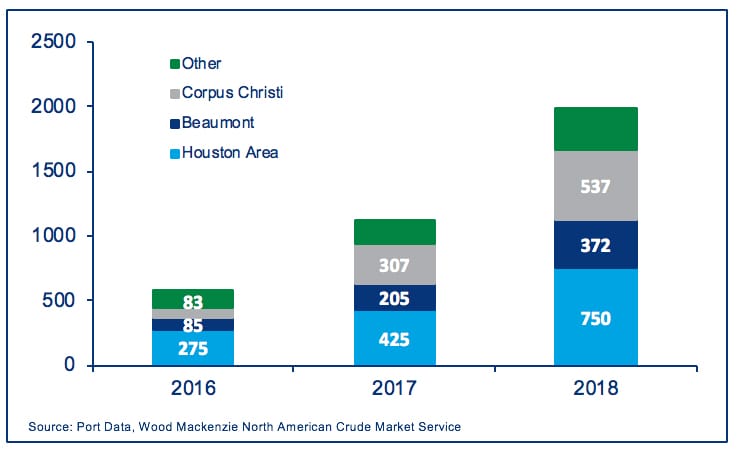

This near parabolic growth over the past decade in the US has only been possible with the congressional lifting of the crude export ban in late 2015 to balance US crude production – and US prices – with the global market. Tepid at first, in 2016 US crude exports averaged ~500,000 b/d – but, similar to production growth, exports similarly saw a significant rise and subsequently doubled in volumes in both 2017 (~1 million b/d) and 2018 (~2 million b/d). Wood Mackenzie forecasts this trend, albeit modestly decelerating, to continue well into the early 2020s.

The shift in the marginal demand centre for US crudes has upended traditional pricing mechanisms in the US and key pricing relationships globally. West Texas Intermediate (WTI) has been the established US benchmark crude price since NYMEX’s (a subsidiary of CME Group) adoption of Cushing, OK as the physical delivery point and launch of the WTI futures contract in March 1983. WTI, priced in Cushing, has historically been a strong indicator for US produced light sweet crude – driven by inland midcontinent demand. While those dynamics are likely to hold true into the future as it relates to US midcontinent demand and pricing, a more relevant pricing point relating to global demand and competition for US crudes is emerging – a WTI grade pricing point in Houston.

This paper will explore the current and future story for US crude exports – pricing, flows, and infrastructure – all through the lens of CME Group’s newly launched NYMEX WTI Houston futures contract, an emerging global benchmark.

Prior to the Shale Revolution, the broader US crude infrastructure system was designed and operated with the sole purpose of importing and distributing barrels within the US to meet domestic refining demand. This flow pattern was broadly South to North i.e. importing barrels into the US Gulf Coast (USGC) market and sending them North via Cushing, OK to inland midcontinent demand centres. For this reason, coastal infrastructure was designed to support crude inflows and regional pricing dynamics reflected this with WTI (priced in Cushing) traditionally trading at a premium to Brent to attract global light sweet barrels.

The Shale Revolution turned this notion on its head – flow patterns reversed to broadly North to South i.e. from inland supply regions flowing South (toward the USGC market) for consumption and eventually export. Pricing dynamics flipped as well with WTI (priced in Cushing) flipping to a discount to Brent to reflect the well-supplied nature of the US light sweet market as well as infrastructure lagging behind the curve in supporting the new crude flow direction – creating infrastructure related pricing blowouts for benchmark US prices.

Additionally, pricing discounts were required on US domestic light sweet crudes to incentivise US refiners to mop up additional growing supply (as US tight oil quality did not fit well with the USGC refinery capabilities) and eventually incentivise outflows into export markets.

Opening of the flood gates

When the export ban was ultimately lifted by the US Congress in December 2015, initial demand was tepid for US shale crudes as there were questions around quality and yield characteristics in the market and US tight oil production declined in 2016 in response to the crude oil price collapse. Initial volumes were steady at ~500,000 b/d mostly into the Canadian market which had been granted export exemptions and been receiving US crude supplies during the export ban. Since 2017, volumes have picked up materially into both the Asian and European markets with the former averaging more than 1 million b/d in 2H 2018.

Infrastructure scramble

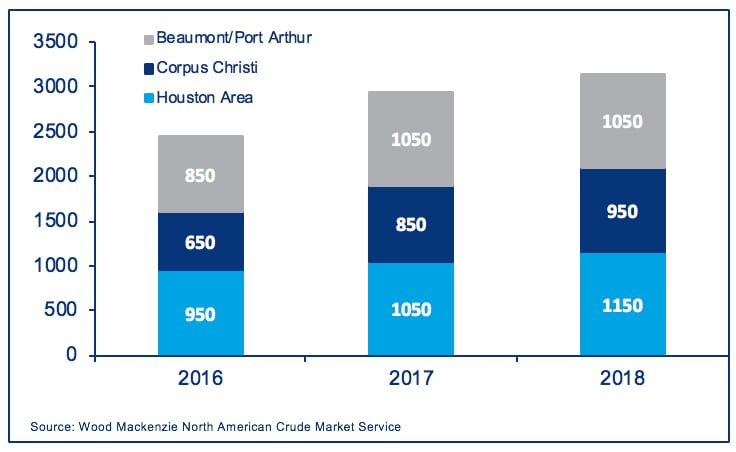

The combination of sudden supply growth, flow reversals and regulatory lifting of the export ban left midstream companies and related coastal logistics assets scrambling to facilitate both flows into coastal hubs for exports and utilize existing marine terminals for crude outflows rather than designed purpose of crude inflows. The Houston area has seen the highest market share for crude exports to date given the legacy infrastructure in place to support a significant refining footprint and geographic proximity to supply regions in West Texas and Cushing, OK. Existing infrastructure has been sufficient to handle export volumes to date – but the race is on for new build terminals to keep up with growing export volumes specifically in the Houston area and Corpus Christi.

Coastal pricing emergence

With increasing flows looking to move through the USGC market and into export markets, a relevant coastal pricing marker was needed to reflect US crude pricing on an export basis. In 2016, Argus launched an assessed price based on trades occurring at Magellan's East Houston terminal (MEH) on a daily basis. This provided the first glimpse of coastal pricing dynamics and their relation to traditional inland pricing in Cushing, OK. However, this reflects the local supply economics in the Houston area, and perhaps does not fully capture the export activity in the market.

In November 2018, CME Group launched a futures contract that is physically-delivered in Houston to add visibility into export demand and market liquidity. Additionally, producers that had previously been structuring contracts to simulate coastal pricing could now directly hedge production they are looking to sell into export markets. This futures contract, delivered in Houston and reflective of global demand for US light sweet crudes, is likely to emerge as a global benchmark alongside WTI (Cushing) in normal quoting and nomenclature against other global benchmarks such as Brent and Dubai and Oman.

Wood Mackenzie forecasts by 2020 ~2-2.5 million b/d of physical light sweet crude flows through the Houston area market on a sustained daily basis. Multiple supply sources will contribute to these volumes – yielding optionality and flexibility on crude quality and blends.

Houston WTI pricing relative to other global benchmarks

As US crude export volumes rise, its significance in the global oil market grows. Global light crude oil prices are typically Brent related, so with Asia Pacific being deficit light crude, the delivered prices of light crudes into Asia are typically higher than prices in the Atlantic Basin. This provides an interesting arbitrage opportunity, as the highest netback for an exported US crude could be either Europe or Asia, depending upon which market offers the highest value and the difference in freight costs. US crudes are better suited to European refineries, whose assets are not as sophisticated as the new-builds in Asia, which are designed to process medium/heavy crude barrels.

Wood Mackenzie expects the value of WTI in Houston to be closely linked to other global benchmarks, with the differences reflecting crude composition, end market product crack spreads and freight market dynamics. Whilst closely linked, the global nature of US crude exports and the transit time to long haul destinations means the differences to other global benchmarks will likely be highly volatile.

CME Group’s NYMEX Houston delivery contract specifics

CME Group has launched a significant new benchmark for the U.S. export market, the physically-delivered NYMEX WTI Houston crude oil futures contract. This new benchmark features a Gulf Coast waterborne price with the flexibility to make and take delivery of WTI type crude oil in Houston, Texas. As a result, it is now possible to hedge U.S. crude oil exports more precisely, and to source physical barrels for export from the Houston trading hub.

The quality specifications for WTI type crude oil for delivery in Houston represent the export quality that is lighter than WTI at Cushing, with low metals content of 4 parts per million (ppm) for vanadium and nickel. Further, the WTI crude oil stream in Houston is a fungible blend of domestic light sweet streams with quality parameters of 40 to 44 degrees API gravity and 0.275% sulfur maximum. The export-grade of WTI in Houston is lighter than the WTI specifications at Cushing and matches the quality of the WTI type crude oil at the export terminals in Houston. These lighter specifications are tailor-made for Asian and European refiners who are becoming active participants in the Houston export market.

The Houston physical delivery mechanism for the NYMEX WTI Houston crude oil futures contract consists of free-on-board (FOB) delivery at three Enterprise Products LP terminals with waterborne marine access geared for the export market: 1) Enterprise’s Echo terminal; 2) Enterprise Houston Ship Channel terminal; and 3) Enterprise’s Genoa Junction in Houston, Texas. These three terminals are active trading hubs with over 30 million barrels of storage capacity and pipeline connectivity to the Midland and Cushing markets. The FOB delivery mechanism allows importers and exporters to make and take delivery of export-grade WTI dockside in Houston at a price that reflects the true value of waterborne barrels in the U.S. Gulf Coast market.

In the first delivery month of January 2019, there were nearly a million barrels of WTI that were delivered against the NYMEX WTI Houston crude oil futures contract after expiration. In February 2019, over 300,000 barrels of crude oil were matched for delivery after the expiry of the futures contract. The trading activity and open interest in the new Houston-delivered contract have risen sharply in the first three months of trading, as shown in the chart below. This represents a significant new source of export barrels for the international crude oil market.

The Enterprise Echo terminal has 7.5 million barrels of storage capacity and is connected to a network of nearly a dozen pipelines and 10 storage terminals. In addition, the Enterprise Houston Ship Channel terminal has 23 million barrels of storage capacity; it is the largest export facility in the Houston area, with seven ship docks that can load tankers up to 900,000 barrels capacity. Further, the Enterprise Genoa Junction facility provides an interconnection point for delivery of pipeline barrels flowing in-bound from Midland, Texas.

The three Enterprise delivery terminals are connected to all the major in-bound pipelines and refineries in the Houston area. There are substantial pipeline inflows of WTI type crude oil to the Enterprise terminals from the two major oil production centers in West Texas: 1) from Midland, Texas via the Enterprise Products, BridgeTex, and Longhorn Pipelines; and 2) from the Eagle Ford production area in South Texas via the Enterprise Products and Kinder Morgan Pipelines.

CME Auction Platform

Starting in March 2019, the CME Group will offer an electronic cash market auction utilizing CME Direct technology which will provide a competitive and transparent venue for firms across the world to access physical crude oil for export. The initial focus of the auction will be FOB delivery of WTI exports from the Enterprise Houston Ship Channel terminal in Houston. Buyers in the auction can efficiently hedge cargoes utilizing the NYMEX WTI Houston crude oil futures contract ouston crude oil futures cont4ract. The auction floor price will be benchmarked against the futures contract. The two-minute electronic auction will allow buyers to place bids for cargo size parcels for a specific loading date range. The auction bids are anonymous, and if a bid is placed within 5 seconds of the close, the auction time will extend in 5 second increments as new bids are entered. The auction buyer will have the option to choose a cargo size for a specific date range for loading. Once matched, the auction winner will work directly with the seller on physical delivery and is subject to the seller’s general terms & conditions.

The CME Auction is an anonymous matching platform that provides an open venue for bilateral physical transactions. The underlying technology has been used to facilitate numerous auctions including daily auctions for Chicago dairy, Irish electricity CFDs, and DME oil auctions. The CME Auction platform will provide access to international markets with better price transparency. The quality specifications will conform to the tight standards of the WTI Houston crude oil futures contract.

Anatomy of the WTI Houston Market

The trading activity in the WTI Houston cash market is driven by in-bound pipeline flows sourced from West Texas and Cushing, Oklahoma. There are substantial pipeline inflows of WTI type crude oil to the Enterprise delivery terminals from the two major oil production centers in the Permian Basin and Eagle Ford areas in West Texas: 1) from Midland, Texas via the Enterprise Products, BridgeTex, and Longhorn Pipelines; and 2) from the Eagle Ford production area in South Texas via the Enterprise Products and Kinder Morgan Pipelines. In addition, there are two major pipelines that connect in-bound to Houston from Cushing: 1) Seaway Pipeline; and 2) Keystone Marketlink Pipeline. Table 1 below outlines the in-bound pipeline capacity for crude oil flowing from West Texas and Cushing to Houston.

Table 1

In-bound Crude Oil Pipelines Connected to Enterprise’s Three Houston Terminals (Capacity expressed in Barrels/Day)

| Incoming Pipelines | Capacity | Owner |

|---|---|---|

| BridgeTex Pipeline (from Midland) | 400,000 | Magellan |

| Longhorn Pipeline (from Midland) | 275,000 | Magellan |

| Enterprise’s Sealy Pipeline (from Midland) | 600,000 | Enterprise Products LLC |

| Enterprise’s Sealy 2 Pipeline (from Midland) | 240,000 | Enterprise Products LLC |

| Enterprise Products Eagle Ford Pipeline | 560,000 | Enterprise Products LLC |

| Kinder Morgan Pipeline (from Eagle Ford) | 350,000 | Kinder Morgan |

| Seaway Pipeline (from Cushing) | 850,000 | Enterprise Products LLC |

| Keystone MarketLink (from Cushing) | 700,000 | Transcanada |

Hedging Alternatives

The new physically-delivered WTI Houston Crude Oil Futures and Options Contracts will provide a superior hedging tool for the expanding U.S. export market. The futures contract provides the flexibility to trade WTI Houston vs. WTI Cushing as an exchange-listed spread on the CME Globex platform. This mirrors how WTI Houston trades in the underlying cash market and will provide access to the deep liquidity of the WTI Cushing futures contract. Further, the WTI Houston Crude Oil Option Contract will provide an American-style option as a hedging tool that features physical exercise directly into the underlying WTI Houston Crude Oil Futures Contract.

The new WTI Houston Crude Oil Futures Contract provides a more direct method to manage the arbitrage price risk associated with an export cargo from the U.S. Gulf Coast to Europe and Asia. In addition, because the futures contract allows for physical delivery, it is possible to source WTI barrels for export from the Houston trading hub. Further, the CME Auction will provide a competitive platform to source and hedge physical WTI barrels for export.

By way of example, a European refiner can lock in the purchase price of a WTI cargo in Houston by buying (or going long) a WTI Houston Crude Oil Futures Contract (CME commodity code HCL), and at the same time selling (or going short) a Brent Last Day futures contract (CME commodity code BZ). This allows the European refiner to lock in the current arbitrage differential, which is economically profitable given that the arbitrage “window” is open and will yield a profit after the freight cost is applied.

At recent futures prices, the arbitrage (“arb”) spread between April WTI Houston crude oil futures ($59.50 per barrel) and May Brent futures ($63.00 per barrel) would present a favorable spread for a European refiner of $3.50 per barrel, and also would cover the current freight cost of $2.50 per barrel for delivery to Europe. In this example, the refiner buys (or goes long) the April WTI Houston crude oil futures and simultaneously sells (or goes short) the May Brent futures, and hence locks in the arb of $3.50 per barrel. This would allow a European refiner the optionality to take physical delivery against the April WTI Houston crude oil futures after expiration, and then load a cargo in Houston in April for transit to Europe in May. The refiner could then schedule the cargo for loading in April and lock in the current freight rate of $2.50 per barrel. After liquidating the long and short futures positions, the European refiner could successfully realize a profit in this cargo transaction, by utilizing the WTI Houston crude oil futures contract to source barrels.

To summarize the hypothetical European hedging example:

In January, a European Refiner buys (goes long) 600 April WTI Houston futures contracts at $59.50 per barrel (equivalent to a cargo size of 600,000 barrels);

The Refiner then sells (goes short) 600 May Brent futures at $63.00 per barrel;

Locks in the arbitrage spread at $3.50 per barrel.

In late March after the Expiration of April WTI Houston futures, the European Refiner elects to take delivery of 600,000 barrels of WTI which can be scheduled for export in April;

The Refiner then liquidates (buys back) the 600 May Brent futures contracts, and thereby realizes the arbitrage profit of $3.50 per barrel.

The European Refiner can then schedule the WTI export cargo for April loading in Houston, and can execute a hedge position to protect the value of the cargo during transit to Europe;

The refiner can sell (short) 600 June or July Brent futures contracts to coincide with the delivery timing as a hedge for the transit to Europe.

Summary: The European Refiner sources WTI barrels for export with a profitable arbitrage spread of $3.50 per barrel and covers the freight costs of $2.50 per barrel; Thus, the refiner would realize a profit of $1.00 per barrel.

In a similar hedging scenario for Asian destinations, the Asian refiner could lock in the purchase price of a WTI cargo in Houston by buying (or going long) a WTI Houston crude oil futures contract (commodity code HCL), and at the same time selling (or going short) a Dubai crude oil futures contract (commodity code DC).This would allow an Asian refiner to lock in the current arbitrage differential, which is economically profitable given that the arbitrage “window” is open and would yield a profit after the freight cost is applied.

At prevailing futures prices, the arbitrage (“arb”) spread between May WTI Houston crude oil futures ($58.50 per barrel) and June Dubai futures ($62.00 per barrel) presents a favorable spread for an Asian refiner of $3.50 per barrel, which covers the current freight cost of $3.00 per barrel for delivery to Asia. In this example, the refiner buys (or goes long) the May WTI Houston crude oil futures and simultaneously sells (or goes short) the June Dubai futures, and hence locks in the favorable arb spread of $3.50 per barrel. This would allow the Asian refiner the alternative to take physical delivery against the May WTI Houston crude oil futures after expiration, and then load a cargo in Houston in May for transit to Asia in June. The refiner can then schedule the cargo for loading in May and arrange for freight. After liquidating the long and short futures positions, the Asian refiner could successfully realize a profit in this cargo transaction, by utilizing the WTI Houston crude oil futures contract to source barrels.

To summarize the hypothetical Asian hedging example:

In January, the Asian Refiner buys (goes long) 600 May WTI Houston futures contracts at $58.50 per barrel (equivalent to a small cargo size of 600,000 barrels);

The Refiner then sells (goes short) 600 June Dubai crude oil futures at $62.00 per barrel;

Locks in the arbitrage spread at $3.50 per barrel.

In late April at the Expiry of May WTI Houston futures, the Asian Refiner elects to take delivery of 600,000 barrels of WTI which can be scheduled for export in May;

The Refiner then liquidates (buys back) the 600 June Dubai futures contracts, and thereby realizes the arbitrage profit of $3.50 per barrel;

The Asian Refiner can then schedule the WTI export cargo for May loading in Houston, and can then execute a hedge position to protect the value of the cargo during transit to Asia;

The refiner can sell (short) 600 June or July Dubai futures contracts to coincide with the delivery timing as a hedge during the shipment to Asia;

Summary: The Asian Refiner sources WTI barrels for export with a profitable arbitrage spread of $3.50 per barrel relative to Dubai crude oil and covers the current freight costs of $3.00 per barrel; Thus, the refiner would realize a profit of $0.50 per barrel.

The new physically-delivered WTI Houston Futures Contract provides an effective hedging tool for the U.S. export market that reflects the fair value of waterborne loadings in the U.S. Gulf Coast market.

Outlook for US crude exports

US crude exports topped 2 million b/d in 2018 and Wood Mackenzie forecasts that number will approach ~3 million in 2019, requiring yet more export terminal capacity and higher volumes through Enterprise-linked assets. In the longer term, Wood Mackenzie forecasts exports to peak and plateau in the mid-2020s at roughly 4.5 million b/d, a 125% increase from 2018 levels.

Both Asia and Europe are forecast to be increased buyers of US crudes in coming years but with nearly 1.8 million b/d forecast for exports from US into the Asian market, WTI-Houston vs. Dubai will become an increasingly relevant marker as an indicator of US crudes competing against Arab medium sour crudes in the Asian market.

As US crudes exports are forecast to increase in coming years, volumes through Enterprise owned (and CME Group contract linked) assets is forecast to rise in unison. At peak, Wood Mackenzie forecasts ~1.2 million b/d of WTI grade export volumes out of Enterprise Houston area terminals, a 6x increase off 2016 levels and nearly 2x 2018 levels. This level of exports is similar, if not indeed larger, than the supplies from many OPEC countries.

Future coastal crude infrastructure development and export hub competition

With continued growth in US crude production, the midstream picture is constantly evolving and reshaping the outlook for how (and where) volumes will be exported in the future. The focus at present is how to create a logistical solution to fully load a Very Large Crude Carrier (VLCC) despite the Gulf Coast’s shallow waters. The leading contending projects (including one from Enterprise) intend to create offshore buoys to load VLCCs in deeper waters – this could drive significant impacts on how crude flows into and out of the USGC market once a project moves forward.

Wood Mackenzie currently forecasts two VLCC capable terminals to move forward in the Corpus Christi area and one (the Enterprise offering) to move forward in the Houston area. Despite expanding export capacity and market share gain expected from the Corpus Christi market, Houston will remain a major exporting and consumption hub in the USGC market, likely offering deep liquidity to physical delivery contracts.

The newly launched NYMEX WTI Houston futures contract is an important development, and provides a new hedging tool for the U.S. export market that reflects the true value of cargo loadings in the U.S. Gulf Coast market. Consequently, we view this as an emerging global benchmark that will bring transparency and price discovery to the global arbitrage market.

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.