- 15 Feb 2017

- By Ricky Li

PJM Western Hub is one of the most liquid electricity trading hubs and is often used as the benchmark for power basis trading in this region. Dominion South Point is the natural gas trading and delivery location in Dominion pipeline that is geographically adjacent to the PJM Western Hub area. Because of the proximity of these two hubs and an increasing number of gas generators, the fluctuation of natural gas price in Marcellus region is factored into PJM Western Hub real-time peak price to some extent. Meanwhile, coal plants in this region traditionally use coal produced from Central Appalachian region, so the weekly spot price of Central Appalachian coal will have certain impact over electricity price as well.

Figure 1.a shows the historical price level after heat rate conversion for Central Appalachian coal, Dominion South Point natural gas and PJM Western Hub real-time peak prices1. In Figure 1.b, from March 2012 to September 2016, we observe a strong monthly correlation between gas price (average fuel cost of gas generator per MWh) and price of electricity in PJM, while coal price (average fuel cost of coal generator per MWh) has mostly stayed flat with slight decline over the years, generating a scattered linear trend plot.

Before we step into the full analysis, we notice extreme price movements in the historical real-time peak prices possibly due to unforeseen weather conditions, forced plant outages, etc. These event-driven price movements in the electricity market usually does not reflect the fundamental reason for cost-based generators dispatch, but rather a response by ISO/RTOs to maintain stable frequency to ensure grid stability. Therefore, we smooth out the electricity price by capping these extreme values.

Available capacity for system operator to dispatch is a fundamental factor in determining the electricity price. As coal plants retire and are replaced by natural gas plant predominantly, gas price becomes more impactful to generation costs holding all other factors unchanged. Figure 2 shows the capacity retirements on a monthly basis since 2012 based on the actual deactivated date3. As of October 2016, total PJM capacity is 171,648 MW. The cumulative capacity retirements and new capacity added since 2012 are 21,468.9 MW and 14,022.5 MW, or 12.5% and 8.2% respectively4. As you see in Table 1, most of the capacity retired is coal generators especially in 2012 (84.9%) and 2015 (77.7%), where we see a spike in capacity retirement. Considering the overall capacity increase in PJM region, the replacement of coal plant for gas plant is relatively large.

| Retirements in | Coal | Natural Gas | Other |

|---|---|---|---|

2012 |

84.9% | 3.6% | 11.5% |

2013 |

90.7% | 0.0% | 9.3% |

2014 |

81.7% | 9.9% | 8.4% |

2015 |

77.7% | 13.4% | 8.9% |

2016 |

60.6% | 0.0% | 39.4% |

Total |

81.7% | 8.1% | 10.2% |

Source: Generation and Transmission Planning – Section 126.

Marginal fuel usage directly indicates which fuel type sets the locational marginal price in the ISO. Figure 3 shows the marginal fuel usage in PJM on a percentage basis overall. Coal and gas are two main sources of fuels for generation, accounting for over 80% for most of the time. Due to the intermittent nature of renewables, system operator often dispatches gas or coal plant to meet marginal demand to ensure system stability and safety, while renewables and other distributed generators often serve as baseload. If we limit our analysis to only peak hours where electricity demand is high, shares of other fuel types and renewable energy stabilize with a slight decrease. Coal and gas persist to dominate electricity generation as shown in Figure 4. Hence, in our following analysis, we examine closely the peak electricity price as it reflects the competition clearly.

Marginal fuel cost determines the electricity price in the deregulated market. We model and decompose the electricity price in PJM western hub the way that reflects the market.

Pricecoal and Pricegas are prices per MWh after heat rate conversion. We first run a simple static multivariate linear regression using the model above. The intercept here captures fixed cost of electricity as well as effects of other fuel sources, such as wind and solar. Besides running the regression using the full sample, we divide the sample evenly into three sub-periods. Results of four regressions are presented in Table 2.

|

All | 3/9/2012 – 9/17/2013 | 9/18/2013 – 4/8/2015 | 4/9/2015 – 10/14/2016 | ||||

|---|---|---|---|---|---|---|---|---|

| Beta | t-stats | Beta | t-stats | Beta | t-stats | Beta | t-stats | |

| Intercept | 37.6992 | 14.014 | 68.6872 | 5.302 | 86.5265 | 7.510 | 5.033 | 0.898 |

| p-value | (0.0000) | (0.0000) | (0.0000) | (0.3700) | ||||

| Gas | 0.8812 | 14.29 | 1.1312 | 7.102 | 1.0512 | 11.352 | 0.9431 | 3.417 |

| p-value | (0.0000) | (0.0000) | (0.0000) | (0.0007) | ||||

| Coal | -0.5903 | -3.932 | -2.0299 | -3.678 | -2.6702 | -5.083 | 1.0799 | 4.098 |

| p-value | (0.0000) | (0.0002) | (0.0000) | (0.0000) | ||||

| Adj. R-squared | 0.2274 | 0.1131 | 0.2641 | 0.0700 | ||||

As we can see from the ρ values of coefficients, both coal and gas coefficients are significant as independent variables. Noticeably, the beta coefficients vary across three sub-periods, giving us preliminary evidence that the dynamics among coal, gas and electricity prices has changed throughout the observed period. R-square values are low because electricity price is also affected largely by other factors such as unexpected weather condition, forced generator maintenance, etc. Here, we are focusing on the beta relationship between coal price, gas price and electricity price, instead of comprehensively explaining the price movement of electricity.

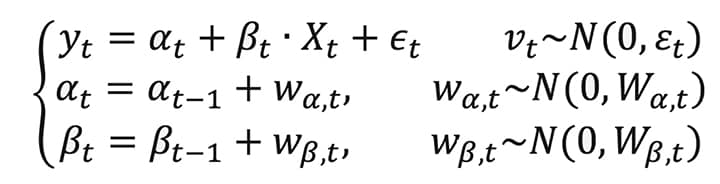

We further investigate the changing price dynamics among coal, gas and electricity in this market. Based on the preliminary discoveries above, a simple static regression presented above will not suffice as the beta relationships clearly shifted over time. A multivariate dynamic linear model7 will help us unravel how βcoal and βgas varies in a critical period when Marcellus shale gas production flourish, coal plants retirement accelerates and natural gas price fluctuates. A time-varying dynamic linear model is presented below:

where yt is the time series of real-time peak hour prices in PJM and Xt is an n by 2 matrix containing time series of two independent variables with n observations. Hence, βt is an 2 by n matrix representing a time-varying coefficients for gas and coal. Here αt is the time-varying intercept capturing effects from other fuel sources and fixed cost. The following is the matrix form of the linear system.

As shown in Figure 5.a, the model-estimated electricity prices closely track the observed average monthly electricity real- time peak prices. The difference between them is small in daily observations and almost negligible in monthly average price plot. Figure 5.b demonstrates the distribution of residuals in the model. Most of residuals center around zero with no sign of heteroscedasticity. Since we have pre-processed the electricity prices to remove extreme market conditions, the residuals on the bottom part of the chart in Figure 6.b (marked light blue) reflects those outliers.

Figure 6 shows the changing beta relationship between coal price and gas price over electricity price, estimated as βGas,t and βCoal,t in the model. The intercept has remained flat, while coefficients of gas and coal considerably vary across time. This model aims to focus on the relative impact of gas and coal prices over electricity price. It disregards other factors including emission allowances, weather changes, transportation cost, profit margin for coal and gas plant, etc.

From March 2012 to December 2013, approximately 10 GW capacity coal plant retired. Electricity price was climbing upward, ascending from $35/MWh in spring 2012 to $60/MWh in winter 2013. Natural gas price surged from $19/MWh to $30/MWh in the same period. In Figure 6, the high beta value for gas price and low beta value for coal price indicates that the rising gas price has a relatively stronger influence to the rising electricity price. Due to significant amount of coal plant capacity retirement, the coal price, although on a slight decline, stayed less relevant as marginal fuel.

From December 2013 to December 2014, coal plant retirement decelerated, while electricity price witnessed a seasonal high demand and high price in the winter of 2013. Coal and gas competition for generation stabilized while less efficient coal plants retired or were priced out of the generation stack. In Figure 6, beta values for coal and gas both oscillate around 1, representing a tied competition between two fuels since coal price has further declined to around $25/MWh, while gas price reaches over $40/MWh.

From December 2014 to September 2016, natural gas price has further plunged to below $10/MWh. Low gas price accompanied with relatively stable coal price yields a high beta value for gas price in Figure 5. In this period, as shown in the dynamic beta value for gas price, correlation between gas prices and electricity price has soared significantly. This is also partially due to the continuing trend of coal plant retirement of another 11 GW capacity.

Coal and gas competition in PJM market and Marcellus region has shown tremendous fluctuation since 2012. Such competition is reflected in the dynamic relationship of coal and gas prices over electricity prices. Generation capacity also plays a key role as gas generators have replaced large amount of coal plant capacity, further magnifying the impact of natural gas over electricity prices.

Looking ahead for 2017, there are about 2.6 GW projected plant retirements in the PJM market. Most of them are aged coal or fuel oil generators. EIA’s 2017 henry hub natural gas price forecast is a slight increase from 2016 price level to $3.2/MMBtu in 20178. With sustained low natural gas price and steady Central Appalachia coal prices, the high beta value for gas price over electricity price is likely to endure through 2017.

- For natural gas, we use the annual average heat rate data provided by EIA: https://www.eia.gov/electricity/annual/html/epa_08_01.html On the coal side, the average heat content of coal produced in Central Appalachia region, according to EIA, is 12,500 Btu/Pound: http://www.eia.gov/coal/

- For electricity prices greater than its 95% percentile, we cap these price series at 95% percentile value.

- Total generation capacity in PJM is 171,648 MW, according to PJM 101 as of 10/11/2016. Source: http://www.pjm.com/~/media/training/core-curriculum/ip-pjm-101/pjm101-the%20basics.ashx

- ttp://www.pjm.com/planning/rtep-upgrades-status/queues-status.aspx

- ttp://www.pjm.com/planning/generation-deactivation/gd-summaries.aspx

- http://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2016/2016q3-som-pjm-sec12.pdf

- Giovanni Petris (2010). “An R Package for Dynamic Linear Models”. Volume 36, Issue 12, Journal of Statistical Software

- Source: Short-Term Energy Outlook: https://www.eia.gov/outlooks/steo/report/natgas.cfm

About CME Group

As the world’s leading derivatives marketplace, CME Group is where the world comes to manage risk. Comprised of four exchanges - CME, CBOT, NYMEX and COMEX - we offer the widest range of global benchmark products across all major asset classes, helping businesses everywhere mitigate the myriad of risks they face in today's uncertain global economy.

Follow us for global economic and financial news.